Why do SBDs start and stop printing? A simple visual.

Yesterday, Steem Dollars started being included in post payouts again for the first time since some time around June or so. When we go through these transitions, it can be confusing to people who haven't seen it happen before.

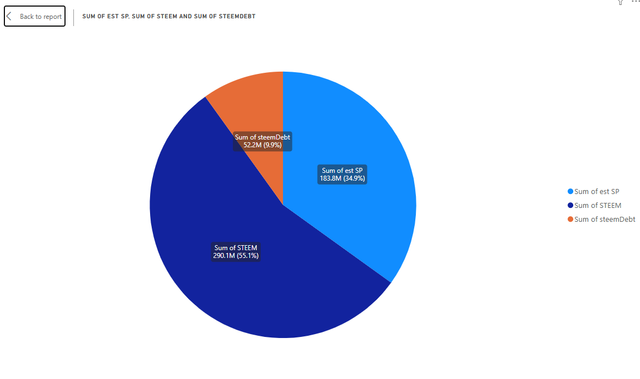

In order to understand what's going on, let's take a look at the pie chart to the right.

The three forms of post payment from the Steem blockchain are shown there. These are Steem Power (SP), STEEM, and Steem Backed Dollars (SBDs).

The pie chart shows the approximate STEEM value of those tokens in all wallets on the blockchain (as of yesterday)*:

- Steem Power (SP)/staked STEEM (which, technically, is an abstraction for VESTS) is shown in light blue.

- STEEM is shown in dark blue. This is the fundamental unit of the blockchain.

- SBDs are shown in orange.

The orange slice is what we need to focus on in order to understand when SBDs will and won't print. We also need to remember that SBDs are a form of blockchain debt. Under the "standard" conditions - when the total value of all SBDs is less than 10% of the virtual supply (all STEEM plus all SP plus all SBD debt in circulation) the holder of the SBD is entitled to redeem 1 USD worth of STEEM from the blockchain using a blockchain conversion function.

Importantly, when the price of STEEM goes up, the SBD debt in terms of STEEM goes down (and vice versa). If STEEM is worth $0.50, then one SBD can be redeemed for two STEEM, but if STEEM is worth $1.00 then the same SBD only converts to 1 STEEM at the blockchain layer. Thus, the orange slice gets smaller when the price of STEEM goes up, and it gets bigger when the price of STEEM goes down.

- If the size of the slice is 10% or higher, SBDs stop printing entirely. (Aside: Technically, the slice will never exceed 10% because the blockchain stops paying in full dollars for SBDs when this threshold is hit. This is informally known as the "haircut price". SBD investors take a haircut if they decide to convert to STEEM at those prices. Authors and curators also take a haircut in terms of post payout values.)

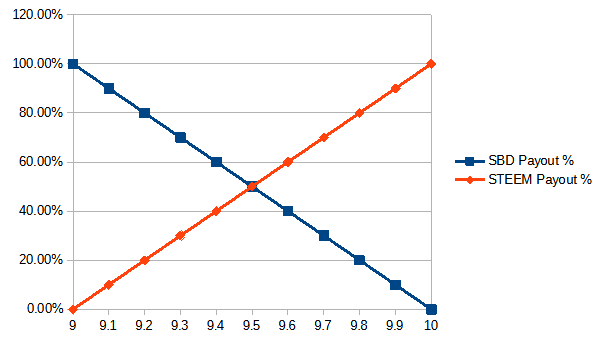

- If the size of the orange slice is between 9% and 10%, both STEEM and SBDs will be paid, as illustrated in the graph to the right.

- If the size of the orange slice is less than 9%, then all liquid rewards are issued as SBDs.

Yesterday, the threshold dropped below the 10% threshold, and right now with the orange slice at 9.9%, the blockchain is paying 90% in STEEM and 10% in SBDs. This balance will continue to fluctuate according to the line chart above until the size of the orange slice drops to 9% (STEEM approx. $0.29) or climbs to 10% (STEEM approx. $0.26) again.

I think that description covers most of the basic points. Hopefully, this might be helpful to anyone new who may not have observed one of these transitions before.

*The STEEM value in the pie chart is calculated using the blockchain's internal prices for STEEM and SBD, which will typically differ from market prices on external exchanges. The STEEM price is the median of the last 84 hourly price feeds from the witnesses, and SBD is always priced at 1 USD (subject to "haircut" adjustments).

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

I'm probably being more pedantic than necessary, but at the chain level the number of vested Steem is known, the "vests" abstraction only matters on a per-account basis.

It might be a helpful for people just learning about this topic be more explicit that the $1 is 1 USD. (I think it can be easy to slip into thinking "one dollar" is "one SBD", which can be confusing if they think the value of "one SBD" is the market price of an SBD).

Since "worth" is a loaded term it might be better to phrase this as something like "can be redeemed for".

Thanks. I updated the article with the 2nd and 3rd points. I left VESTS alone because I don't want to veer too far of topic or overcomplicate the explanation. The topic of VESTS is not really material to the point of the post, but I just wanted to observe that there's a little hidden complexity that's being glossed over there.

Thank you for posting a good and easy-to-understand article about the issuance conditions of SBD, the relationship between STEEM and SBD, etc.

It was very helpful for me! :)

While reading the article, I had a question about the data of the pie chart.

I found the data in the market info and system info of steemworld.org (thanks to @steemchiller for providing a great tool). The STEEM and SP data that I found are roughly similar to the numbers in the pie chart, but the numbers for SBD are quite different.

<Steemworld.org data>

I have two questions.

First, is it okay to draw a pie chart with the STEEM and SP data that I found on steemworld.org?

Second, the SBD values I found on steemworld.org are quite different from the numbers in the pie chart, so I wonder how you got the SBD values. :)

Thank you!

On the first question, mine was calculated from the wallets of each of the accounts, converted from VESTS to SP one at a time, so there would have been many rounding errors the way I did it. Also, I noticed after posting that I was using an old conversion factor to get from VESTS to SP.

So yeah, a pie chart that is constructed with the numbers in steemworld would definitely be more accurate. I only used these approximations because I already had the chart in place from a previous report.

For the second question, the SteemWorld number is expressed in terms of SBD. But for comparing with STEEM and SP, it needs to be expressed in terms of STEEM debt owed. If the number of SBDs is 13,827,985 and the median price of STEEM is 0.264, then the value in terms of STEEM for the pie chart would need to be (13,827,985 / 0.264 ) = 52,378,731.06 in STEEM debt.

After that conversion from SBD to STEEM, the SteemWorld value is also similar to the pie chart.

Thank you, much appreciated!

Thanks to you, I think I can now draw the pie chart you drew using data from steemworld.org :)

Including those outside SteemitWallet (ie external exchanges?)

Yes, this included the exchange holdings. It's 3 months old, though, so it looks very different now. Especially considering that several million SBDs were converted to STEEM in the last couple of weeks.

No problem. This (Steem Economy) is one of the topics I like, though sometimes I don't know what I'm reading and get dizzy from it, and @moecki, @danmaruschak have answered quite a bunch of my questions on this topic.

Does that make the possibility of the next SBD minting even more remote? I guess this question would be easier to answer by looking at a chart based on the latest data. If only I know how to collect the necessary data.

Thanks.

0.00 SBD,

0.38 STEEM,

0.38 SP

The reason the chain stops minting SBDs for rewards is because it thinks (according to its formula) that there are too many SBDs in the ecosystem compared to the market-cap of Steem in the ecosystem. Since converting reduces the number of SBDs it will generally move things closer to a condition where SBDs will be minted for rewards. (It's slightly complicated by the dynamics of the economy, though, since things might affect the Steem price).

The amount of Steem and SBDs in the ecosystem are parameters that the chain keeps track of, so there are a number of ways to get that info. One way is to go to Steemworld.org and look at the Market Info tab, you'll see "Current Supply" of Steem and SBDs there, those are the number of tokens that exist in the world. (Some of those Steem are powered up, so it combines the two blue regions from the "pie chart" representation in the original post).

0.00 SBD,

0.00 STEEM,

0.78 SP

I was wondering why SBD is printing, now I have an explanation, I have experienced the SBD printing moment but never knew processes like this leads to its printing, we are waiting to see the debt ratio fall below 9% for a 100% SBD printing rate.

Regarding the haircut, how do curators benefits from SBD printing, I discover they don't receive SBD, so do they receive double the SBD conversion to steem

To be honest, I'm not sure I understand the full impact on curators. On one hand, when the ratio is above 10%, the value of the STEEM + SP is below the post's listed payout value by the haircut ratio, so it would seem that when SBDs are printing curators should do better on the posts that they vote on.

However, curators definitely don't get anywhere near as much of a benefit as authors when SBDs are above 1 USD on external markets. If they get any benefit at all, it's subtle.

I'm uncertain, though, because in the past my own curation rewards have seemed to go down when SBDs started paying out, and I don't understand why that would be. If the STEEM price stays above the haircut threshold, I'm going to see if I can get a better understanding of the impact for curators.

Okay I grasp every point here, if you make some discovery I would love you to share again may be in this comment section or in another post, if possible give me a tag so I can locate it soon, I would really appreciate,

You know I asked this because I want to know as I have been observing the steemworld when SBD was here and I noticed the difference in author and curators rewards and pls how long do you think SBD can print, Does it have a span?

It's fascinating how the relationship between STEEM, SP, and SBDs creates such dynamic changes in payouts. The 9-10% threshold for SBDs is a clever way to balance rewards. It's a reminder of how blockchain mechanisms adjust in response to market conditions, offering insight into token economy management. Thanks for shedding light on this complex yet vital topic.

Well explained. I have read posts explaining it and yours is the easiest to understand. Thanks