Bitcoin's fatal quarter: everything that has happened so that it has lost 50% of its value

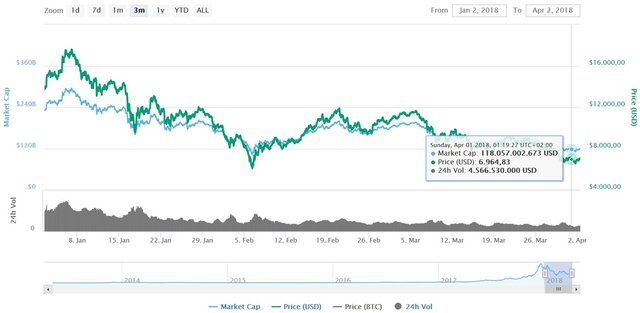

On January 1, 2018, a bitcoin was worth $ 14,112. One quarter later, on April 1, we found that its value dropped to $ 6,976 . What has happened so that the bitcoin loses half of its value in these three months?

Well, among other things, cryptocurrency does not have such a good reputation. Efforts to regulate them are linked to a clear tendency not to publicize them, something that slows down the progress of many initiatives but that above all is focused on one thing: protecting users

The advertising disappears:

One of the fundamental factors of the fall has been that change of attitude that we have seen among the internet greats. Until a few months ago the attitude of Google, Facebook, Twitter or Reddit was the same as with many other topics: live and let live .

However, the scandals in the cryptocurrency segment have caused these and other companies to change their philosophy when dealing with issues related to cryptocurrency.

.jpg)

Massive robberies such as CoinCheck or that inevitable image of fraud that ICOs have - 46% of which fail , according to a recent study - have suddenly caused a direct impact on the communication that is made of cryptocurrency.

Google has been the most striking case of advertising ban on criptodivisas , but that measure has also been taken into Facebook , in Yandex or on Twitter .

.jpg)

It is curious how this measure was adopted for a long time in Reddit , whose subreddits have become a source of information and debate about this segment. The company even decided not to accept bitcoins as a payment method for its Reddit Gold programs a few days ago. To this list of dropouts are added others such as Mailchimp , which also see how the enormous volatility of the market does not make it recommendable to continue enabling this option.

Those measures have not been well received by those who firmly believe in the future of cryptocurrency. Some organizations in Russia, South Korea or China are considering suing Google, Twitter, Facebook or Yandex for banning those ads, which according to these organizations qualify as conspiracy and that according to them has been one of the keys to the "significant" decline of the value of the cryptocurrency market in recent months.

Countries also start to regulate (or to try):

The measures that some governments have begun to explore to regulate crypto currencies have not helped cryptocurrency to go back the way. We already saw months ago how the prohibition of ICOs and exchanges in China or South Korea caused sharp falls in cryptocurrency such as ether , ripple or bitcoin .

In the United States, the Securities and Exchange Commission (SEC) also recently acted to indicate that platforms that trade cryptocurrency should be registered and operate like any other economic platform , something that undoubtedly threatens the interest of these markets for certain investors and operators.

In Spain , the matter is already being investigated, although the Treasury will not take measures at the moment , following the line of the European Union , which for now will not act on it .

The falls have also been motivated by the ever greater fear of control that the 'whales' ( whales ) Bitcoin can exercise this cryptocurrency. It is said that 1,000 entities or people control 40% of the market, and that suggests the enormous power of these digital billionaires when it comes to provoking movements of purchase or sale of these cryptocurrency.

Protecting the user becomes fashionable, for better or for worse:

Why so many measures? The conspiracy theories suggest that governments want to control criptomonedas to benefit from them after discovering their potential, but the truth is that all these regulations and bans on advertising can also defend another argument: that make it more difficult that users lose (or win) money.

.jpg)

Many have been those who have invested large sums of money and have gone into debt by investing in cryptocurrency or undermining them -although it is not profitable except in certain cases-, and they have done so by trying to take advantage of the deregulation of the market and responding to many ads without analyzing too much those investments.

These measures, such as not being able to invest with credit cards , are clearly aimed at protecting users and their money , not advertising campaigns that are a potential fraud -although that happens in many other markets that do continue to advertise- and beginning to limit the limits of what one can or can not do with these virtual currencies .

This may simply be a turning point in the history of some cryptocurrency that may be abandoning that first crazy initial stage to mature and, perhaps, become a real alternative to fiat money.

(i have collected these pictures from internet)

Keep this up, Followed you for more :)

thank you