How last week's sentiment analysis top/bottom coins performed against the market last week

Another week, another mixed market with not a ton of action.

Such has been the norm recently (though this week may be shaping up a bit better).

That doesn't mean there weren't winners or losers. So how'd my sentiment analysis do? Not too shabby! Last week was the first week I started including both the top and the bottom coins, to give some perspective and potentially allow people to root out if a coin is headed for a bottom.

If you're just joining us, I scrape the social media data of 135 crypto traders and influencers,, run sentiment analysis on the coins they mentioned and combine it with other measures like mention volume and unique influencer mentions to create a power rating for a given timeframe.

One change I'm going to institute for next week: I'm going to start attaching an indicator to show if a coin's price action has been particularly hot. This can be a problem for shorter term traders using my data, especially for the top coins, which may be reaching a local peak and be due for a dip.

But both measures did pretty well last week. Let's start with the top coins.

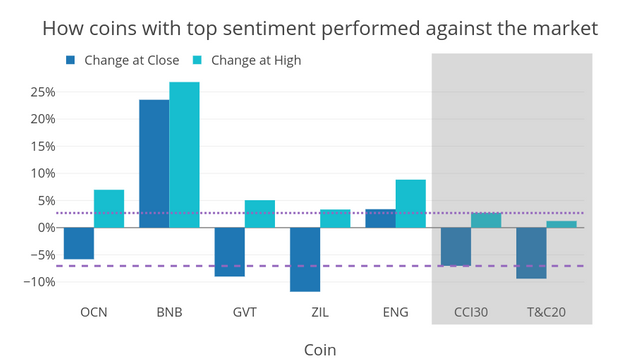

Top Coins

First, two coins are missing. $NOS, which is an ICO, and $TUBE, which didn't have $BTC price data on CoinGecko. $TUBE, generally, had a shitty week against the $USD, so we'll chalk that up as a loss. And I don't see much point in charting price changes of such a nascent coin as $NOS, so I've excluded it.

Of the remaining five on the chart above, all five outperformed the market at their heights, and 3 of the five ended the week higher than the general market. Putting $TUBE in the loss column for lack of data, that gives us a roll of 5 of 6 and 3 of 6 respectively, which I'm happy with.

I'm continuing to monitor and tweak things here. I think the hot price action indicator will help root out some of the coins that end up down.

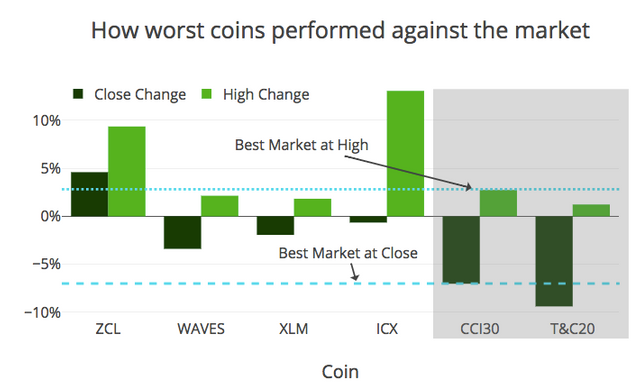

What I liked about the worst coins is that all four outperformed the market if you grabbed and held them. If you're talking about coins/tokens that may be reaching bottom, that's really what you want to look for here. Unless we get coins that make an absolute "V" bottom and shoot right up, these coins generally will have some room to run medium-term if they're truly turning around.

That said, also nice to see $ICX and $ZCL outperforming the market at their heights as well.

The Influencers

I follow an ever growing list of crypto influencers, traders and newsmakers. The list is up to 135 separate people and I’m always looking to add more. You can click the link in this paragraph to follow a public Twitter list of my analysis list.

Who am I?

I'm an investigative data journalist during the day, and I've been looking for a way to cut through the noise and get a true sense of what some of the biggest crypto influencers are pushing toward and pulling away from.

Using a pseudonym here because I can't post about this shit on my verified accounts. I've become mildly obsessed with crypto and its constant stream of data and needed an outlet. So here I am.

What is this?

Each week, I scrape the Twitter accounts of some of the crypto world’s favorite influencers, traders and TA folk. I run a sentiment analysis to see which coins they are mentioning positively, neutrally and which they are mentioning in a negative light.

I also take in data on unique influencers, retweets, favorites, volume and strength of feeling in sentiment.

I calculate power by through a weighted formula that takes into consideration volume, number of unique influencers and sentiment. The higher the score, the better, the lower the worse.

This isn’t financial advice, just my own way of trying to make sense of what’s out there. And as with most things, the more data I collect, hopefully, the more interesting it’ll be. This is a work in progress. Please leave suggestions on how to make it better. I imagine if I keep up with it, I’ll be able to expand a bunch of the analysis, but I wanted to start somewhere.