Daily Crypto News And Price Analysis, 23rd, November

Welcome to the daily crypto news :

After Testing $7K — Is Bitcoin Price Finally Close to the Bottom?;

Fidelity Digital Assets to Sign Up Its First Crypto Exchange by End of the Year;

Algorand 2.0’s New Non-Turing-Complete Smart Contracts Are a Feature, Not a Bug;

Chinese Central Bank Plans to Nip Young Crypto Businesses ‘In the Bud’;

Morocco Plans to Expand Access to Financial Services With Fintech;

After Testing $7K — Is Bitcoin Price Finally Close to the Bottom?

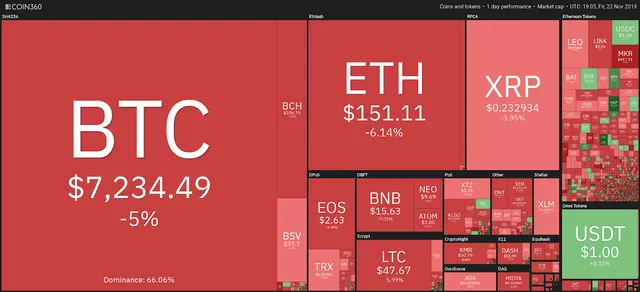

Bitcoin (BTC) opened the day at $7,600 and began a sharp decline to find lows of $6,800 — a loss of just over 10%. Price has since been pushed back across $7,000 with buyers showing interest in prices below the $7K handle.

The loss in Bitcoin valuation has dragged the entire market down with notable loser being Ether (ETH), which has lost support at $150 and printed lows of almost -15% at $137.

Bitcoin dominance is up for the week at 69%, meaning that BTC has outperformed the remainder of the cryptocurrency market during the continued decline this week.

Read more.......

Fidelity Digital Assets to Sign Up Its First Crypto Exchange by End of the Year

Fidelity Digital Assets (FDAS), the young cryptocurrency trading business of a financial-services powerhouse, expects to sign its first exchange by the end of the year, according to its president Tom Jessop.

As a brokerage, FDAS helps institutional investors get the best deal buying or selling bitcoin from various sources. So far, those have all been over-the-counter (OTC) trading desks.

“Between launching our trading platform five months ago to year-end, we will have more than doubled the number of liquidity providers,” Jessop told CoinDesk, declining to say exactly how many that would be. “We are primarily focused on OTC liquidity providers. It's likely we will connect to our first exchange perhaps before year-end.”

The move would likely give FDAS access to a broader market and liquidity for smaller trades. OTC desks primarily trade with larger institutions and high-roller “whale” investors, whereas exchanges serve retail traders and smaller institutions.

Read more.......

Algorand 2.0’s New Non-Turing-Complete Smart Contracts Are a Feature, Not a Bug

Proof-of-stake blockchain Algorand now supports smart contracts.

The Algorand Foundation released an update to the blockchain’s protocol on Thursday, adding decentralized finance (DeFi) features plus the long-awaited smart contracts. “Algorand 2.0” is the largest expansion of the network’s capabilities since the network’s launch in June 2019.

“With this release, new features and simple developer resources enable new use cases and broader adoption of blockchain overall,” Algorand CEO Steve Kokinos said in a statement.

For months Algorand employees have been hinting at the pending development. It’s the first time Algorand has supported smart contracts, the code-driven contracts that can track and execute the terms of formal agreements over time.

Algorand’s ASC smart contracts have back-end differences from the smart contracts pioneered by blockchains like ethereum. That’s because Algorand’s new in-house programming language Transaction Execution Approval Language (TEAL), is non-Turing-complete.

Read more.......

Chinese Central Bank Plans to Nip Young Crypto Businesses ‘In the Bud’

China’s central bank has launched a new campaign to crack down on crypto trading in Shanghai on Friday, after speculation about softer regulations surged in the sector.

The official announcement came one week after CoinDesk reported a leaked notice that detailed an inspection plan for crypto-trading operations in each district of Shanghai.

“If investors see activities and operations related to virtual currencies in any form, they can report to authorities,” the bank said in today’s announcement, stressing the distinction between blockchain technologies and virtual currencies.

The bank, joined by other local financial authorities, including the Shanghai Internet Finance Rectification Agency, plans to monitor crypto-related activities continuously and “nip the small and early-stage businesses in the bud” to protect investors.

Read more.......

Morocco Plans to Expand Access to Financial Services With Fintech

Morocco is looking to expand access to financial services through the integration of blockchain technology in the country’s financial sector.

Speaking at the Africa Blockchain Summit in Morocco’s capital of Rabat, the country’s central bank governor Abdellatif Jouahri said that Morocco will deploy financial technology to enhance access to financial services, Morocco World News reported on Nov. 21. This fintech implementation will come as part of the country’s financial inclusion strategy and especially targets underserved citizens.

To reach the unbanked

Jouahri further elaborated that the application of fintech, including blockchain technology, would help Morocco to achieve its goal to provide “all individuals and businesses a fair access to formal financial products and services […] in order to promote economic and social inclusion.” Jouahri said:

“Blockchain is by far the most disruptive technology of this decade.”

Read more.......