Freelancing revolutionized with this new stablecoin

On June 7th of 2018 the United States Department of Labor released statistics stating that there are roughly 15.5 million independent contractors (10.1% of total workforce) working in the United States.

These numbers are arguably lacking due to the short timeframe the survey was conducted therefore not including all part time workers in the study, not including those that may use gigs to supplement their full time income, and several other factors. Forbes and NPR estimate a more realistic number of freelance workers to be around 20-36%. There is speculation that by the year 2020 the workforce in the US will be 40-50% independent workers.

There are approximately 2.2 million independently contracted drivers that work for Lyft and Uber in the United States. In the age of the gig economy these numbers should not be surprising. The surprising part is that every one of these independently contracted workers are being robbed without realising it.

When signing up for one of these platforms the provider clearly state that they will be taking 20%(Lyft) or 25%(Uber) of each ride fare. These percentages are also skeptical with some studies finding it is closer to 40-60%!

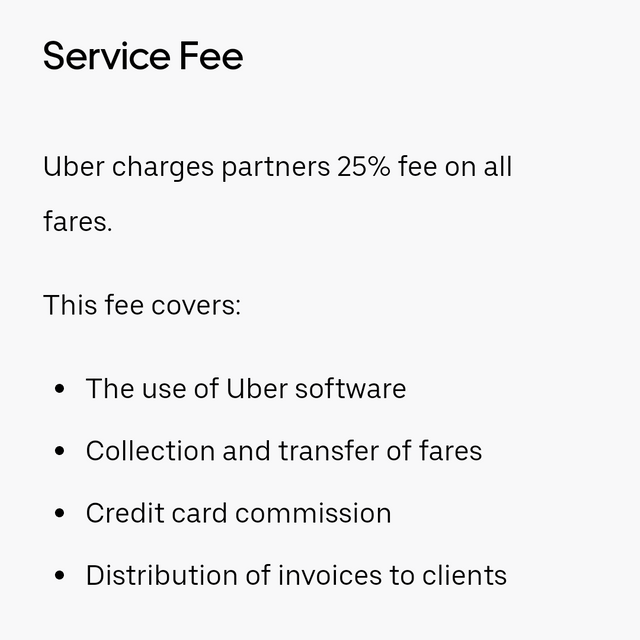

Of course the company needs to make money so taking a percentage is justified but let’s look at the breakdown of what UBER includes in their 25%* take.

These points are not easy to break down and, of course, Uber isn’t going to break them down for you any more than they have above.

Platform use

Uber charges for the use of their platform. They could, in actuality, charge whatever they would like for this service. Let’s come back to this after we look at the other points.

Collection and transfer of fees

Uber takes the money from the customer transferring it to the Uber bank account then transfers a percentage of that money back to the driver. They charge the driver for each transfer. Since Uber uses a different bank for almost every country it is difficult to come up with a transfer fee that fits across the board. Also, these fees could be a flat rate or they could be a percentage. This information is not easy to come by. Next point.

Credit card commissions

This one should be rather easy but, of course, it isn’t. Not every rider uses a credit card. Some use debit which should be feeless, in theory. Let’s, for the purpose of simplicity, give Uber 3% commissions for credit card processing. This is an estimated percentage. At Uber’s volume the rate is probably much lower.

Distribution of invoices to clients

Uber sends the rider an invoice. This should be straightforward, right? Right!? This also could be a flat rate or a percentage. It could also just be included in the platform use fee but this information is unclear.

Uber’s fees conclusion

This is nearly impossible to calculate due to the lack of transparency and outright false information that Uber claims. To create an approximate fee total that is easy to understand let’s just give everything my estimated credit card processing fee.

-Uber invoices rider - 3%

-Customer pays with credit card - 3%

-Fare is transferred to Uber’s bank account - 3%

-Uber sends driver’s paycheck - 3%

-This leaves us with an unclaimed 13% that Uber must be charging for use of their platform.

It is pretty clear now that Uber is robbing every driver that works for them. If these fees are even close to what actually goes on behind the scenes and providing over 15 million rides per day it is obvious how Uber became a $70 Billion dollar company in less than 10 years.

What can we do about this situation? How can we pay the drivers more, charge the riders less, be more transparent about fees and charges, and maybe even save the planet?

NOS Stablecoin Limited has developed a stablecoin called Nollar. Nollar is a 1:1 USD backed cryptocurrency that is literally the first of its kind. Transferring Nollar is absolutely feeless and instantaneous. Let’s do a short breakdown of the fees if Uber utilized Nollar.

-Uber invoices rider using trustless pay-per-use settlement program - 0%

-Customer pays with Nollar - 0%

-Fare is transferred to Uber’s secure digital wallet - 0%

-Uber sends paycheck to driver’s secure digital wallet - 0%

-Uber’s platform use fee could still be any percentage they decide. In an optimistic world they would not charge more than they are now.

There is one flaw in this equation. The trustless pay-per-use settlement program could, in theory, eliminate the need for 100% of the fare to be sent to Uber directly. Let’s break down the fees equation one more time.

-Uber invoices rider using trustless pay-per-use settlement program - 0%

-Customer pays with Nollar - 0%

-A percentage of the fare, the platform use fee, is transferred to Uber’s secure digital wallet - 0%

-In the same moment the drivers percentage of fare, their paycheck, is sent directly and instantly to their secure digital wallet - still 0%

The trustless pay-per-use settlement program is a software program, not a smart contract, so there are many ways that it could be utilized. Keeping with the Uber example, the program could use time or distance to determine the fare. The program could also use an equation that factors both time and distance. The program would reassure that the rider is not paying more than is necessary and would reassure the driver that they are receiving a just fare. All of these transaction would be publicly available on the block-lattice. In this care there would no longer be discrepancy about hidden fees or underserved wages.

For the driver being paid in Nollar there is very little risk. The price is stable and, as long as their wallet is secure, their funds are secure.

NOS works with a trust company, Prime Trust LLC, that holds the backed USD in over 200 FDIC insured banks across the US. Prime Trust controls a KYC/AML that is used to trade Nollar for USD. Those Nollar that have been sent in exchange for USD are then burned so that the Nollar to USD is always 1:1.

NOS nor Prime Trust have complete access to these bank accounts. There is an escrow system in place for the benefit of Nollar holders. The only way anybody can access the USD is to first transfer Nollar. This ensures the 1:1 ratio.

This instant, feeless, stable cryptocurrency seems too good to be true. There must be a catch, right? Well, there is. In order to convert Nollar into USD you must pay a fee. The cash out fee is .9%. Less than 1%! If an independently contracted Uber driver wanted to withdraw USD with their Nollar income they would still be profiting 11.1% more than they are right now. That is if Uber kept their platform usage fee at my example estimate of 13%.

There would be no need to cash out when Nollar is accepted and utilized. Already there are stores in Venezuela and in the Philippines that accept Nollar. Some people are already paid in Nollar! Nollar is changing the lives of those that work out of country and send money back to their families. These workers that have been sending money using a bank transfer or a transfer service are subject to being charged a 3–10% fee. These workers now have the ability to send 100% of their earning instantaneously to their families without being charged any fees when they utilize Nollar.

Some counties that are dealing with hyperinflation and super-centralization could be radically altered by this one stablecoin. It will allow the people to trust the stable currency they are using knowing that it is backed and they have complete control over their digital wallet. It will allow countries’ economies to stabilize and continue trade on a currency that is safe. It will show the world that it is possible to utilize a digital currency that also happens to be feeless, instant, eco-friendly, and stable.

Read the whitepaper then come chat on Discord and Telegram

Congratulations @simplesirup! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @simplesirup! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!