Bitcoin’s up and other cryptocurrencies are down –So, What’s Your Move?

Like most other crypto enthusiasts, I make it a point to check the crypto charts every morning.

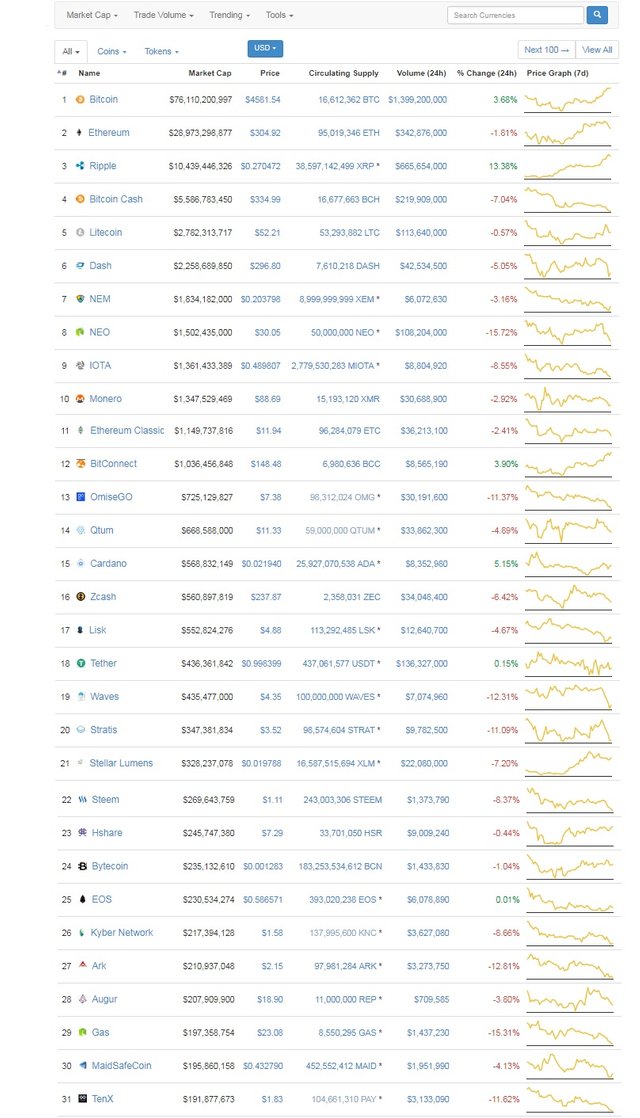

After checking today morning’s chart, I was presented with an interesting scenario. Have a look at the top 31 currencies in the crypto market the time I’m posting this:

Here are the main points I noticed:

- Bitcoin (BTC) has started soaring and has crossed $4600 and a quick check of candlesticks seems to suggest it looks good for more.

- Apart from Ripple (XRP) which has shown an impressive 13% growth overnight, almost every other crypto is down (with just a couple of exceptions) considerably.

So what’s possibly behind this sudden surge?

Everytime in the past couple of months I saw a surge in cryptos, it’s more or less collective – all these coins in the top 25, more or less go up together. The time Bitcoin hit 5k, the general euphoria was felt in the valuations of the other coins too. So why this selective surge in Bitcoin?We are getting into speculative territory here, but if the hype and hoopla around the next hard fork on Bitcoin to introduce Bitcoin Gold, is anything to go by, it seems people are cashing in on their cryptos to hold Bitcoin till the hard fork happens. If you haven’t been keeping up with the news, check this article from cointelegraph https://cointelegraph.com/news/will-bitcoin-gold-return-power-to-ordinary-users

The new hard fork, set to happen on October 25, is also referred to as the people’s fork, and trying to bring in more democratization in the mining space (this could probably mean the home PC user will be able to mine the new Bitcoin Gold, unlike BTC, which is now beyond the reach of the ordinary home users because of the heavy computing power required for mining).

The last Bitcoin hard fork resulted in the creation of Bitcoin cash (BCC). Every user who held BTC (atleast those who held it in their private wallets) ended up getting BCC at a 1:1 ratio, and given that BCC at one point was valued at over $700 (not bad for a bonus), it seems nobody wants to miss the bus this time with Bitcoin Gold. So it is possible that a large faction of crypto currency holders is liquidating their holdings to retain BTC at least till 25th October so that they can claim the new Bitcoin Gold currency.

This could rationally explain why most of the coins are falling against BTC now. Though I’m not certain why Ripple’s an exception here – will have to check out for news on this this – the only thing I can think of is that it’s recovering after crashing 85% against BTC from its highpoint and is undergoing some strong recovery – additionally there might be some news that’s cooking in the XRP space, which might be evident later.

So what can one do in this situation?

There are three viable options in this situation they way I see it:

Option 1: Go with the tide

If you’re going with the tide, you are betting big on Bitcoin and the new hard fork. In such a case, you’d probably want to convert a good part of your holdings into Bitcoin (or purchase more BTC using Fiat currency if you have spare cash).

Here are the pros and cons as I see it of this strategy:

Pros:

- Bitcoin could surge all the way to $5000 and even more before Oct 25th, and this would mean atleast a 10% rise from current levels.

- The new hard fork could give you Bitcoin Gold, which could be of considerable value – and if miners take to it (like it’s expected), it might be a good long term hold too.

- You would be selling off your altcoins are a considerable loss and once the hoopla dies down, you may end up paying far more if you want to get them back.

- BTC might fall considerably after the hard fork if people are just waiting for the fork and additionally if the entire Bitcoin gold hard fork, turns out to be a damp squib, you would be losing both ways.

Every other crytocurrency is at a major discount right now and you might want to sell off your BTC to purchase them at lower levels and opt to hold minimal BTC at the time of the fork.

Pros:

- You get valuable cryptocurrencies at a discount and at some point they would go up in value.

- If BTC prices crash considerably after the hard fork, you can buy back BTC using these altcoins at lower rates.

- If BTC climbs up to completely unexpected levels, you miss making a considerable profit from it and the value of cryptos you hold might fall further.

- You miss out on Bitcoin Gold, which may turn out to be valuable.

Option 3: Keep watching and then take a call

Pros:

- You get an excellent entry point into promising cryptos at rates you may not get for a long time

- If Bitcoin corrects after the hard fork as expected, you can still buyback Bitcoin at lower rates and you get to gain both ways.

- If BTC does a reversal at this point, you miss the chance to buy at these lows.

What would I do in this situation?

My gut instinct is that Bitcoin will head higher but will correct after the hard fork considerably. However, it’s unlikely I’ll get other cryptos at discounts like this every time, here’s what I am planning

- Do nothing on existing cryptoholdings – it would be foolhardy to exchange them for BTC such low rates, I’d rather buy BTC with Fiat currency, if I want to try my luck with BTC.

- Start buying the cryptos I wanted to get into or average out (NEO, Stratis, Ether, OMG, TenX are the ones I am looking at long term) by placing limit orders to purchase at every 10% dip starting from this point – if they go down I get them at good discounts, if not my money stays in BTC for now.

- Move any BTC that I’m not using for purchasing into cold storage/paper wallets before Oct 24th to claim Bitcoin Gold when the fork happens. Leaving it in exchanges would be risky since I may not get Bitcoin Gold when holding in exchanges.

Disclaimer: The views expressed are of the author alone and is not to be taken as investment advice. Do your own research before taking any decision.

Nice analysis

Resteemed

Thank you @emad- appreciate it!

@mrainp420 has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

Cool that you exposed all the possible cases!

Thank you @mejustandrew