In-depth analysis on Red Pulse Token (RPX)

Yet again another Chinese project, which is coincidentally focusing on something, which you are reading right now: business research.

Conventional market & business research is usually done by professionals, which are mainly referred as “analysts” in the public. This analysis is basically doing the same: analyzing a project, grading it, then putting it in perspective to the value of the currency behind it and in the end giving a rought estimate: buy/hold/sell. Conventional analyses are quite expensive, not only because many experts are involved producing them, but also due to the amount of data that is needed to be screened. Red Pulse points out three big general disadvantages regarding this industry: big companies control the majority of the market, the lack of transparency & accuracy of the information in China and finally: information overload. At least the last point I guess everyone can totally agree with – the amount of information that need to be processed has risen significantly in the past years in general.

So, Red Pulse wants to solve these three points by providing a research content platform, which gives smaller research providers the possibility, to get a compensation for their work and customers the opportunity to get the information they need. No more excess information, no more information overload.

Let’s dig into this.

Red Pulse is operating in Shanghai, China and is registered as a Limited in Hongkong.1 The three founders Jonathan Ha, Stanley Chao and Peter Alexander manage a team of about 9 employees in total (one intern, five analysts and 3 employees of unknown areas of responsibility).2

Jonathan Ha 3

His background (academical as well as past working experience) is focusing heavily on management consulting, project management, financial services & analysis and similar fields at companies like IBM and LG. His last employer was a Chinese management consulting company Z-Ben Advisors with about 70 employees, where he worked for about five years and met with his superior Peter Alexander. He also holds a CFA certificate.

Stanley Chao 4

His academical background is centered around mathematical science and computational finance, but he also lists actual experience in due diligence, marketing and quantitative trading. He holds a CFA as well as a CAIA certification (a certification which is similar to a CFA, but centere d more around alternative investments like private equity or real estate).

Peter Alexander 5 6

Most experienced among the three founders. The nature of his position as “non-executive Chairman” is better described as an advisor and monitor (board responsibilities) – which explains, why he is still working for his company Z-Ben Advisors. Like already stated: he was the superior of Jonathan Ha at Z-Ben Advisors, where he is still working, since he helped it being funded back in 2004. He is living in China for about 20 years know, so he is most likely quite familiar with mentality, regulations and the implications of events in China.

The fact, that Peter Alexander is with Red Pulse, is quite a positive sign – Red Pulse is providing a platform for Chinese business knowledge, Z-Ben Advisors is providing research and intel from Chinese markets. This way, both companies complement each other quite well from a logical point of view – one provides the “car” (Red Pulse), the other provides the fuel (Z-Ben Advisors). Also, it is to be expected that the friction in between both companies is quite low, as Jonathan Ha worked there for five years & Peter Alexander is involved.

I however also need to point out, that the reviews on Z-Ben Advisors are not just positive and some former employees describe the company to be more a sales-company than an actual consulting firm. One former employee even called their research “very basic level”. 6

Regarding the news coverage, RPX received quite a wide coverage and seems to be known quite well in the English-speaking community. Some crypto currency news outlets covered them, after they announced that they will exclude Chinese citizens from participating in the ICO.7 8 What is on the other hand impressing is the secondary news coverage – CEO Jonathan Ha often seems to receive requests from news outlets, who reach out for his opinion.9 10 11 This might come from his connections and reputation from working with Z-Ben Advisors, but is in the end a good sign, as it shows that he is a known and respected person in some circles.

They also list some partners on their ICO-website as well as on their regular website:

- Z-Ben Advisors

The advantages of such a partnership is pointed out above. I personally would be interested in the details of their partnership. - NEO and Onchain

They conducted their ICO via NEO and were actually the first project to do so, so this partnership (and Da Hongfei listed as their advisor) is somewhat expected. - Kenetic Capital 12

A Chinese venture-capital firm, which focusses on blockchain projects. Regarding Kenetic, I would love to see some transparence, if they gained a pre-sale offer – and if yes, more details on the conditions. For now, I consider them as a part of the “shareholders” that took part in the first round of the ICO. - FinTech Innovation Lab 13

An accelerator, which offered ten promising blockchain startups a mentorship over the course of 3 months. By being accepted from this accelerator, it can be guaranteed that Red Pulse has a working product which is at least in beta phase. 14 Also, it adds to the network between Red Pulse and institutions, as Accenture initiated this initiative together with other institutions like Goldman Sachs, J.P. Morgan, Credit Suisse etc. 15

The website of red pulse itself also lists Bloomberg, Reuters, S&P Capital IQ and FactSet. 16 They stated themselves the following on this:

This is indeed a quite refreshing fact, that speculations on the nature of partnerships are smothered, even before they can arise. Please keep in mind: Red Pulse is also providing research besides working on the platform. These partnerships have not much to do with the platform directly, which is why these partners are not listed among the partners stated above. Bloomberg, Reuters etc. are simply customers of the Red Pulses services of research on Chinese markets, which is what they do for some years already.

Publicity: 7.5/10 (7 – high transparency, experienced team and partnerships with a focus on the goal of the service they want to provide; +0.5 for the great secondary news coverage)

Their communication channels are: reddit17 , slack18, facebook19 , twitter20 and a thread on Bitcointalk21. Twitter is a bit about Red Pulse the company itself, some business news and RPX itself, Facebook is focusing more on RPX. The subreddit as a community driven platform is of course almost exclusive about RPX. Slack is active with announcements on RPX and the hype after the ICO has slowed down a bit, so activity from the community has diminished a bit over the past weeks. Nevertheless, questions are answered from the team, it just might take a bit of time. During the time I was active there, Jonathan Ha and Stanley Hao were not present due to them speaking on fairs and holding presentations. The thread on Bitcointalk however could see a bit more attention.

RPX is traded only on one exchange so far: Kucoin. It is tradable against BTC, ETH and NEO with a major focus on BTC (~85-90%). The pair RPX/NEO however shows way more market depth than RPX/BTC.

Their whitepaper is mainly about:

- how the platform will work and what RPX will have to do with it

- competitors

- addressing several problems & risks (e.g. cold start, content manipulation & regulatory risk)

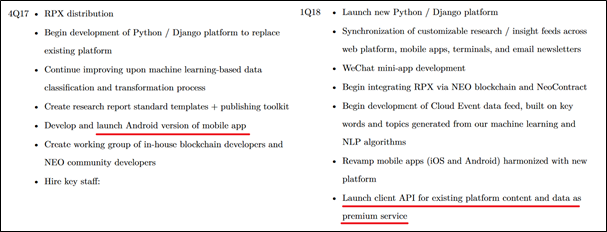

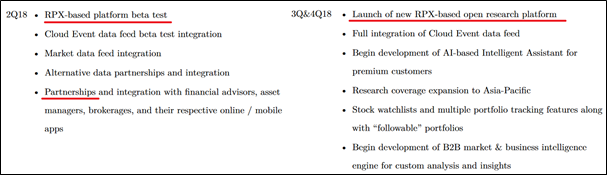

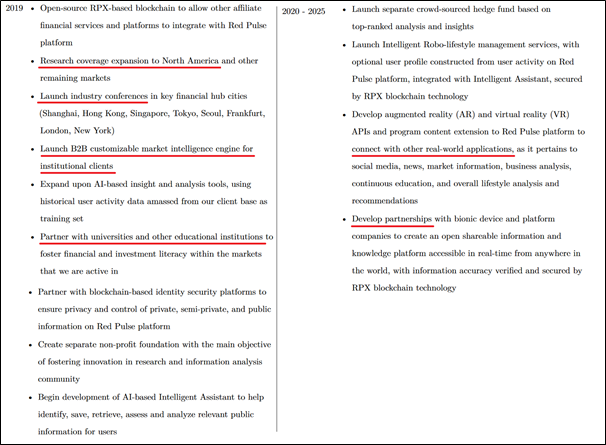

It also includes a roadmap, which is focusing on three time-frames: short-term (2017-2018), medium-term (2019) and long-term (2020-2025). It makes single goals a little bit hard to pinpoint overall, but this can be seen quite positive, as it prevents p&d-like speculation and exaggerated hype on RPX, based on single day announcements. The big milestones however should be emphasized a bit more, but I guess this is just my personal taste for classification of information.

What is positive however, is the “upcoming events and presentations” - post on reddit.22 If they keep it updated, it could help to prevent exaggerated hype on conferences, like we have seen in the past with e.g. Digibyte in June.

One thing however I feel the need to criticize: from a team which is heavily from a business & market intelligence background, I expected a little bit more business-plan-like approach on the whitepaper (scenario-analysis, some details on financing etc.). I am quite sure that they have such a plan - but why not make it public, to ensure more trust in the project?

In the past, there was also a Q&A with a community member, which they released in October.23 The transparency they showed there is good, similar Q&As / AMAs should be conducted on a more regular base.

Basically, RPX will be the utility token of the Red Pulse platform. If you are e.g. a business analyst, providing business information regarding Chinese companies or industry sectors, you can upload it on the platform and receive RPX, if someone wants to read your analysis. This amount of RPX is based on the amount of “upvotes” as well as your reputation on the platform. In some respects, it works like Steemit, while at the same time, Red Pulse wants to prevent manipulation and abuse of the platform as well as establishing a system to track the credibility of the user (whitepaper, pg. 14-16).

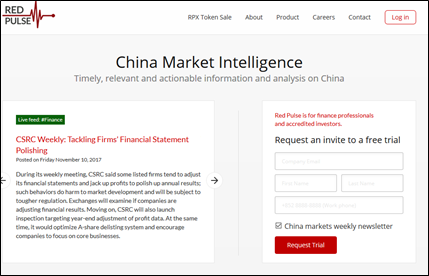

front page of their website

The market for business and market intelligence itself is growing for several years now and shows no sign to stop with the total amount (and demand) of information increasing day by day.24 Same goes for the Chinese economy, which (albeit showing signs of slowing down) still needs to liberalize foreign access to their capital markets and therefore has yet to open the full potential to foreign investors. I definitely see a growing market for their application. But as the Chinese market is so different from e.g. the US market, it is not possible for me alone, to assess the extent of how much growth potential is actually in their market and how big the audience for their service may be. Therefore, even a rough estimation on the target market cap of RPX is not possible.

There is a working platform already, on which Red Pulse employees publish information and analysis for customers. In the future, others will also be able to provide analyses and translations and get paid in RPX. The platform itself wants to lower the amount of information presented to the customer by using e.g. machine learning, to match relevant information over irrelevant ones to the user and filtering information from the daily information flood (whitepaper, pg. 9-10). It also wants to focus more on the individual user, as the Chinese stock markets are more dominated by individuals, not so much on institutional investors, like it is in e.g. the USA.

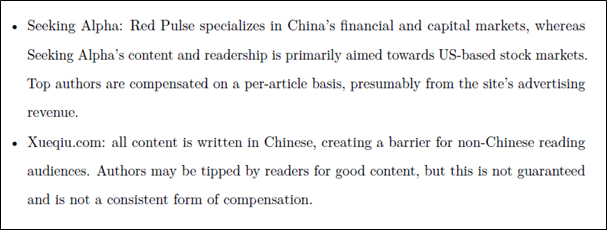

All in all, RPX will be the currency of a platform, that wants to focus on sectors and areas, which the big players (Reuters, Bloomberg etc.) do not cover. This is appealing to the external, English speaking community, that is interested in the Chinese markets. Within China, they compete with two companies: Seeking Alpha and Xueqiu.com. They line out the differences in between these companies and themselves like this:

The content of Seeking Alpha is mostly about the US markets, Xueqiu.com is in Chinese. Both platforms serve either a different audience or have a different focus than Red Pulse.

One think to mention is also, that customers can offer RPX for other users to earn by providing analysis or insight into certain topics. That way, the market on their platform is not only based on offering a wide amount of information but also a demand-driven market, where the providers of information can provide their services compensated and on-demand.

While Red Pulse is indeed unique in their approach, does not seem to have major competitors, a head start in development and the technology behind it seems solid, it is not fundamentally groundbreaking on a technological level. It does not need to be for what it aims to do - but it may indicate a lower entrance barrier in the market for competitors in the future.

Technology - Grade: 6.0/10 (5 - the tech seems to be there already & “only” needs to be modified to use RPX, but it is not so much innovative on a technological level; +0.5 for already utilizing the platform without RPX; +0.5 for being able to utilize a blue-ocean-strategy in a growing market)

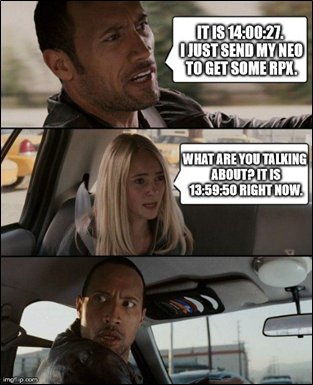

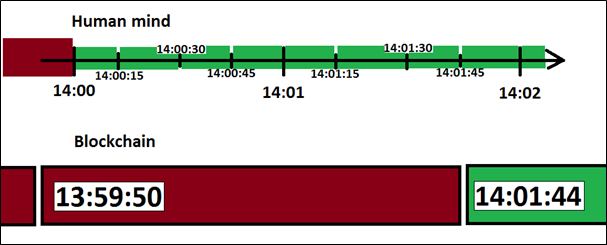

During the ICO, there was an issue in regard of the participation, which led to quite a shitstorm right away, including threats or some involved investors taking legal action. Reason for this was, that some investors did send the NEO to participate on the block 1.445.025 of the NEO blockchain. Which was right on time for the human logic - but not for the logic of the algorithm, according to Jonathan Ha.25 I will try to explain, what happened (please correct me on this, if I am wrong, this is how I understood it):

The ICO was officially opened at the 8th of October in 2017 at 14:00 GMT (2:00 PM). Therefore, people who were eager to invest into RPX did send their NEO at 14:00 or in the minute after that. And regarding time, you can say that our mind works “analogue”, so we understand that there are always 60 seconds in between 14:00:00 and 14:01:00. And in between these seconds, we always have sub-units of time, which we can break down infinitely (in theory). Computers on the other hand work “digital”, so for them, there are 60 seconds in between one minute. If they are not programmed to understand, that there are subunits in between these seconds, they will always assume, that it is 14:00:01, 14:00:02 and so on. You could say, that they think in “blocks”.

So, for our mind and our understanding, the sale started right away at 14:00:00. But in regard of a decentralized blockchain, the system always needs a agreement on the time. And as this cannot work via using a central time (as it would contradict the decentralized idea of the blockchain), there needs to be consensus of all nodes, on what time it is on the system right now. One solution for this problem is, to consider the time of creation of the last accepted block, to also set the “time” on the whole network.

Unfortunately for the investors, the last accepted block had a time of 13:59:50. So, for the whole network, the time is 13:59:50, until the next block is accepted. This next block was then created 14:01:33. But as long as this block was not created, the whole system assumed, that the time was exactly 13:59:50 - aka “not time for the ICO yet”. The time on the blockchain was working on a block, which was lagging behind the real time.

Consequently, the smart contract considered the NEO from this time (or block) as not appropriate to send RPX in return for this transaction of NEO. Red Pulse now held NEO of interested investors, which were technically too early to be handed out RPX, but in reality, right on time.

It is always easy to put up a statement in hindsight, saying “they should have checked on this / know about it”. And if only Red Pulse were involved in this, it would also be quite easy to give them the credit of being the first ICO of NEO. But they explicitly list Onchain and Neo as partners, Da Hongfei as an advisor. There is no way around the statement that “they should have checked on this”, because they should have. I stumbled over a screenshot of their Slack, where Red Pulse confirmed that it was based on real rime, but I have not received confirmation from them, that this screenshot is faked or not, so I give them the benefit of a doubt on this.26

I will not jump the wagon of “compensate those, who missed out because of this”, as I am neither familiar with the legal situation in China, nor am I invested into RPX right now or affected by the incident. I however think, that this indeed leaves a bad impression for people, who are interested in RPX in the future. Even more so, if it boils down to legal consequences in the future. Because when it comes to missed profits, people can go quite long ways.

It is not fraud (as always: scamming and fraud can only work with intent), but it can be viewed at least as a miscommunication between devs and potential investors, leading to a huge problem.

Those who are however seek compensation for that, should take in mind:

- compensation in RPX will crash the price

This is a logical consequence, as many ICO-investors act this way. Many people dumping = price crashes. If this happens, you can be left with XRP, which is worth way less than today. - compensation in USD/BTC-equivalent is unlikely

I hear some people disagreeing with me on that. But I can imagine, that this whole incident could fall under the same laws as the ones that handle electronic trading systems. And e.g. in German law, the “bank” would only be liable for losses due to a failure of said system (which I could imagine are treated similar), if the failure was intentional or if the bank acted grossly negligent. Intention cannot be proven in this case & gross negligence… well, this needs to be argued.

Enough playing lawyer, as I am not one. If you are affected by Block 25 however, I would suggest reading into NEO and then decide if you want to hold it or sell it.

Also, there seems to be a problem in withdrawing XRP from Kucoin, the only exchange it is listed on.27 This is most likely one of the factors, why the volume of RPX is quite low these days and will most stay like this for the rest of November, as this issue will be solved at the end of the month, according to a statement on Slack. It is not possible to determine, who is actually at fault for this.

UPDATE:

This issue has been solved - RPX is now withdrawable from Kucoin.

Irregularities in regard of their roadmap are not pinpointable, as the progress so far cannot be compared with an older roadmap.

Also, Red Pulse was intended to be listed on Binance right after the ICO, which was then canceled shortly after. There is only little information on this to get and obviously NDA prevents details getting out. Reading too much into this, would be fortune telling. But I hope that this does not generally hamper a listing of RPX on Binance in the future.

History - grade: 5.5/10 (6 - in regard of history, there is not much to grade, but Red Pulse having a working platform already is quite a positive sign, as they do not need to develop from scratch; -1.0 for the block-time-issue; +0.5 for compensating the loss with a bit additional GAS from their own stash after holding the NEO of failed ICO deposits)

I would like to diversify this section into three time horizons, as the roadmap is quite long.

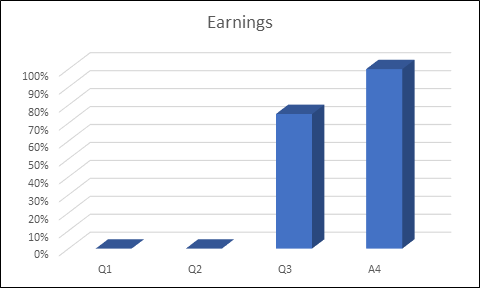

short-term (Now – Q1 2018)

Being able to show visible progress is more likely to trigger interest into RPX, so these events are more likely to drive up the price, than the other events. But as these apps are focused on the customers of Red Pulse, I would not expect a broad hype, but more of a gradual rising interest.

medium-term (2018)

It is different with these events. The beta test itself can increase demand significantly, if it is done public – otherwise, it will have little to no impact. It is different with the actual launch of the platform itself, which could very well lead to a strong short-term increase in demand for RPX. Same goes for the announcements of partnerships.

long-term (2019 – 2025)

Expanding the focus from purely Chinese based research to conventional markets also means entering competition, but in the end, is the logical consequence, if the original market is saturated. This also explains the extension to the B2B (Business to Business) market. Hosting conferences, further networking & partnering with other institutions and companies also are more of a gradual increase of interest into the company in nature. The conferences include the possibility of strong price increases, depending on how much hyped these receive in the community.

The goals after 2020 seem ambitious, but this is okay – nobody knows exactly, how AR (augmented reality) / VR (virtual reality) will impact our daily life. I can imagine that e.g. a relaunch of google glass can open the opportunity to Red Pulse to expand into the “business AR” market quite easy. But this is science fiction right now, the impact of these technologies on Red Pulse is not possible to foresee.

The impact of the team participating in conferences and holding presentations in the past couple of weeks was not so strong, so I would not give too much attention to these right now. It would be great, if Red Pulse could cultivate a similar event-calendar like Ripple, to let it stay this way and to keep the price of RPX somewhat more resilient to event-based hype and pumps.

RPX as a currency will be inflationary with a rate of 10% p.a., which will be lowered gradually, “if there is deemed to be enough additional RPX circulation to provide reasonable rewards for new research content”. 50% of this to holders of RPX on the platform itself (so for the users), 50% for content producers on said platform. So it is a currency I would strongly discourage to hold in a wallet, as these units will be subjected to this inflation. Even more so, as the 50% for the holders on the platform also receive the share of those RPX, that are on exchanges or wallets.

The distribution of total RPX:

- 40% crowdsale (ICO)

- 40% company funds

- 15% company shareholders (excluding employees)

- 5% employees

Distribution of the sold RPX (from the ICO) is like this:

| Neo | Bonus | RPX | Share | Descr. | |

|---|---|---|---|---|---|

| 33,768 | 50% | 50,652,000 | 9.32% | private pre-sale | |

| 64,977 | 40% | 90,967,800 | 16.74% | Family | |

| 25,000 | 40% | 35,000,000 | 6.44% | Lottery | |

| 282,099 | 30% | 366,728,700 | 67.49% | Crowdsale | |

| Total | 405,844 | 543,348,500 | 100.00% |

40% of total RPX is still in the hands of Red Pulse, which I guess will be used to handle the inflation & content rewards on the platform in the following years. I see less of a problem in this, as RPX is meant to have a use on their platform – crashing the price and thrashing any trust in Red Pulse would be costlier for the company as a whole, than any short-term gains from this. This however might not be enough for sceptics.

Initially, I saw a couple of problems in the 15% of the company shareholders and the 5% of the employees. After asking about the 15% of the shareholders however, it was confirmed, that these 15% will not actually enter circulation.

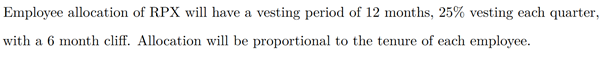

As for the 5% for the employees, they disclosed this in the whitepaper:

Which means that these 5% are distributed like this:

So, after one year, 100% of said 5% will be distributed to the employees. While this does not seem much, we need to consider that this is 5% of total RPX, not 5% of the ICO-amount. So, the inflation after the whole year is (if all employees sell their RPX) not 5% but 5% / 40% = 12.5% or about 68,00,000 RPX. It was confirmed on Slack, that these 5% are locked for a whole year.

It is not foreseeable, how the market depth looks like after this year and who or how many employees might leave the company in the meanwhile or after this. The impact of even 5-6 million XRP on the market would be overall not heavy, but noticeable, if we would assume a similar market depth like today (~9.5 million XRP market depth over ETH/XRP, NEO/XRP and $BTC/XRP). Personally, I would prefer a similar agreement like the one Ripple made with McCaleb, who is only allowed to sell a certain percentage of the daily volume per day, to lessen the impact of this share on the market. Especially, as the release of said RPX to the employees is matching roughly with the launch of the platform 2018.

Future - grade: 6.5/10 (7 – the basic outlook is quite positive, the roadmap and their goals not unrealistic; -0.5 as I personally see the 5% RPX-share of the employees as a little bit dangerous)

Right now, the price of RPX is still about double the price of the ICO (~$0,023) and has found its footing around 500 satoshi per RPX, after hitting an all-time-low of ~420 Satoshi. The big sellout that is usually seen after an ICO is over, the price is comparatively stable and shows positive signs after the canceling of the Segwit 2x – fork.

If the withdraw-issue and the listing on other exchanges however takes even more time, I still expect more of a sideways movement, as long as these issues are not sorted out. Withdrawing RPX will be settled around the end of the month, according to statements on Slack, which I personally see as quite a bit too slow. New exchanges are subject of speculation, but I would expect a couple of exchanges being added until the end of the year.

The project, the company and the overall picture of Red Pulse and RPX is quite positive. But it is still unsure, if the future market capitalization is matching with what the platform will handle in respect of revenue.

The value of RPX might later(!) come from the demand of RPX on its platform and will be less related to the crypto currency market, but more to the price of the research you can pay with it for. For this however, the platform needs to work with RPX, so the connection between RPX and other crypto currencies can be lowered – which is not until Q3/Q4 2018, when the platform is launched. Until then and a certain time after this (time for adaption of RPX on the platform), the price still will be more subjected to speculation and will therefore correlate strongly with events like looming BTC-forks.

Also, as the platform is not just outlined on paper, but in use right now and has actual customers, the demand of the service is proven. Same goes for the steadily rising interest in business and market intelligence.

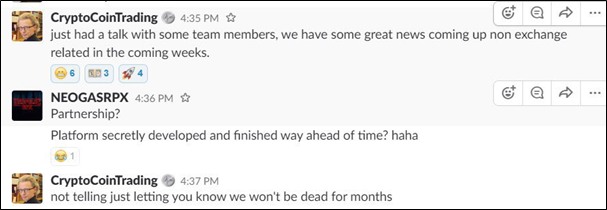

Purely from the point of speculation, it seems like a good opportunity, as the following statement was made & did not influence the price much so far (writing this conclusion at 01:00 PM GMT+1):

If the team stays active as well as on-track with their project, I expect a positive trend up until around late 2018, when the platform is launched. After this, it depends more on how the platform performs and how well RPX is accepted by the users, to let RPX become more disconnected from the crypto currency market. I expect however, that the value of RPX might be overhyped at this time, which could result in a downswing after the platform is released. Reason for this is, that RPX needs time to be adapted by the users of the platform, which will not happen overnight.

The immediate issue with being listed only on Kucoin and not being able to withdraw RPX from the exchange however, could still very well outweigh good upcoming news and activity of the company. A price of 500-700 satoshi should (ceteris paribus) still prove to be a valid entry-point in anticipation for them solving both problems (withdrawing funds & listing on other exchanges) in the upcoming weeks.

UPDATE:

This issue has been solved - RPX is now withdrawable from Kucoin.

PDF with footnotes and sources (please note, that the withdrawl from Kucoin is now available)

Feel free to visit my blog, where you can find even more analysis on altcoins

If you like my analysis & want to give something back – vote here on steemit or treat me a beer with BTC, ETH or LTC.

After all, I am a German penguin.

BTC: 12dTyxchdGhYjGBi1QFVPWbagQrRSJssWT

ETH: 0x3D8e6B27F7ab389888791ABEe6FA62F4718A1164

LTC: LT6qfsrxPhVxcYPbNgT267W1aVRd6n5AFq

Disclaimer:

- I am not invested in RPX right now

- I have no connection to employees, their relatives or partners of the company

- I have not received any monetary or non-monetary incentive for conducting this analysis

Great amount of detail went into this good job. The picture explaining how the block was in the previous hour was really well done.

good job

Withdrawal is now available @kucoin

Thanks for the news - will update it around this evening. :)

Awesome, awesome post, @randallmaller. Upvoted, resteemed, and following you now. Thanks a lot.

Much appreciated, thank you.

Will try to keep the quality high.

Yes! And by the way:

Nice.

On Slack, they said it is solved roughly at the end of November - good to see them being faster than that.

Kucoin is a great exchange, if they keep up this work ethic. No reason it cant be one of the top exchanges.

I honestly like them a lot.

Excellent analysis and a worthy read. A breath of fresh air in a market saturated by pump and dump reviews.

I’ll send you some eth over for the weekend 🍹