Some words on the myth of "deflation" of BTC

I see it so often thrown around, that BTC is a deflationary currency and therefore WILL gain in value. You should get suspicious on this - the reason for this is right below.

In the last post we saw, that the actual number of BTC is a bit lower than many believe. And while some people might still disagree with me on the conclusion, we will now take into consideration, what implications it may have for the inflationary nature of Bitcoin.

First, we need to assess the generation of new BTC. Bitcoin has ~10 minutes block time, meaning that 12.5 BTC is entering the circulation every ten minutes.

This equals to:

- 75 BTC per hour

- 1,800 per day

- 12,600 per week

- 656,250 per year

We also simple estimate 17,000,000 BTC in circulation at the end of 2017, so we end up with an inflation rate of about 3.86% (656,250/17,000,000) for 2018. This number is nothing to worry about – after all, also Kostolany considered Inflation just a “warm bath” for a currency (let’s put aside the question, if BTC is a currency – at least for now).

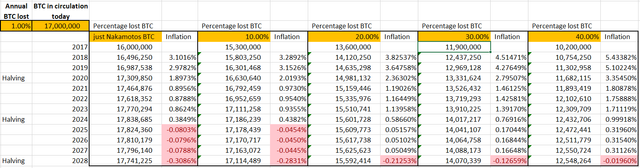

Let’s see, how this turns out, when certain amounts of BTC are not accessible:

- 0% lost (leftmost column – assuming, that only Satoshi Nakaomotos BTC are out of circulation)

- 10% lost (Nakamoto + 700,000 BTC lost)

- 20% lost (Nakamoto + 2,400,000 BTC lost)

- 30% lost (Nakamoto + 4,100,000 BTC lost)

- 40% lost (Nakamoto + 5,800,000 BTC lost)

This table shows several scenarios, based on the following fixed assumptions:

- predictable new coin circulation (656,250 per year, halves every ~4 years)

- 1% annual loss of BTC (death of the holder / failed backup / whatever)

The file for this calculation can be found here (just download the .xslx - docdroid otherwise only shows you the content of the file as a simple PDF).

What is important here however is the percentage number and the respective year, when the inflation turns negative (red). Because these are the years, when BTC will become actual deflationary – until then, it is still an inflationary currency. Here, we see why it is important, to calculate the numbers of BTC lost in the system: the less BTC are in circulation, the higher the annual inflation and the later BTC turns into a deflationary currency in a narrow sense.

And if we consider that BTC will - even by taking just Nakamotos BTC lost and only 1% annual loss of BTC - not turn deflationary for at least another 7 years, we should not be deceived by the term "deflationary". Everyone who is referring to "deflation" as the core attribute why BTC should gain value, may refer to a point in time, that is still far away in the future.