In-depth analysis on LoMoCoin (LMC)

One thing I learned in my short time in China is the fact, that the Chinese people love to play. I had the opportunity to get beaten by an elder Chinese guy in chess a couple times and we both had a great time, without even understanding each other. And when you ride the Subway in Beijing, many Chinese – old and young – love to play games of all kinds on their smartphones. Chess, mahjong, racing games, RPGs, TCGs and so on.

It matches with my personal mentality, as I am a gamer myself and I am not ashamed to admit, that my wife and I played Pokémon Go, as soon as we could install it. Later, we also happened to notice an event related to the game in my hometown. A mall encouraged players, to participate and get special discounts in some shops. We were impressed, that this event drew out so many people and surely upped the revenue of many shops in the area – to see the bridge between online mobile gaming and offline retail shopping being used was fascinating.

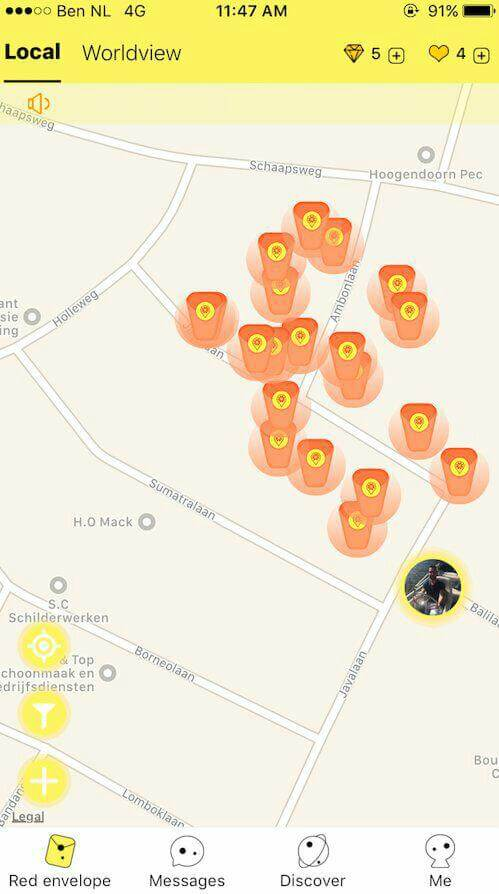

But this was still just a single event. Said bridge was created by the shops and the mall. Without the event, the mall would just be another reference point in the map and the inventive for players to spend time inside the mall, is as high as it is for any other bypassing person. LoMoCoin aims (among other things) to provide a permanent bridge between smartphone-users / players, retail shops and crypto currencies. Users of the app can collect LMC while being on a treasure-hunt, which itself was created by a retail shop, to attract the players that collected LMC.

Let’s see, if the project is as good as the idea.

Reminder:

The team plans to release an updated roadmap and whitepaper in the following week - I try to give an update one or two days after it is released. This is also, why some sections have no grading yet.

According to their thread on Bitcointalk , the team is comprised of 30 individuals of which the six executives can be seen at their website . They are registered in Beijing as a limited under the name of Walibida Technologies.

The CEO Xion Lijian is providing us with some information of himself, information on the rest of the team will be outlined in the upcoming whitepaper. Unfortunately, there are not LinkedIn accounts, and the researchable background is hard to dig into. It is however possible to stitch together the information of their old website and their new one, which reveals a bit of the academic background of some of them. Here, I want to thank their community manager Milan, who reached out to me and answered several questions regarding team and project.

Media coverage is not so high so far, being only covered by technode a couple of weeks back and by cointelegraph as a sidenote, being listed among the “biggest gainers” back in February. In China however, it was featured in an article on sina.com, which is one of the most visited website in China, according to alexa. Other than that, it also received coverage from a smaller Japanese tech website. As I speak neither Japanese nor sufficient Chinese, I cannot tell if these articles had negative undertones or were paid press releases. Recently, a press release was added on cryptocoinsnews.com.

Regarding their partners, there are no big names, so far. Right now, there are no names at all, but they claim to have a cooperation with many SMEs (Small & Medium Enterprises). Also, there is an organization called “F5 lab”, which is a conglomerate of technology companies. F5 lab is engaged in R&D as well as in collaborations with universities and other companies – so far, there is no big name known from this initiative or on what legal foundation it is based, but the goal is quite appealing.

All in all, the team composition as well as their backgrounds are convincing, albeit the detailed information needed to confirm it, needs a bit digging. But I personally think, that the checkable background of the CEO alone is convincing enough to overlook the fact, that they cannot back up their background by e.g. LinkedIn-accounts.

Publicity: 7/10 (7 – the team itself is known and also competent enough to run this operation, at least from my perspective – this might be not enough for the heavily skeptical persons, though; also, there should be more clarification on their partners)

We see the usual means of communication. Twitter , Facebook , Reddit , Telegram , Bitcointalk and of course: Slack (you need to ask for an invite-link on reddit or telegram). Also, you can find them on Github. I also must add, that the person responsible for western communication reached out to me, to answer many questions on the project.

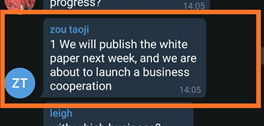

Facebook, not being the most used communication platform of a blockchain project, is posting some news and updates from time to time, but is not so much active. Twitter is a bit more up-to-date with regular posts and updates on the situation. Reddit – albeit lacking a bit of activity in general, as not many people are aware of LMC yet – sees indeed attention from the team. The same goes for Slack and Bitcointalk, which both can see a single post in a day and not much more. For main communication, I would assume Telegram the most active among the ones they use. This might change back to Slack eventually, if / as soon as they gain traction on western audiences. Coincidentally, Zou Taoji (CMO) conducted an AMA on Telegram today (12 AM – 1:10 PM), the answers will be later uploaded. Shows that they care for their western audiences, even though the language barrier is still existent.

LMC is traded on two markets right now: Bittrex and Coinexchange. Most of the trading (>99%) is done on Bittrex, with a daily volume of usually less than one million USD. Buying and trading LMC should therefore be done on Bittrex.

Regarding their whitepaper, there is not much to say about, because they work on an updated one. I guess it is the same with their roadmap, as the old one is finished with the release of the 2.0-version of the app back in October and the plan for 2018 is quite vague right now.

I in general have the impression, that the community is quite strong with LMC, which might be in part, because the app is already usable.

Activity - grade: XX/10 (As whitepaper and roadmap are being updated, it is not possible to grade this yet – the overall impression from the communication channels is, that the team is active and responsive on questions, even though the western audience is still quite small; still - said community is also strong and dedicated)

Unfortunately, technology is also not gradable right now – with no whitepaper, it is next to impossible to check on the underlying technology or fundamentals yet. But with LMC, we have another way of checking on the product this time: we can use it. Just download it on your mobile, pass the registration and you are good to go.

The idea behind LMC and the red envelopes is, that single retail shops buy LMC and distribute them in red envelopes around the shop, so people come by, pick up the envelopes around the shop and buy something in the shop itself, as they are already near it. The app can also be linked to a promotion, so the users can get e.g. rebates, giveaways etc. – the usual stuff, when it comes to promotions. Now, if we consider the digitalization penetrating every part of our everyday life, everything getting more and more connected, LMC can indeed provide quite a key point in this network, bringing together IoT-devices and users via an economy, based on crypto currencies.

When we look into the blockchain industry, we see no comparable competitor so far. Outside however, we see apps like “Pokémon Go”, “Ingress”, “Landlord” or “Zombies, Run!” (which I actually can recommend, if you need an incentive to go jogging). Some of them included real-life-events (like Pokémon Go), but there is nothing featuring something like a real usable economy behind the philosophy of the product. In this regard, LMC can indeed work without any competitor.

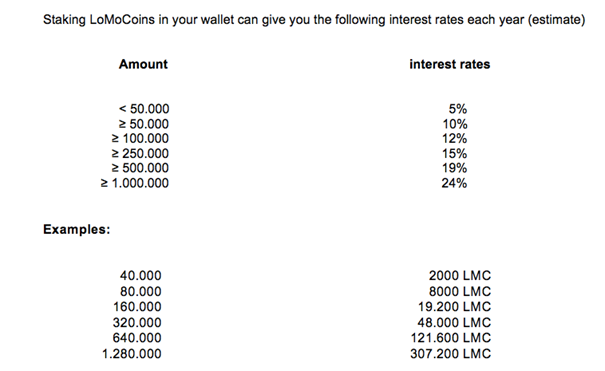

Regarding the technology itself, it is known that they switched from Proof of Work to a Proof of Stake. The transfer fee is neglectable (0.0001 LMC), the block time is quite fast with 60 seconds. Initially, they wanted to distribute 1 billion LMC, but after the switch from PoW to PoS, the total possible supply will be capped at 305,274,326 LMC, of which around 220 million (~72%) is in circulation already.

The yield of the PoS-staking will depend on the amount of LMC on the wallet. The more is on the wallet, the more LMC will be rewarded later on.

LoMoStar will also later provide a similar service as e.g. Localbitcoin, meaning that you can buy and sell BTC and other currencies not by using an exchange but from buying them from e.g. other users (which is called OTC – “over the counter”, meaning that you do not buy at an exchange). Making this usable via their app at the same time makes crypto currencies quite usable for the average non-techie, so I indeed consider this quite a good strategy to integrate this service.

It should also be mentioned, that LMC plans on opening an exchange later on: https://xstar.io/index. I cannot estimate, how far the development on the exchange is, but I would say, that a working exchange associated with LMC can indeed mean quite a positive indication on the price.

Technology - Grade: XX/10 (XX – grading will come, after the whitepaper is released; the general impression however is quite well, considering that it is the first project you can actually use by just downloading an app)

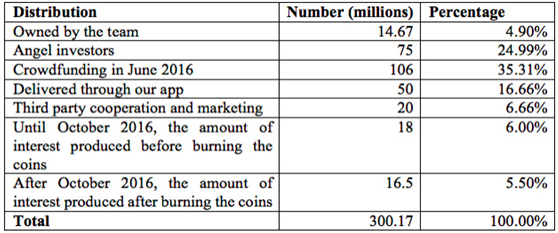

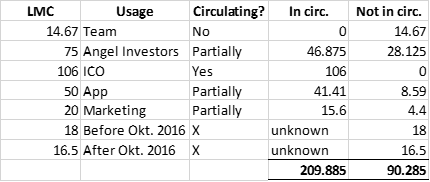

LoMoStar has quite a history, so far. Their first step on their roadmap is exactly two years ago, the first release of the application followed in March on the Chinese messenger platform WeChat. The ICO for LMC was conducted at June 2016, where 100 million LMC were sold. The rest is distributed like this:

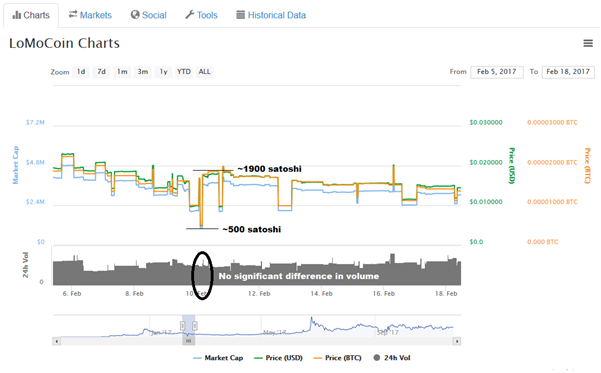

Let’s come to the events that influenced the price of LMC:

Back in December / January 2016 (1), this increase in price was also accustomed by a significantly higher trading volume and could be due to LMC winning the second place in the “China Block Chain Innovation and Application Competition”. It is quite normal that such an event increases the price.

The short crash (2) in February looks terrific, but was just due to a thin orderbook. The volume at the time of the crash was not different than it was within the hours before. Without this happening, the bearish tendency would have had continued the same way it did after the crash, I think.

(3) in June seems like the usual rally we see with altcoins following the price increase of BTC – but it is a bit late for this, to show on the price of LMC. I see more of a correlation between the price and the size of the userbase in China, as June was the month when they reached 300,000 users on their app in China. Depending on how this was communicated, that could have been the trigger.

(4) was – I think – the announcement & subsequent release of the app to the western audiences, which increased the interest among this audience. It also paused the uncertainty of the Chinese regulations on crypto currencies for a short time, but could not completely root out the uncertainty the Chinese market represents for crypto currencies right now.

Looking at the history, LMC tends to be mostly subjected to event-driven price pumps, that are not yet sustainable enough, to increase the price in relation to BTC. In part, I think this is due to the lack of marketing in the western audiences so far and might change, after they gain traction on the western markets.

History - grade: 6.5/10 (7 – I could not find bad events in their past, which might be due to the fact, that it is hard to do research on Chinese projects in general, but I give them the benefit of a doubt, as significant troubles would have been reflected on the chart and spilled over into the [ANN] on bitcointalk; -0.5 as past positive events had no sustainable impact the price of LMC)

As whitepaper and roadmap are being reworked, the future roadmap cannot be taken into consideration right now, as it is unknown what the next steps will be. The updated whitepaper (and with it, the roadmap) is however announced to be released next week (11.27.2017-12.03.2017).

This leaves us to turn to the question, how the circulation will develop in the future. Like already lined out, around 72% of all units are currently in circulation (see “History” for more details on this). Regarding the future circulation, they outlined it quite well themselves on the announcement-post on Bitcointalk, so I will just sum it up a bit here

Coinmarketcap is listing LMC with a circulation of 220 million LMC, so the majority of the angel investors LMC still have not entered circulation. Until April 2018, the team as well as the angel investors will have full access to all the locked up 42.795 million LMC, giving them control over ~14% of the total LMC or ~19% of the total circulation of LMC.

And this is, what worries me a bit. I am fine with the team holding LMC, as the team has an inherent incentive to make the project a success. But I generally have some concerns regarding angel investors and / or venture capital firms holding the currency of a project, as it may shift their interest from making the company worth more, to making the currency worth more. Making a company worth more is more likely to be sustainable, than increasing the value of a currency, which is subject to speculation. I would personally love to see more clarity on what agreements LoMoStar has with their angel investors, who they are and how they are involved with the project, as this issue will even become more pressing due to the high interest rate of the PoS. Because if they receive even more LMC from the staking, the problem even expands. Without further information on this, there is could be concerns on that the LMC of the angel investors can have an impact on the price of LMC.

As they have quite an extensive userbase in China, it can be assumed that they also have a solid financial fundament, that is independent on the value of BTC – a collapsing crypto market is therefore no danger to the company itself (even though it would most likely have also some consequences for the price of LMC). I assume the overall danger of a total loss comparatively low, even with the still existing insecurity of the Chinese regulations.

The outlook of the industry overall is quite good. Especially because mobile gaming is predicted to have an ever-growing share of the industry in the next years. As China will have the biggest share of this growth, I would assume that LoMoStar can expand their position in their home country even further.

It should be said however, that the future of crypto currencies in China is still not really secure. With the exchanges still closed, some officials in China raise their concerns also for OTC trades (over the counter – if you trade BTC outside of exchanges). I however must admit, that I have no means to possibly assess, how high the danger for LMC is in this regard, but it should definitely be mentioned as a possible risk.

Future - grade: XX/10 (XX – LoMoStar is working in a growing industry and is having quite a head start in regard of direct competitors, the issue regarding the LMC of the angel investors however should be addressed to ensure a higher trust of future buyers of LMC; also, the Chinese market still poses a risk to the business of LMC in general, which in worst case(!) could force them out of the Chinese market)

Having a working product on the market is quite unique for a blockchain project, this alone is a reason to consider adding LMC to a portfolio. I personally expect a surge in price, as soon as the whitepaper and roadmap is updated. As RPX is also only listed on two exchanges so far, it can be assumed that the adding of more exchanges will also attract more potential buyers – but as Bittrex is already listing LMC, the significance of said listings might be a bit lower. The inherent value of LMC itself is impossible to grasp, but with LoMoStar already having a strong position in China, a good foundation is laid out. Also, especially as their market is growing in China, adaption and usage of the app (and with it, LMC) is likely to increase.

From a speculative position, it is possible to bet on them getting traction in the western audience with the release of their whitepaper and roadmap this week as well as new partnerships and more clarity on their general international strategy. With Sirius, there is a good start to build on top of an already strong community, so I guess they are in a good starting position to expand beyond the Chinese borders.

After the release of the new roadmap and whitepaper, it depends on the timing on their roadmap and which focus they set on their development and marketing. With a price of 500-600 satoshi however, I think the entry point right now is quite good – with a company of about 70 persons and experienced executives, the market cap of 10 million USD for LMC is too low and does not at all reflect on the very good potential of the project.

It should be however mentioned, that the app might become the subject of attention of regulators in China, due to the OTC-nature of their app. I personally would assume this danger to be low, but it should be kept in mind, that an unexpected ban of such an activity in China would force LoMoStar to change their attention to markets, in whom they are not as known as they are now in China.

PDF with footnotes and sources

Feel free to visit my blog, where you can find even more analysis on altcoins

If you like my analysis & want to give something back – vote here on steemit or treat me a beer with BTC, ETH or LTC.

After all, I am a German penguin.

BTC: 12dTyxchdGhYjGBi1QFVPWbagQrRSJssWT

ETH: 0x3D8e6B27F7ab389888791ABEe6FA62F4718A1164

LTC: LT6qfsrxPhVxcYPbNgT267W1aVRd6n5AFq

Disclaimer:

- I have a small position of <10 LMC right now (USD-value of <$0.50), due to testing the app

- I have no connection to employees, their relatives or partners of the company

- I have not received any monetary or non-monetary incentive for conducting this analysis

Congratulations @randallmaller! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Great company, great investment here!

Congratulations @randallmaller! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!