Huobi Introduces HUSD — The Universal Stablecoin Providing Maximum Stability

Huobi Global recently announced the launch of their very own stablecoin- HUSD. The welcome move aims at combating the complications of several stablecoins flooding the market, as well as a convenient uniform platform for users to trade in.

With the recent Tether (USDT) FUD that engulfed the market and caused a significant spike in BTC and other altcoin levels, the issue of alternative stablecoins has never been more vital. This is also at a time when a number of new stablecoins are increasingly entering the market and providing users more and more options to hedge their risk, with the security of knowing their funds are held in reserves, verified and continuously audited to ensure complete transparency and security- factors which have been the primary scourge of Tether’s recent instability.

What is a Stablecoin?

A stablecoin is an asset or medium of currency, which offers price stability characteristics, thus making them very convenient for specific trading functions as well as medium of exchange, unit of account, as a store of value, and to hedge risk against downside volatility.

These characteristics are vital for currencies to be used in any purposeful manner. Presently, cryptocurrencies including Bitcoin, Ethereum and others are not ideal at being a unit of account or store of value over the longer term, mainly due to the often profound price volatility that they experience. This hinders the broader adoption of cryptocurrencies as stakeholders such as businesses would not like to be exposed to the intense risk levels associated when executing transactions in cryptocurrency. Consumer adoption can also be difficult, due to concerns regarding fluctuations in purchasing power.

Stablecoins as such is seen as being a price-stable solution in an otherwise very volatile environment.

What Stablecoins Are Supported by HUSD?

Huobi’s launch of HUSD allows it to support four existing stablecoins, PAX, GUSD, USDC, and TUSD; these are further explored below:

Paxos Standard (PAX)

Released in September this year, the Paxos Standard is a stablecoin introduced by New York-based blockchain company Paxos. The stablecoin is fully USD collateralized stablecoin, with full regulation and approval by the New York State Department of Financial Services. It is an ERC-20 token, and users can purchase and redeem PAX tokens directly from their website with a 1:1 USD peg. Paxos has had the most widespread adoption of the most recent stablecoins in the quickest time, with exchanges such as Binance, OKEx, Kucoin, and Gate.io already listing it.

TrueUSD (TUSD)

TrustToken is a somewhat new platform created with the aim of making tokenized assets available. TrueUSD (TUSD), which is pegged 1:1 with USD, is the projects first stablecoin and the flagship token of the platform. The TrustToken website states that “TrueUSD is a USD backed ERC-20 stablecoin that is fully collateralized, legally protected, and transparently verified by third-party attestations.” TrueUSD uses third-party escrow accounts to allow for the functioning of TrustTokens tokenized assets. Once customers have complete KYC and AML requirements, they can purchase TUSD. Firstly USD has to be wired to an escrow account, after which the same amount of TUSD is minted. When other tokens become available, the purchaser can decide which tokens they would like to purchase.

Gemini Dollar (GUSD)

Announced by the Gemini cryptocurrency exchange, operated by the Winklevoss twins, the Gemini Dollar (GUSD) is an ERC-20 stablecoin that allows users to transact via the Ethereum network. The GUSD can be exchanged for other cryptocurrencies on other exchanges for different trading pairs. The GUSD is strictly backed on a 1:1 peg with the USD and can be redeemed through Gemini. Notably, the New York Department of Financial Services (NYDFS) has reviewed and approved the Gemini Dollar. To ensure safety, Gemini will have USD holdings backing the stablecoin in the State Street Bank and will be insured through the Federal Deposit Insurance Corporation (FDIC). Independent auditor BPM accounting will also be in charge of regular monthly auditing of the company’s holdings.

USD Coin (USDC)

Operated by the Circle group and the CENTRE open source consortium, the USD Coin, is a 1:1 USD backed stablecoin currently operating on a variety of exchanges including Poloniex, OKEx and more. The coin acts as a way to tokenize USD to allow seamless transfer value on blockchains.

So What is HUSD?

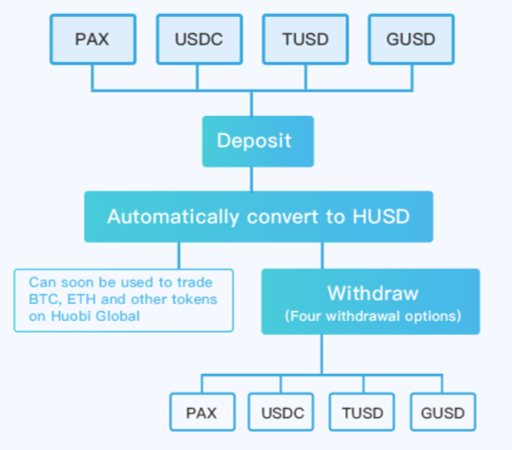

To ensure maximum efficiency and convenience for its users, Huobi Global is launching Huobi HUSD- their uniform platform stablecoin solution. HUSD allows users to make deposits and withdrawals in any of the stablecoins explained above.

Find out more about Huobi's new and unique stablecoin solution, the $HUSD. https://t.co/cEFB8wGgUg@PaxosStandard @TrustToken @GeminiTrust @Circlepay #HuobiGlobal #StableCoin

Huobi Global (@HuobiGlobal) October 19, 2018

“It’s no secret that community concerns have driven strong demand for stablecoins across the crypto space,” stated Leon Li, founder, and CEO of Huobi Group.

According to the Huobi website, HUSD is an integrated solution targeted at multiple stablecoins; it helps to:

Eliminate the need to choose between various stablecoins

Save costs when switching between stablecoins.

The site further states, “When you deposit any kind of stablecoins, they will be shown as HUSD in your account. You may withdraw any kind of stablecoin; when the amount of a particular stablecoin is not sufficient in your account balance, you may withdraw other stablecoins in which you have excess balances in.”

“For example, when you deposit 1 PAX, it will show as 1 HUSD in your account, and you can withdraw 1 TUSD (excluding transaction fees on the blockchain).”

Positive Reaction

Understandably the news garnered a very positive reaction from the crypto community with all four of the stablecoins retweeting the official announcement via their twitter accounts.

Other prominent crypto organizations were also quick to share the news including:

Cointelegraph

Huobi launches ‘stablecoin solution’ HUSD in phased rollouthttps://t.co/NI798Q6sPr

Cointelegraph (@Cointelegraph) October 19, 2018

ICO Drops

Huobi is launching HUSD solution, which supports PAX, TUSD, USDC, GUSD.

ICO Drops (@ICODrops) October 19, 2018

E.g. deposit 1 PAX -> 1 HUSD in your account -> withdraw 1 TUSD.

USDT/HUSD trading: Oct 22, 2:00 UTC.

Details: https://t.co/LCv8SAeox8 pic.twitter.com/JshGqMXI0s

BlockZone

Crypto Exchange Huobi to Launch Its own Stablecoin HUSD https://t.co/ddxuizvZhK pic.twitter.com/wH9qCwiTOI

BlockZone (@BlockZoneMedia) October 19, 2018

Tether Fake News Causes Market Turbulence

In a hugely volatile market like cryptocurrencies, any positive news or FUD can lead to substantial swings in prices and as a result, severe losses or profits dependent on which way an individual’s trades was placed. Most recently fake Tether (USDT) news caused panic among investors which resulted in many selling their Tether for other cryptocurrencies and stablecoins. The resulting sell-off caused a surge in Bitcoin and altcoin prices with Bitcoin trading at a $7k premium on Bitfinex due to Tether’s price dropping to $0.87 at one point.

The Tether dump was further compounded by a fake article perpetrating in crypto social and media circles about Binance delisting Tether. The official seeming blog post from Binance, labeled Tether a ‘scam’ and all USDT related pairs were to be delisted on 16th October.

FAKE: Saw this floating around and it's an obvious fake. Binance is VERY politically correct and will never write "Tether big scam" (it doesn't even make grammatical sense). This is just as bad as the "Vitalik is dead" scam last year. @cz_binance @binance pic.twitter.com/bd9Anvclmt

boxmining (@boxmining) October 15, 2018

Binance CEO Changpeng Zao, commented on the FUD, tweeting simply:

too much FUD.

CZ Binance (@cz_binance) October 15, 2018

Further adding fuel to the fire was a Bitfinex fiat deposit issue. The exchange announced on Monday that week that fiat deposits for certain customers were to be stopped. In a blog post they wrote that on 11th October, fiat deposits in JYP, EUR, GBP, and USD had been stopped for individual customers. They went to clarify the issue affected an only select group of people.

Further adding fuel to the fire was a Bitfinex fiat deposit issue. The exchange announced on Monday that week that fiat deposits for certain customers were to be stopped. In a blog post they wrote that on 11th October, fiat deposits in JYP, EUR, GBP, and USD had been stopped for individual customers. They went to clarify the issue affected an only select group of people.

Fiat deposit update - October 15th, 2018. https://t.co/F8o2ltVCN4 pic.twitter.com/ukE9JsRB0j

Bitfinex (@bitfinex) October 15, 2018

Along with an earlier announcement that Tether’s main banking parent Noble Bank was facing insolvency issues, the combinations of news events was enough to cause popular reception of Tether to change to an unstable stablecoin, one in which investors were sure to lose their funds should expect they continued to hold reserves. The sell-off also resulted in stablecoins such as PAX and TUSD trading at a $1.2 premium on exchanges such as Binance, showcasing how essential it was for investors to move out of Tether and into a new stablecoin.

As a trader myself the Tether sell-off caught me by huge surprise and resulted in some losses. At the time I was hedging my risk on Ethereum and was trading at an Ethereum short position. However, due to the Tether FUD and panic sell, the market surge, squeezed my short position at a loss. If I had decided to enter any of the other stablecoins, I would’ve been required to pay a sizeable premium on the stablecoin, for which I was not willing to do.

The Tether FUD and ensuing market surge and movement of funds into new stablecoins, showcased the apparent requirement for investors to have alternative stablecoins in which they can hedge their risk besides Tether. This is why the launch of HUSD is so beneficial to investors, instead of having the option of one stablecoin; they now have the security of four.

The Full Schedule For HUSD Rollout

The Huobi site has the current schedule as being:

The deposit service of PAX, TUSD, USDC, and GUSD will start at 16:00, October 19 (GMT+8).

USDT/HUSD trading pair will be listed at 10:00 AM, October 22 (GMT+8) on Huobi Global.

Transfer service of HUSD between Huobi OTC and Huobi Global will start at 10:00 AM, October 22 (GMT+8), and trading services of HUSD on Huobi OTC will start at 10:00, October 23 (GMT+8).

Huobi Global will list the BTC/HUSD trading pair at 18:00, Oct. 22 (GMT+8), and will list the ETH/HUSD trading pair as situation may require.

Huobi App will support the trading service of USDT/HUSD, and the deposit and withdrawal services of HUSD will be available in the next App version.

Huobi Global will start the withdrawal services of the stablecoins at 18:00, Oct. 29 (GMT+8), you may withdraw any coin among PAX, TUSD, USDC and GUSD. The specific time and date will be notified via a separate announcement.

Personal Review

It is of my personal opinion that the launch of HUSD will be of a beneficial move to investors. As the Tether episode showed, stablecoins will become increasingly relevant in the cryptocurrency universe and having a variety of options under one platform is wholly positive. Even if one was to ignore the recent Tether FUD, there has been heavy scrutiny of Tether for a while now in regards to their ability to have actual 1:1 USD reserves and their failure to be fully audited by an independent company.

There will be concerns of course. As stated by @LindaCrypto, arbitrage trading will be a worry. During the Tether sell-off, the four stablecoins supported by HUSD were all trading at substantial premiums. If a user deposited the stablecoins for far less than what they are worth when withdrawing a different HUSD stablecoin, it could prove to be very costly for Huobi.

Another concern for some investors is their belief of stablecoins being another form of custodial banking and other features of the already existing centralized banking system. By being pegged to another asset (USD), these stablecoins ultimately face exposure to the underlying asset itself- it’s mostly just adding a second layer to the asset through tokenizing it.

However, overall, the chances of USD volatility causing a disturbance in the stablecoin pegs are very slim and would not be of much concern to the majority of investors. The introduction of HUSD is a good move, and the prevalence of stablecoins will positively impact the Huobi community.

♂️ Hi, my name’s Sal.

If you found this article useful and would like to view my other work please be sure to comment and follow me on✌: