Survival guide on dump times for Bitcoin and CryptoCurrencies

When the market dumps, the same fate hit the sentiment of the people that are directly involved in it with open investments: all those emotions that are associated with a bull market and growth in general (excitement and confidence) gets crushed, leaving room to anger, disillusion and even depression.

In this context, looking for excuses is the worst behaviour that a trader can have, ending to make emotionally driven decisions instead of rational choices. Inexperienced traders especially tend to externalise the causes of their losses in an attempt not to hit their ego, ending to identify major events like SEC, futures market, Spoofy etc. as the main reasons behind the general wreckage of their unmanaged portfolio.

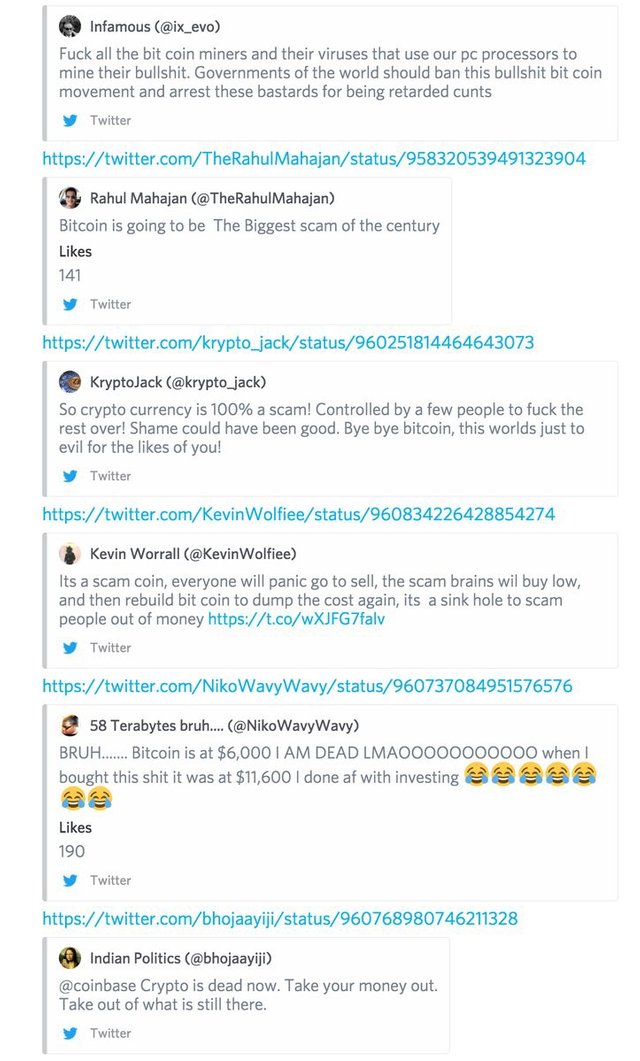

Inevitably, these arguments get traction on social media, going viral. Newbies are prone to get stricken by those kinds of statements: their lack of specific knowledge related to the financial markets, in fact, makes them particularly vulnerable, ending to develop pessimistic behaviours that inhibit every kind of learning effort, because -in their minds- it would be useless anyway in a “highly manipulated market”.

The direct result is the prevalence of pessimism, declined conventionally in the following way: The trader has a pessimistic feeling; therefore, trading practice becomes emotionally driven; external reasons justify the losses, suppressing that kind of positive self-critique which puts the basis for refining trading and risk management practices; money gets lost, and anger rises.

While things in the market get worse, social media, as a direct result, becomes crowded with angry and noisy people. Coalitions arise, feeding each other moods in the attempt to preserve their egos: if the perceived reality is that some kind of external event has fooled everybody, then even if in practice your capital could have been protected with proper risk management, nobody will think about that, therefore you will not appear as “stupid”. That’s the norm after all.

Here are some tips that may be useful to prevent to approach these hard market phases as those subjects that I have presented to you in the first part of the article:

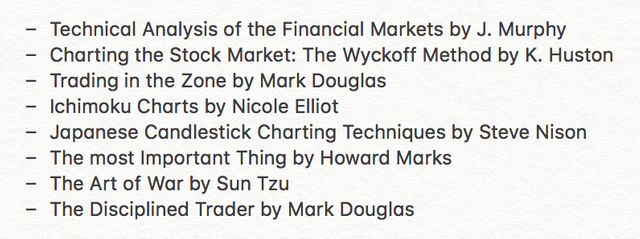

Books will always be better than Twitter. Static knowledge is emotionless and fear-poof. Some of my favourites:

There is no need to trade every single day or week. Overtrading will generate losses. You will make 80% of your gains during bull runs. During the rest of the time, the focus should shift to capital preservation.

Be humble; not as a way of life (there is no need to go on with the slave-moral heritage). Be humble with yourself, instead. Discover your limitations and design a strategy accordingly.

You don’t need always to be up with every tiny detail of the price action. There is nothing wrong with reading charts. Just make sure to remain flexible so you can respond promptly to any scenario. Many people are obsessed with being updated with the price action in every candle of every single timeframe. But sometimes the scene is uncertain, and that’s it. There is no need to risk your capital on a weak trade.

Don’t invest more than you are willing to lose. It’s a very well known mistake, still hitting a good chunk of people anyway. Trades must be opened and closed when the right times come, not just when you need money. The market isn’t tailored to your needs.

Trying to apply risk management after every asset dumped hard is like being late at the party. Risk management and diversification in USDT or BTC must be planned when the market is going up with the aim to build a cushion for the future dumps. There is no endless bull-run (unless you are a central bank).

When it’s not the right time to enter into any trade, spend your time wisely by studying TA and FA, research good projects, getting a grasp on how mining works etc. Create connections and share your ideas with friends. If the right people surround you, it’s possible to improve yourself significantly by backtesting your strategies and receiving feedback from other traders.

Develop patience and endure your nerves. Emotions always lead to radical decisions. It’s better to consider the scale of greys rather than look at everything with an absolutistic “black vs white” approach. Even if your opinion is clear, keep your mind open and accept the eventuality to be wrong.

Travel, meet new people, cultures, taste new foods and enjoy new landscapes. All these experience will contribute to keeping your mind open to new possibilities.

To wrap-up:

Be sceptical of every info that you gather on social networks and media;

Practice patience and trade only when needed, because the market isn’t aware of your necessities;

Take your time to analyse all the potential scenarios and use a flexible approach.

If you are accumulating Bitcoin or other cryptocurrencies, you don’t need to wait for the perfect moment to buy. For example, if you’re looking to buy Bitcoin, grab positions on the way down while continually trying to re-evaluate the scenario, gauging the weight of each portion instead of placing all your bets on a single specific price. This way you won’t get trapped, and, even if you failed to spot the bottom, you’ll have the chance to average down. As commented previously, there is no need for a “black vs white” approach when the reality shows uncertainty. Having an open-minded and rational approach will add value to your portfolio over time. Don’t fall as a victim of ego battles.

Keep yourself alive in this market, so you can shine in the long run.

That was really a nice article to read. Keep up the excellent work!

This types of comments will motivate me always...thanks a lot