Daily Crypto News And Price Analysis, 04th, December

Welcome to the daily crypto news :

Bitcoin Price Shifts Toward Key Moving Average as Bears Target $5,000;

Data Shows Crypto Exchange Volume May Not Equate to Website Traffic;

Canadian Venture Capital Firm Secured $320 Million to Invest in Fintech Startups;

SoFi Obtains BitLicense to Offer Crypto Trading Services in New York;

Cointelegraph Launches Consulting Division to Drive Enterprise Blockchain Adoption, Partners With Insolar and VeChain;

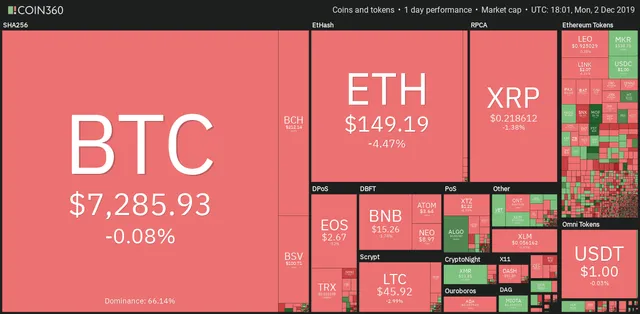

Bitcoin Price Shifts Toward Key Moving Average as Bears Target $5,000

As part of its current mid-term downtrend, Bitcoin (BTC) could be headed toward its 200-week moving average (MA), a level that has been a major historical bottom.

Since hitting its 2019 high of approximately $13,890, Bitcoin has seen lower highs indicative of a downward trend, at least in the mid-term.

After a corrective bounce up to $7,875 last week, Bitcoin was unable to shake its larger downtrend, heading back down to $7,285 by press time. The asset could ultimately have its sights set near $5,000 before a mid-term trend reversal as its charts look mostly bearish at present.

Read more.......

Data Shows Crypto Exchange Volume May Not Equate to Website Traffic

As a young industry, the cryptocurrency space has been like a revolving door, seeing numerous companies, projects and assets come and go with the wind. Crypto exchanges, in particular, have seen their fair share of changing tides. Outfits such as BitMEX and Binance have grown since 2017 while newcomers such as Bybit have more recently entered the spotlight.

It is not uncommon for such exchanges to gain social media attention as various personalities promote their reference links and talk about different digital assets on crypto-Twitter and YouTube.

BitMEX, Bitfinex, Coinbase, Binance and Bybit have each seen their share of activity on social media, each with varying amounts of trading volume, although recent data from Amazon’s analytics site Alexa shows where these five exchanges really stand in terms of traffic and engagement. High trading volume does not necessarily equate to a high website traffic and engagement ranking compared to all online websites.

Read more.......

Canadian Venture Capital Firm Secured $320 Million to Invest in Fintech Startups

Portag3 Ventures, a Canadian venture capital (VC) firm, has closed a second fund with around $320 million to invest in fintech startup companies globally.

On Dec. 3, TechCrunch reported that the VC company received final commitments from institutional and strategic investors totaling $320 million. The funds will allow the company to make early-stage investments in promising fintech startups around the world, with a particular focus on regions like Canada, the United States, Europe and certain markets in the Asia-Pacific region.

“Build global champions”

Portag3 Ventures CEO Adam Felesky reportedly said that the company is on a mission “to build global champions from a Canadian base.” He explained:

“Canada has the talent, the expertise and one of the biggest markets in the world directly to our south. All the ingredients are there, we just need more success stories — and we are on our way to getting them. Success will breed more success. In order to understand what it takes to succeed globally, you need to invest and work with the best of the best from around the world. Many of the early fintech unicorns are based in Europe on the back of substantive, helpful policy changes. Canada needs to learn from these examples so we get the right ingredients for building a leading, vibrant ecosystem — and we slowly but surely are.”

Read more.......

SoFi Obtains BitLicense to Offer Crypto Trading Services in New York

California-based financial firm SoFi has acquired a BitLicense from the New York State Department of Financial Services (NYDFS), the regulator said in a statement on Dec. 3.

SoFi is now one of 24 crypto-related firms that have obtained a BitLicense since 2015, Bloomberg Law’s crypto reporter Lydia Beyoud tweeted the same day.

Specifically, SoFi has acquired two licenses — a virtual currency license (BitLicense) and a money transmitter license — that will allow SoFi Digital Assets to offer crypto trading services to its New York customers.

According to the announcement, the firm is authorized to support a total of six digital assets including Bitcoin (BTC), Ether (ETH), Bitcoin Cash (BCH), Ethereum Classic (ETC), Litecoin (LTC) and Stellar (XLM).

Read more.......

Cointelegraph Launches Consulting Division to Drive Enterprise Blockchain Adoption, Partners With Insolar and VeChain

Cointelegraph, the leading publication for blockchain and cryptocurrency news, has announced the launch of its Cointelegraph Consulting division. The new business sector is focused on advancing enterprise blockchain adoption by helping companies understand the potential of blockchain technology and then matching them with enterprise blockchain vendors to implement solutions.

According to Gartner, the business value added by blockchain will grow to more than $176 billion by 2025. This number is expected to exceed $3.1 trillion by 2030. While the growth of enterprise blockchain is on the rise, traditional consulting firms are just becoming familiar with the blockchain space.

Given Cointelegraph’s six years of expertise covering the blockchain industry, the company believes that it is best positioned to boost enterprise blockchain adoption by educating and connecting customers with leading blockchain vendors. Its wide network across blockchain startups and technology leaders will facilitate this endeavor.

Read more.......