Trading on Bittrex Confuses the Hell Out of Me | Help Me Wrap My Head Around Profits and Losses

So I've traded stocks for years, and even trading on GDAX is simple enough I buy Ethereum and $330, if I sell it for $340 I've made a profit.

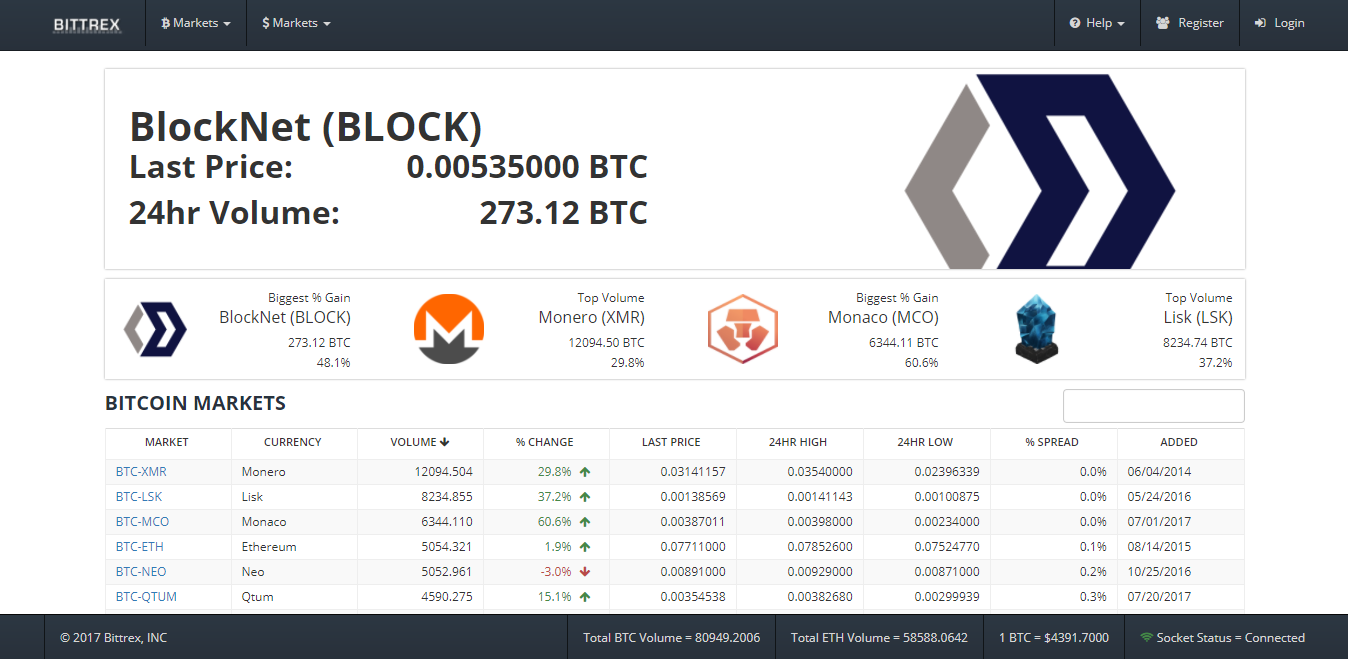

That said I have a really hard time wrapping my head around trading on Bittrex since everything is priced in Bitcoins. Say I buy Factom at $20. Should I make note of the USD price at time of purchase or the Bitcoin price?

Also, if I buy Factom at $20 and it goes up to $30 but Bitcoin goes up say $200, have I really made anything since I have less buying power when I have to go back into Bitcoin to complete the trade?

Another scenario, say I buy Litecoin at $50 and the price of Litecoin stays at $50 but the price of Bitcoin falls $300, have I made money since I have more buying power going back into Bitcoin? I'm winding up with more Bitcoins than when I started?

I've been doing more trading on GDAX lately because I'm really having a hard time wrapping my head around profits and losses on Bittrex trading.

How do you look at your trades and or if your using a profit and loss tracking software or app what are you using? I've tried Cointracking.Info and AltPocket and neither accurately tracks my positions or my cost basis.

This is a good question and I am sure that the currency traders have a better answer for us than stock traders. But there is another side and that is the IRS. There is a fair amount of speculation on how the IRS views profit and loss. As that becomes clearer then I think that will be the same way you will view it because who wants to keep two sets of books. Most of what I have seen so far is the worst outcome of putting every exchange valued in equivalent dollars at the time regardless of whether $ are used in the transaction or not.

You have to get used to pricing things in BTC. I would only trade 2-3 alts for a while to get the hang of it.

However, for the most part, a lot of the trading on Bittrex is done through good price entry accumulation and catching a big wave up. I think day trading would be somewhat difficult on Trex, but I know some people do it.

I just do buy orders at what I think is a good entry. From there, either scale up sells or accumulate for the moon. Gotta learn the BTC price. For instance, I trade a lot of NEM(XEM) and I know the BTC price range that I really don't care what the USD value is. But I've had days where my portfolio is down BTC but up USD.

I guess that's part of my question, is it cool just to totally disregard USD price and only look at it in terms of BTC price?

Also, once I'm in a position, should I care at all about what BTC price is doing in relation to USD?

In many cases, yes, you can ignore USD. You will want to follow for a while to get used to looking at the charts this way.

So altcoins lag behind when Bitcoin's value increases, therefore the BTC price of an alt will go down. However, when Bitcoins price goes down, the alts go down with it. So you cant be emotionally attached to your altcoins. You want to have stop loses to sell when bitcoin causes them to bleed. Once Bitcoins consolidates, the alts will start to correct in price accordingly. It's kind of the wild west in cryptoland. :)

I think the best way to approach this is get the concept of fiat currency out of your mind. Think as if bitcoin is the only currency there is. Don't try and convert prices back to USD to compare how much you made. If you have more bitcoins than what you started out with, you have made profit. In the short term this might not seem like a good enough solution. But if you believe in bitcoin and the price speculations of bitcoin for the next few years, then yes, definitely, if you have more bitcoins you have made good profit in the long term

I'm right there with ya @rulesforrebels! Bittrex is confusing! :(

I have the same problem with tracking profits n losses here.