The psychology of the nonprofessional trader

The situation

So it seems alt season has ended , bulls are resting and bears have wake up from their winter hibernation with great hunger the result of this circle of life is to make our profits be hidden in the bushes or got eaten by a beast!

Your situation

Scenario A) You have already taken your profits and you are already in vacations ! Well done!

Scenario B) You are 50-50 taken part of profits , still watching the market , still your positions are unbeatable !

Solution: Cash out your short term high mcaps maybe maybe your mid term bags also , just stay with your longs and watch it burn ! Better safe than sorry!

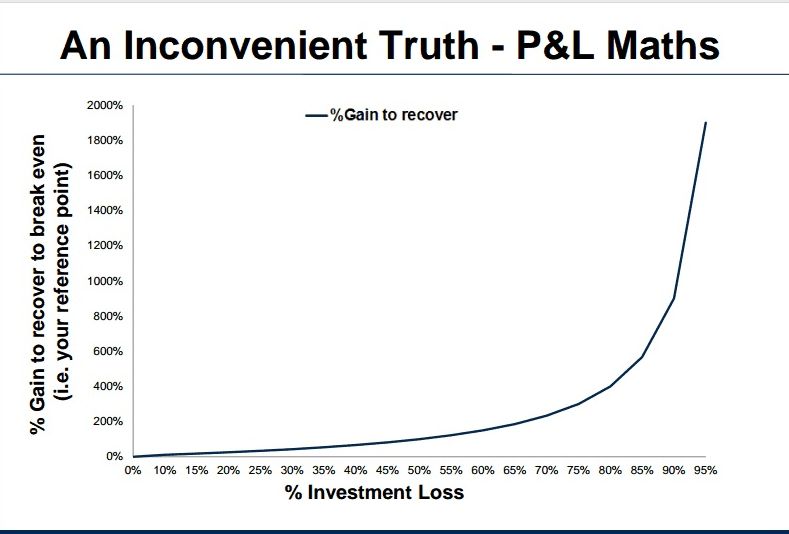

Scenario C) You are in deep shit , you have buy-in high & already with 50% loss

Solution: If you know what are you holding and tracking the progress of development , news, trends etc. continue loading your bags all the way down till you find the bottom! You shall be rewarded ! Holding a total shitcoin is excluded !

pep talk

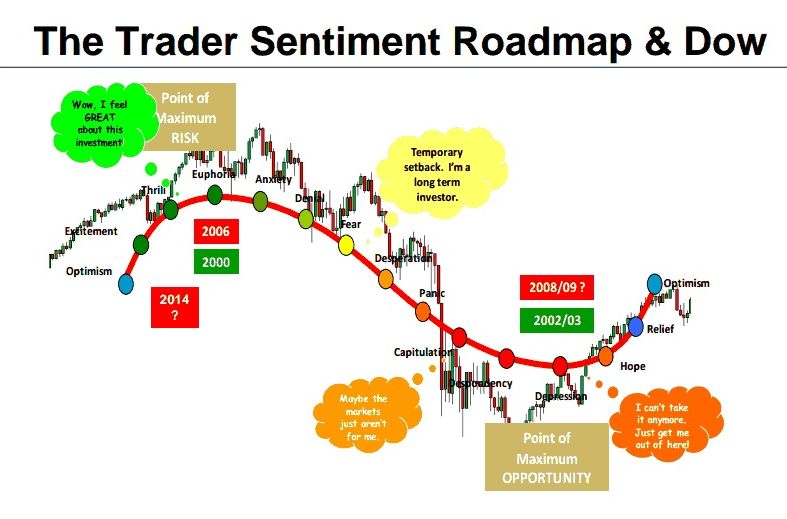

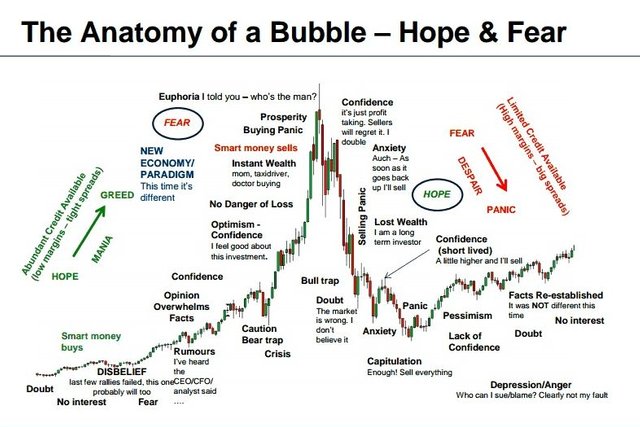

Every trader / investor is or at least thinks different from the others. He believes that he is able to evaluate fundamental and facts, always acting on a mature thought, that he knows the market "tricks" and the dangers. However, a systematic scientific study of trader / investor behavior shows that everyone is moving on the basis of certain common rules.

Each investment move is the result of a decision making process that involves a wealth of psychological related data. Some of them are common to everyone. But they are directly related to personality and character.

"Most investors are unaware of the psychological and emotional dimension of investment decisions, so they often fail to explain and justify them." Kim Cramer Larsson, technical analyst at Saxo Bank, said in a presentation on "Behavioral Financial & Technical Analysis".

As he said, all investors / traders feel about being "specialists" on the subject and listening to what they want to hear. There are thousands of information on the market. They choose not to process the information they do not like.

And because they consider themselves "experts," they do not change opinion easily , even when there are events that contradict their views.

The worst part is they are convinced that they can defeat the market with their knowledge and skills. They believe they always have good and adequate information, which puts them in a position of supremacy over the other "players" of the market. They gain so much confidence in themselves that they inevitably fall into repeated mistakes.

They get bigger risks when they record losses from an investment.

They invest additional funds in a stock that writes losses in order to lower the average purchase price.

They pay close attention to the first information they are learning. They then process all the further information, but they make decisions by giving great weight to the first information.

Surveys show that the more the investor loses a placement, the more risky he gets.

Usually, when it loses some placement, it changes its investment horizon: It postpones the liquidation, hoping that the recovery will come quickly and it will break even.

Another common behavior of investors is that they try to avoid the negative feelings caused by the damage. That's why, when they place a loss on them, they throw more money on it, lowering the average cost of ownership. Thus, they can claim (themselves and others) that they have reduced the (per cent or per share) loss and can more easily cover it.

Investment psychology and discipline

It needs discipline

90% of this advice is that all of the above is understood. The trader/investor should keep an investment journal. This helps him to think more clearly and learn from his mistakes.

The investment horizon should not change

Investors should be disciplined about their coins price targets and not change their strategy without real reason.

«Kill Your Loved Ones»

Investors should not "fall in love" with an investment simply because they see a company or products-services that it produces.

Love your losses

The trader must learn to "love" his damages. An important "asset" is to be able to close positions with damage when the market (or the specific stock) goes down and does not postpone it, hoping in vain to some recovery that will save him from the damage. This alone can make a big difference in terms of profitability and return on placements.

Let the profit run

When their coins go up, traders typically earn much less profit because selling early . On the contrary, when they fall they let the damage grow.

-Rouketas

Always remember to DYOR and have patience and discipline

lots of useful information! being new to crypto, such awesome articles are great to read....

I am glad you like it ! also i hope to answered you some questions or dillemas ! trade safe and don't panic with the whole situation !

Great article and we were lucky to invest in a few things when bitcoin was still around $800... so though it might be down at the moment we cannot complain. Our charts are still in the green. But for those who are in the red... do not panic and hold on to it! I'm sure better times are ahead!

Since we are in cryptos for the long run everything is fine! And yeah there is no reason for ppl to panic because if you take a closer look to BTC chart it is full parabolic it need to retrace some time ! heh!

I'm glad for your calls Amy ! :)

It's unfortunate that when most people find out about crypto it's when its in the bullrush. They all get in hoping for sky rocketing performance and are left with a bad taste in their mouth. The effects of FOMO (fear of missing out) can be devastating to a new investor and leave a bad taste in their mouth.

meep

my meep meep friend !!

meep

The real investors they don't have the FOMO effect because the are getting in in the long run , FOMO is more likely a trader side effect, that why iv said always do your DYOR and have patience !

"They make decisions by giving great weight to the first information." It has happened to me so many times but I had not payed attention in order to observe it. I liked your "Let the profit run" quote and your whole post.

We tend to be biased when it comes down to ourselves. We believe we make desicions based on bulletproof logic thus we fail to make a proper adjustmenent after a loss. But you said it yourself, love your losses, everything must be a win or learn situation.

There is always the loss situation but you don't have to make it up from the same coin, you can always move along , just don't forget your mistake !

Αληθές :P

Honestly a lot of things are streaming through the minds of the majority of the investors out there.i don't think this is play end game,there is a green light at the end of the tunnel,what matters is the big T (time) and his bigger brother P (patience). i too have my dark side of the story,but i just hold on for now and see what the future can offer.a big thanks for sharing.is all about the game and it is not yet over until it is over!stay steemed!!

Nothing has ended i agree (at least for the legit coins) but there is the factor also called available liquidity ! This adds up more stress to the new comers !

hey man its a really interesting article for me since I just started trading coins,

also Id like to nominate the post in a small curation group im in if you dont mind

This gem of a post was discovered by the OCD Team!

Reply to this comment if you accept, and are willing to let us share your gem of a post! By accepting this, you have a chance to receive extra rewards and one of your photos in this article may be used in our compilation post!

You can follow @ocd – learn more about the project and see other Gems! We strive for transparency.

Please feel free to share my post ! :) Thank you

followed

great ill add it into our pool for the day after tomorrow and then you might get into that compilation

Congratulations @rouketas! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @rouketas! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here

Scenario C, yes, that's me!

What are you holding ? & at what price you got in

This post has received a 7.67 % upvote from @booster thanks to: @rouketas.