A look at Blockchain Capital's FORM D for the SEC's private placement exemptions of 'security' token issuance

Blockchain Capital raised $10 million in 6 hours in its token sale of BCAP. They sold to 745 investors and to US persons. After their token sale, they filed a FORM D with the SEC declaring a private placement exemption under regulation D of the Securities Act of 1933, citing rule 506 (c) as their exemption.

But what does this mean, and what (and what quality of) information must you included in a FORM D?

In this post, we will dissect the FORM D submitted to the EDGAR database on the SEC's website for Blockchain Capital. This is a public record, and you can visit it here and follow along with me:

https://www.sec.gov/Archives/edgar/data/1703926/000095017217000040/xslFormDX01/primary_doc.xml

A brief background:

An issuance of securities to US persons, both abroad or stateside, is in violation of the Securities Act of 1933, unless the company is publicly and officially registered with the SEC or meets private placement exemption guidelines. With the newest notice from the SEC about the DAO token being a security, it might be worth educating yourself on what a company must do to stay within the limits of the law.

What is a private placement? It is an initial private offering of a companies shares, bonds, stocks, etc. to specific investors.

Investopedia states:

"Regulation D (Reg D) is a Securities and Exchange Commission (SEC) regulation governing private placement exemptions. Reg D allows usually smaller companies to raise capital through the sale of equity or debt securities without having to register their securities with the SEC."

The SEC makes a company file a FORM D 10 days after the first sale of their 'security' token, but they do not have to officially register with the SEC (known as an IPO).

Now, let's a take a detailed look at Blockchain Capital's FORM D:

Section 1 Issuer Identity:

In this section, one sees the official name of the company : Blockchain Capital TokenHub Pte. Ltd, that is was formed in 2017, incorporated in Singapore, and is a private limited company. It is interesting that there are no limits to how old your company must be.

Even though they are incorporated in Singapore, since they sold to US persons, they must file a FORM D with the SEC.

Section 2 Principal Place of Business and Contact Information:

Blockchain capital reveals where they do business, #32-02A ONE RAFFLES PLACE, Singapore and their phone number.

Section 3 Related Persons:

Next, the names of the directors are listed. Stan Miroshnik of Beverly Hills, California and his general partner Yong Leong Chu of Singapore. If you notice, Miroshnik listed a full residential address, but Chu just listed the business office they work at, one Raffles place.

Section 4 Industry group:

Blockchain Capital listed that they are a pooled investment fund and a venture capitalist fund.

Section 5 Issuer Size:

Here, Blockchain capital admits that they have no revenue before they offered the token sale. Which might explain why they needed to raise money.

Section 6 Federal Exemption(s) and Exclusion(s) Claimed:

Here is an important section. Blockchain Capital marked off that they claim

the Investment Company Act Section 3(c)

Section 3(c)(1)

and rule 506 (c)

The most important is rule 506 (c). This means that a company can raise unlimited amounts of money, but the amount of non-accredited investors must be less than 35 persons. You can have unlimited accredited investors, but the non-accredited investors must have a high level of sophistication related to financial matters. You can use general solicitation and advertising with this exemption, but you cannot use that type of advertising if you claim rule 506 (b).

Rule 506 (c) is a private placement exemption (reg D).

Section 7 Type of Filing:

Here Blockchain Capital stated that their issuance is a new issuance and the sale happened on April 10, 2017.

Section 8 Duration of Offering:

The token sale was meant to last less than a year.

Section 9 Type(s) of Securities Offered (select all that apply)

Here, Blockchain Capital checked 'other' and then specified that they issued digital tokens. When the SEC made their rules and regulations surrounding securities offerings, things like a token sale did not exists. So, their rules may be antiquated for the current technological realities of blockchains and cryptocurrencies.

In Section 10, 11 & 12:

Blockchain capital states that they are not acquiring or merging a company (this is meant to sniff out black-check companies) and that 100 USD is the minimum amount needed to invest in their fund. In the last section, Blockchain capital mentions that their was no commission paid to third party brokers or underwriters. This is a big difference between normal private exemptions and token sales. The developers and investors can exchange mutual value with each other, without needing third parties to broker the deal.

Section 13 Offering and Sales Amounts:

$10 million dollars raised

Section 14 Investors:

This is an illuminating section. It shows two blank boxes for the question asking how many non-accredited investors were involved in the issuance. Apparently, non-accredited investors did not participate in Blockchain Capital's token sale. The total number of investors is 745. Are they all accredited? One has to assume so based off the previous question. Notice how there are no questions asking how they vetted if a person is an accredited investor. On the SEC's fast answers page on their website, they state that in order to prove an investor's accredited status, the investors should furnish "W-2s, tax returns, bank and brokerage statements, credit reports."

There are no questions in the FORM D about what steps the issuer took to vet investors on their level of sophistication or accreditation.

Section 15 Sales Commissions & Finder's Fees Expenses

No commissions were paid because no brokers or third parties were used in the token sale. Even tokenhub.com is not listed here, yet this company hosted/designed/ curated the token sale for Blockchain Capital.

Section 16 Use of Proceeds:

Interestingly, none of the proceeds from the token sale went to the original partners of Blockchain Capital. They did not get any bonus from the 10 million dollars they raised.

And last but not least, Stan Miroshnik signed the FORM D on April 20th, just shying away from the 10 day limit of submitting the form after the first token issuance on April 10th.

Hopefully, you found this post helpful. My goal was to discover and share what type of questions are involved in a FORM D in a real life example with the people of steem.

What questions and comments arose in your mind as you got first hand experience of a FORM D private placement exemption? Please share below :-)

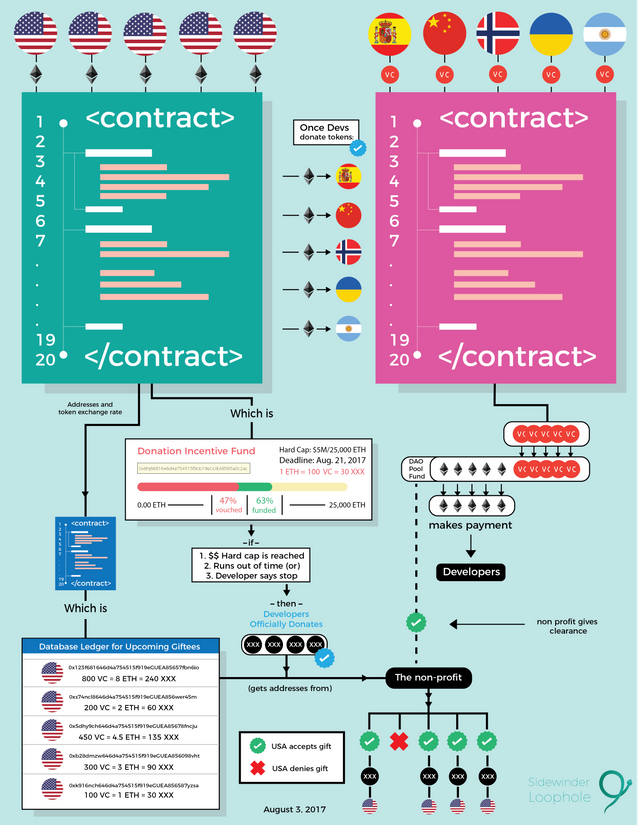

Also, I wrote an idea about how you circumvent the securities law of the US, so that US persons can get the tokens they paid for and the developers of token sales get the capital they need, all without breaking the law. Check it out!