Chinese cryptocurrency ecosystem, an overview Part 1

Chinese cryptocurrency ecosystem, an overview Part 1

In the past months we’ve seen a massive bull run in the cryptocurrency space, with a peak coin market cap of approximately 115 billion dollars. Some, including myself have speculated that this bull run was largely triggered by money coming in from markets in Asia. Specifically, the vast majority of the Asian market is composed of three countries: China, Japan, and South Korea.

In this series of articles, I will focus on the Chinese market, because relative to its neighbors, China is much more involved in both the development of, and spending in the cryptocurrency space.

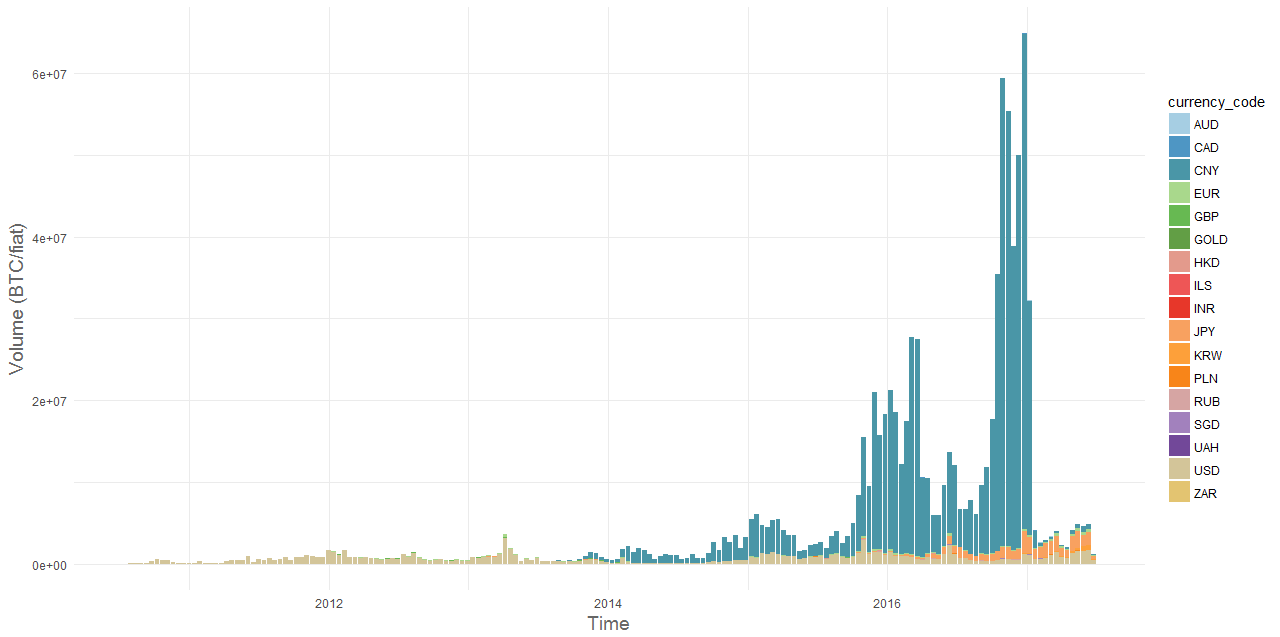

To show just how dominant the Chinese market, we can examine the graph below.

Analyzing Ethereum, Bitcoin, and 1200+ other Cryptocurrencies using PostgreSQL

You’ll notice that, up until 2017, fiat money flowing from China into bitcoins dwarfed the other major markets. Due to increased regulations , this fiat money seems like it dried up, but that it is not to say that this money flowed out from cryptocurrency. I speculate that most of this money is still entrenched in cryptocurrency, in the form of bitcoins and other altcoins. After all it is still very difficult to move large sums of crypto currencies back into fiat, and the ICO craze has shown that there are a lot of crypto holders looking to park their earnings into other investment vehicles.

So we can clearly see the importance of the Chinese crypto market, but it is not to imply that China is simply a hotbed for trading volume. I think the argument can be made that China is the most important country in cryptocurrencies as a whole. In this article I’ll be doing a focus two major groups: miners, which most crypto enthusiasts are likely to be familiar with, and the development community, which I’m sure western audiences have much less exposure too.

Miners

It is no secret that mining pools in China have had dominant control over the hash rate on the bitcoin network. Several factors that have lead to this situation include, but are not limited to, cheap electricity, specialized mining hardware, and early consolidation of individual miners into pools. In simplest terms, a mining pool is where all miners combine their equipment into a pool and split any rewards that are generated when they mine a block in a proof of work system. Today, Chinese mining pools control over 70% of the bitcoin hash rate.

China is undisputedly the biggest leader in cryptocurrency mining power, and the biggest individual in the Chinese mining community is Jihan Wu, founder of Bitmain. Bitmain produces the custom mining hardware that I mentioned above and is also the parent company of the largest mining pool in the world, Antpool. Antpool controls more than 25% of the network hash rate, which is more than double the second largest mining pool, which of course is also based in China.

And it’s not only bitcoin where Chinese mining pools control the majority of the hash rate. F2pool the largest Ethereum mining pool controls roughly 25% of the hash rate , and it also happens to control 49% of the Litecoin hash rate.

Whether or not you see this centralization of mining as a problem, as long as the top currencies remain based on proof-of-work, the Chinese mining community will continue to form the backbone of the cryptocurrency community. A development to watch will be several currencies, most notably Ethereum, attempting to move away from proof-of-work to alternate consensus mechanisms such as proof-of-stake. This will render mining obsolete.

For an in-depth look into an actual “mine” itself please check out the video below.

Life Inside a Secret Chinese Bitcoin Mine - YouTube

Although avid crypto currency followers are not strangers to the information to this information , I thought it impossible to do an overview of the Chinese crypto ecosystem without mentioning the miners. But there is one key take away that I would like readers to focus on. One of the advantages that I mentioned, and what I believe is the main reason for the centralization of hash rate, is early mining pool consolidation. This consolidation might have occurred more quickly in China compared to Western Communities due to a cultural bent towards collectivization in the east vs individualism in west. We’ll see how this cultural attitude might bleed into other aspects of the ecosystem in the following sections.

Development Ecosystem

Unnoticed to most, one group that has been affected by the growth of the cryptocurrency space is the open source software community. To those who don’t know, open source software is software that is developed for free, and the source code is released to the public where anyone can comment and make changes on it. In the past the most famous open source projects (including chromium, linux kernel, and bitcoin) have come from western communities.

Even something like the ruby programming language, another open source software project which was originally developed in Japan, became largely steered by the Western Community.

“In early 2002, the English-language ruby-talk mailing list was receiving more messages than the Japanese-language ruby-list, demonstrating Ruby's increasing popularity in the English-speaking world.” https://en.wikipedia.org/wiki/Ruby_(programming_language)

So how does this relate to cryptocurrency? Well, as I mentioned earlier, the most successful cryptocurrency projects are open source. This can be primarily attributed to the benefit of the network effect in cryptocurrency. The nature of open source inherently attracts more developers, who clean up code and add new features, naturally drawing further interest from both other developers and, eventually, outside communities. The increased quality of the program and the heightened attention around it make it seem safer and more palatable to potential buyers, who then invest and drive forward the program’s economic value.

So if open source software is necessary for the success of a cryptocurrency, but the open source software movement is not prevalent in China, how can we expect there to be a successful cryptocurrency to come out of China?

To answer this question I think we need to see there is an unnoticed change taking place in open source software projects, specifically ones that are based on blockchain technology. That is, where these projects were previously developed for free, now the developers can directly profit in two ways from the work that they contribute to a project.

- A developer who makes an improvement that drives some economic gain for the project, if they are tokenholders in the project that they are developing, receives a direct increase in the value of their holdings. For example, if an Ethereum developer actively contributes to the community and creates something of value, then the value of the whole ecosystem is expected to go up. In turn, the value of his slice of that ecosystem increases, so he gains a profit.

- A developer that contributes to a project may receive a bounty for his work. This is most common in projects in early development. Since the pool of tokens is still quite small, the original team can offer large sums of tokens as opposed to fiat currency to developers who implement some feature for the project. For instance in the original Antshares (now known as NEO), the developer was given a large stake for developing a blockchain explorer. That stake is now valued at around one million dollars.

So how will these developments affect the Chinese development ecosystem? Well I am of the opinion, that these new incentive mechanisms will drive the growth of more open source projects; the potential profits will be too juicy to ignore for Chinese developers, leading to a dramatic growth in software coming out of this space.

For the rest of this article I will be examining one Chinese open source software project in particular, Neo(Antshares, I will refer to it as Neo for the rest of the article).

Disclaimer: I am an investor in the project, but nothing I say should be taken as investing advice.

I think it is clear that for an open source to succeed that a strong, active community is necessary, an opinion echoed by Erik Zhang, CTO of Neo. He believes that “90 percent of the enterprise blockchains we are seeing are doomed to fail. Without an open-source code that anyone can build upon, Zhang argues, private solutions will not see the network effect of a healthy ledger.”

Sandbox for Public Blockchain Projects Launched in China By Wanxiang Group — Bitcoin Magazine

So if the Chinese community has been relatively uninvolved in Open Source Software to this date, whereas the West has a long history in the open source software movement, perhaps the software could benefit from the network effects from the Western World. I think that this was realized by the Neo team as well.

Their ICO in 2016 was advertised in English, and a small English community was formed on reddit and slack. In June Neo went through the crypto hype cycle, going from $1 to $15 back down to $7 today, but in this wake a smaller group of developers began to take interest, and sought to help the project, and its been interesting to see that relationship begin to form.

In open source software there are really two types of open source software management: the benevolent dictator, and the design committee. In the cryptoworld, the two market leaders ethereum and bitcoin are divergent in these philosophies. Ethereum is very much a benevolent dictatorship with Vitalik at the lead, whereas although the Bitcoin may have been “led” by Satoshi at some point in its history, it has very much transformed into a design committee approach.

In many ways the design by committee approach has not only been the cause of the current “scaling civil war“, but various prior conflicts as well. The r/btc and r/bitcoin split, the numerous forks off of bitcoin, and the vitriol against whoever’s side you are against at the current moment. So

Jihan Wu, also voiced this criticism of the design by committee approach.

^ You can read the full criticism here, but this, along with other statements have not sat well with many western bitcoiners. I hypothesize that this is because something inherent about the benelovent dictatorship strategy feels wrong to a society that has been taught that freedom, democracy, and individualism are three things that are considered sacred, in stark contrast to the East Asian collective society I mentioned earlier.

I’ve seen this mentality develop in the Neo project as well. In the video I’ve linked below a representative of the Neo projects criticizes how many developers being involved in the project has led to problems. And remember, many Westerns would consider etheruem to very much be a “benevolent dictator” project

A transcript of the piece of dialogue is below

“34:30

then have you considered about expanding it internationally?

34:34

for example, having a special group for international expansion, while maintaining the development in the core (China)?

34:39

I think this has both advantages and disadvantages

34:42

for example, "Ethereum" is more equally distributed when it comes to development

34:45

people from all over the world will participate in "Ethereum"

34:49

but then it can also be seen that the quality of their programming is not high

34:52

if you have been on the "Ethereum" website, you can kind of tell that the quality is not very good

34:57

our development mode is comparatively more centralised, more about the core

35:01

this mode is done under the lead of Mr Zhang, person in charge of technology,

35:07

I think this mode is very beneficial in some ways

35:10

you can call Antshares a rising star of the younger generation

35:15

"Ethereum" is slightly ahead of us

35:17

you can say that we are trying to catch up

35:20

since we are trying to catch up, we have to use all of our strengths and resources to catch up”

So, it will be safe to say the development philosophy of the Neo will maintain a semi centralized philosophy as well. That is not to say they will be excluding projects from the west. I’ve already seen tons of progress by several passionate devs over at GitHub - CityOfZion/neo-scan: Blockchain explorer for NEO, but I expect the communication from the core team in China to be mostly with several key developers on the western side rather than to be with the community at large.

Final Thoughts

In conclusion, Asia and China specifically look to be very exciting places in the cryptocurrency space in the near future. We’ve seen some of the communities that are already a core foundation of crypto (miners) and potentially future stars (developers). Additionally, we’ve briefly shown how collectivism and individualism play a role open source project management, and how it relates to the development of the cryptocurrency space, which is so dependent on network effects.

In the next article, I’ll be covering more about Chinese exchanges, regulations, and the retail investor. Please share if you like this article, and leave me comment if there’s anything I could improve, or that you’d like to know about in more detail.

This article was supported by binance.com. They’ll be running a no fee trading campaign this month, so please check it out.

QTUM, SNT, BNT, and EOS....coming soon

Our fellow BRICS friends. Kudos from South Africa 👌- cryptocurrencies are taking over.

I'm interested in the cryptocurrency scene in South Africa, any good resources?

1.https://steemit.com/bitcoin/@bhalisa/south-african-reserve-bank-to-conduct-trials-of-country-s-cryptocurrency-regulations

2.https://steemit.com/cryptocurrency/@bhalisa/meet-ubu-an-ambitious-south-african-cryptocurrency-project

Thank you, a universal income strategy on blockchain is a very interesting project. Followed

Fuck that was awesome, did you write this?

Thank you for your kindness. And, Ill be doing some more articles in the coming weeks so stay tuned, please follow to get latest update :)