Bitcoin Risks Deeper Pullback After Drop Below $9K

After an overnight drop, bitcoin looks to have observed attractiveness under $nine,000 and risks a deeper pullback, the technical charts suggest.

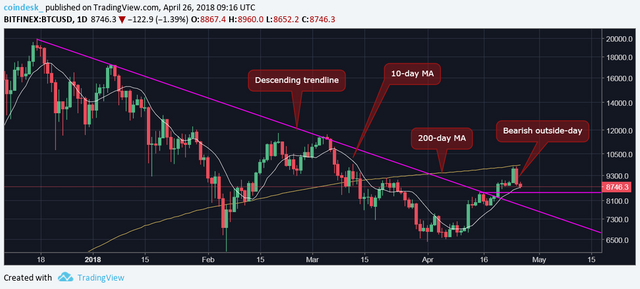

The cryptocurrency hit a one-week low of $eight,652 on Bitfinex earlier these days and is now trading at $8,seven-hundred. the 10-percentage decline from the weekly excessive of $9,767 on Wednesday has neutralized the immediately bullish outlook.

similarly, the failure to preserve above the key technical levels - descending (bearish biased) one hundred-day transferring average (MA) of $nine,126 and the double pinnacle bearish reversal neckline of $9,280 - might be discouraging for the bulls.

but, most effective a spoil under $eight,459 could signal a short-time period bearish reversal and open the doorways for a deeper promote-off.

BTC created a bearish outside-day candle on Wednesday (trading variety was wider than Tuesday's high/low), which, as in step with textbook policies, is an indication of surprising bearish reversal. That said, buyers and analysts normally need to see terrible rate action on the following day, earlier than calling a bearish reversal.

as a consequence, best a near (as in step with UTC) nowadays below the key support of $eight,459 (April 15 excessive) might verify a short-term bullish-to-bearish fashion alternate and open doors for a deeper pullback.

but, BTC is displaying signs of a poor observe-through, as currently it's far buying and selling underneath the previous day's low of $eight,765 - though the disadvantage is capped by using the ascending (bullish) 10-day transferring common at $8,706 and the step by step ascending (bullish) 4-hour 50-day MA.

four-hour chart

BTC may regain some poise if the bulls control to protect the four-hour 50-day MA within the following couple of hours. on the other hand, a failure to preserve above the bullish 4-hour 50-day MA and 10-day MA could improve the percentages of sustained drop below $8,459.

View

affirmation of a bearish out of doors-day reversal might open up disadvantage toward $7,823.

A day by day near (as per UTC) beneath that degree could signal a contravention of higher lows and higher highs pattern (bullish setup) and might also imply the long-time period descending trendline breakout has failed. In this sort of case, BTC ought to revisit the April 1 low of $6,425.

Bullish state of affairs

BTC will possibly revisit $9,280 if the bulls manage to defend the 4-hour 50-day MA and 10-day MA in the following few hours.

reputation above $nine,280 might expose the 200-day transferring average, currently located at $9,853.

Congratulations @sharozgill! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations! This post has been upvoted from the communal account, @minnowsupport, by sharoz gill from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.