Daily Crypto News And Price Analysis, 22nd, December

Welcome to the daily crypto news :

Binance Returns Frozen BTC After User ‘Promises’ Not to Use CoinJoin;

New Draft Bill Aiming to Classify Crypto Assets Introduced in US Congress;

An Identity Layer for the Web Would Identify Us Everywhere;

New York Court Proceeds Against Man Allegedly Linked to OneCoin;

Bitcoin Price: Bear Market Isn’t Over Yet, But $7.6K May Change This;

Binance Returns Frozen BTC After User ‘Promises’ Not to Use CoinJoin

Bitcoin (BTC) users who employ privacy tool CoinJoin to add anonymity to their transactions face a major wake-up call after exchange Binance froze a withdrawal.

In an ongoing Twitter debate which began Dec. 19, a user by the name of Catxolotl uploaded what appeared to be correspondence from Binance Singapore staff stating they had launched an “investigation” into a withdrawal of an unknown amount of BTC.

Binance: we “do not tolerate” CoinJoin

The reason, they said, was Catxolotl was using CoinJoin via wallet provider Wasabi. A Binance representative confirmed the problem in private comments, explaining:

“Binance SG operates under the requirements as set forth by MAS and our MAS regulated partner, Xfers. Hence there are AML CFT controls set in place for the Binance SG. Unfortunately, this user has triggered one of our risk control mechanisms and thus we are conducting a deeper investigation.”

Read more.......

New Draft Bill Aiming to Classify Crypto Assets Introduced in US Congress

Paul Gosar, an Arizona Congressman, has introduced a draft bill, aimed at finally bringing regulatory clarity to the cryptocurrency industry in the United States, according to a Forbes article published on Dec. 19. The Crypto-Currency Act of 2020 sets out which Federal agencies should regulate each type of crypto assets.

Three flavors of crypto asset

One of the key things that the draft bill does is define three types of crypto asset; crypto commodities, crypto currencies, and crypto securities, per a discussion draft of the proposed bill.

Crypto-commodities are defined as economic goods or services, stored on a blockchain, with fungibility and which the market treats with no regard as to who produced it.

Crypto-currencies are defined as representations of U.S. currency or synthetic derivatives resting on a blockchain. This covers reserve-backed stablecoins, and currencies determined by decentralized oracles or smart contracts.

Crypto-securities cover all debt, equity and derivative instruments on a blockchain, other than those which are operated and registered as complaint money services businesses.

Read more.......

An Identity Layer for the Web Would Identify Us Everywhere

This post is part of CoinDesk's 2019 Year in Review, a collection of 100 op-eds, interviews and takes on the state of blockchain and the world. Elizabeth M. Renieris is the Founder of hackylawyER, a fellow at the Berkman Klein Center for Internet & Society at Harvard and an expert on cross-border data protection and privacy laws (CIPP/E, CIPP/US), digital identity, and technologies like blockchain and AI.

Mere months into the blockchain ID business, I had lost count of the presentations featuring the 1993 The New Yorker cartoon with the tagline “On the Internet, nobody knows you’re a dog.” Before blockchain, I had understood the cartoon to depict an intentional and original design choice of the early internet – the privacy and anonymity of users. Now, it was being used to justify the development of a whole new web with a built-in, blockchain-based identity layer. Needless to say, I was confused.

Read more.......

New York Court Proceeds Against Man Allegedly Linked to OneCoin

The New York Southern District Court granted a continuance in the lawsuit against David Pike over his alleged link to the OneCoin Ponzi scheme.

Finance news outlet FinanceFeeds reported on Dec. 21 that the continuation of the case was approved until Jan. 12, 2020 based on court documents filed on Dec. 20.

“Fenero Funds” — tracking OneCoin’s laundered money trail

Assistant United States Attorney Nicholas Folly reportedly stated that the parties' counsels are discussing a potential pre-indictment disposition. The extension has been deemed as appropriate, given that those discussions are still taking place.

Pike was the chief operating officer of an alleged private equity fund known as the “Fenero Funds.” Those funds were reportedly employed to launder money from the OneCoin Ponzi scheme.

Pike is accused of having made materially false statements and representations in front of special agents from the FBI, the IRS Criminal Investigation Division and the United States Attorney’s Office for the Southern District of New York representatives.

Read more.......

Bitcoin Price: Bear Market Isn’t Over Yet, But $7.6K May Change This

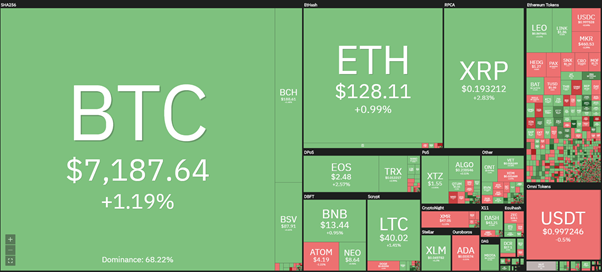

Bitcoin (BTC) is trading around $7,200 on Friday, the level that was found following a large swing to the upside on Wednesday.

As we move into the weekend, the majority of cryptocurrencies are also trading higher. Nevertheless, Ether (ETH) is still struggling to regain $130 while XRP has been unable to reclaim $0.20 after the rejection on Wednesday.

Bitcoin dominance inches higher

This is highlighted in Bitcoin dominance, which is now at 68% and continues to threaten to take the 70% level, which continues to look like a possibility as Ethereum continues to lose market cap share.

Bitcoin is currently ranging between long term weekly resistance of $7,600 and the mid $6,000s.

The 15% swing off the lows on Wednesday engulfed prior days of trading but failed to break through the declining resistance, which has defined the month of December.

Currently, the BTC price is finding support in the middle of this trading range above $7,000. The key moving averages (MA) of the 50, 100 and 200-day are all above price and trending down, illustrating that the overall trend remains to the downside on the daily chart.

The daily volume shows that the most recent high-volume candles coincide with the bullish response in the $6,000s, which goes some way in indicating that this is an area of demand.

Read more.......