Daily Crypto News And Price Analysis, 02nd, December

Welcome to the daily crypto news :

$50M of ETH Stolen, ‘Rare Opportunity’ for BTC: Hodler’s Digest, Nov. 25–Dec. 1;

3 Key Metrics Suggest Bitcoin Price Has Completed Its Macro Bear Cycle;

What the HEX: A Look at Richard Heart’s Controversial New Crypto;

Microsoft to Turn 1980s Gamebook Series Into Blockchain Card Game;

Blockchain, Power and Politics: How Decentralization Engenders Freedom;

$50M of ETH Stolen, ‘Rare Opportunity’ for BTC: Hodler’s Digest, Nov. 25–Dec. 1

Top Stories This Week

Crypto exchange Upbit confirms theft of 342,000 ETH

Another week, another hack — leaving us all with a distinct sense of déjà vu. On Wednesday, the major South Korean crypto exchange Upbit confirmed that a whopping 342,000 Ether (ETH) had been stolen from its hot wallet — funds worth an estimated $50 million at the time of writing. The company stopped short of describing the incident as a hack and said that all remaining crypto assets have since been moved into cold storage. Deposits and withdrawals are going to be suspended for at least two weeks, and Upbit said corporate funds will be used to protect user assets. In recent days, rumors have been swirling that the incident could have been an inside job.

Indian government to issue national blockchain strategy

Despite taking a hardline stance on crypto, India has announced that it is working on a national blockchain strategy to accelerate the technology’s adoption. Officials believe that blockchain could transform a plethora of sectors, including governance, banking, finance and cybersecurity. Several Indian states have already been drawing up policies relating to blockchain and artificial intelligence, including Tamil Nadu and Telangana. This month, hopes were raised in the crypto community after a controversial bill that proposes a 10-year jail term for those caught dealing in digital currencies was postponed, with lawmakers failing to introduce it during the winter session of parliament.

Read more.......

3 Key Metrics Suggest Bitcoin Price Has Completed Its Macro Bear Cycle

Whilst the Bitcoin price (BTC) action may seem bearish to some, the leading digital asset has several bullish indicators that hint towards an imminent recovery.

As Bitcoin enters the last month of 2019, will the king of cryptocurrencies finish on a bullish rally, or fall to a yearly low?

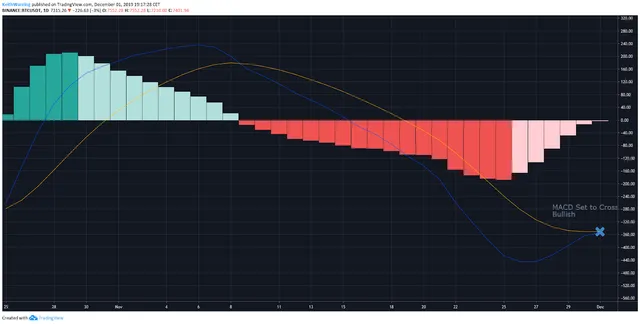

The daily chart turns bullish

Since the beginning of November, the daily chart has been bearish. Multiple attempts were made to break $9,500, but this failed to materialize and what came next was three and a half weeks of pain as Bitcoin plummeted to around $6,500 on Nov. 25.

The good news is that Bitcoin seemed to bounce off its new floor and quickly gained over $1,300 from it's low, changing the trend on the daily chart from bearish to bullish.

Using the Bollinger Bands (BB) Indicator, it seems the next milestone to break will be the moving average which currently lies at $8,000. From here Bitcoin will have a shot at the low $9,000 range.

Read more.......

What the HEX: A Look at Richard Heart’s Controversial New Crypto

HEX is a new financial tool and cryptocurrency launching on the Ethereum network via a Bitcoin UTXO snapshot on December 2. Critics are questioning HEX’s legitimacy, calling it a colossal cash grab and privacy compromise. Devout fans can’t wait to claim their tokens and start staking. So who’s right and who’s wrong?

Richard Heart, the outspoken man behind HEX, sat down with Cointelegraph to talk about the upcoming launch and counter a few of the criticisms surrounding the project.

Heart explained that HEX is the world’s first high-interest blockchain certificate of deposit (CD), letting users stake their tokens in return for interest. Users can enjoy interest payments ranging from 3.69% if 99% of the total supply is staked, up to an improbable and enormous payout of 369% if only one percent of the total supply is staked — paid out in HEX tokens. It’s worth noting that the monetary value of such a payout depends entirely on the market value of HEX at the time of maturity.

“It’s the world’s first blockchain CD that attacks the largest market in the banking ecosystem outside of savings accounts,” Heart said.

Read more.......

Microsoft to Turn 1980s Gamebook Series Into Blockchain Card Game

Microsoft, major game developer Eidos and gamebook firm Fabled Lands are jointly developing a blockchain card game based on a 1980s best-selling gamebook.

According to a press release published on Dec. 1, the new card game will be based on the 1980s best-selling book called “The Way of the Tiger,” written by Jamie Thomson and Mark Smith.

The game’s title will be “Arena of Death” and its players will fight in fantasy-themed card battles with features from the original gamebook series.

Ensuring card ownership

Thomson is also Fabled Lands’ chief executive officer and decided to use blockchain technology because he believes it suits what he is trying to achieve better than a traditional videogame. He said:

“We were going to relaunch the series into a computer game format but this new technology (blockchain), just made more sense. Imagine playing Magic the Gathering but knowing if you owned a card, it really does belong to you. Or if we say there are only 100 editions of an item or skill, you know there really are only 100 editions.”

Read more.......

Blockchain, Power and Politics: How Decentralization Engenders Freedom

The 21st century world is connected, but not centered. These are both good things. Connections link people, cultures and ideas. Indeed, all the great advances in human history have been the result of social and economic networks.

Without the trade routes of the Indian Ocean, the Islamic world would never have acquired the numerals of India that now form the foundation of our mathematics of science. Without the coffeehouses of 17th and 18th century Britain, the Enlightenment probably wouldn’t have materialized. Genius dies in isolation; connection is the engine that drives human progress.

By contrast, the centralization of power is highly correlated with disaster and suffering. Some say that this is the iron law of oligarchy — i.e., as any institution, private or public, becomes larger and more complex, power will inevitably become concentrated in the hands of a small elite. It’s also inevitable that we’ll experience earthquakes and hurricanes, but this doesn’t stop us from trying to mitigate the damage of such natural disasters.

Read more.......