Block66 (B66) : Crowdfunding & Lending

Overview :

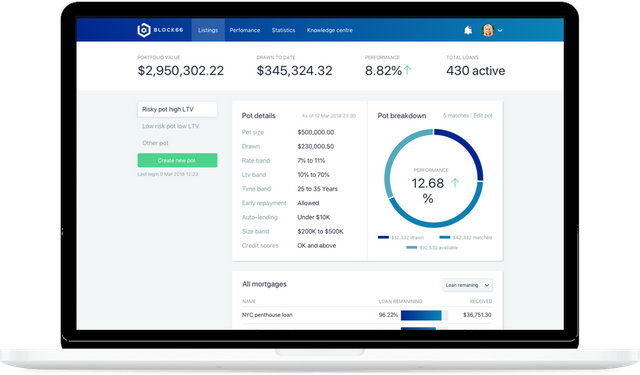

Block66 is constructing a brand new blockchain-enabled market for mortgages. Institutional and personal lenders can use the service to supply loans to a variety of debtors, launched by Block66 dealer companions. By means of the sensible use of good contracts, loans might be taken from origination to facilitation, shortly and effectively. All loans are additionally represented as tradable tokenized securities, offering a liquidity mechanism as normal. The flexibility to commerce fractions of loans and lower order and issuing charges makes investing extra inclusive, offering a beautiful funding car for all method of traders. Because of the usage of cryptocurrency, Block66 eliminates the necessity for a checking account, overcomes geographical lending restrictions and reduces counterparty danger to mere minutes. For debtors, the clear and aggressive nature of the marketplace will profit the patron and provides them the confidence that they’re getting close to sufficient the very best supply achievable.

What makes Block66 unique :

Block66 will be a matching engine for borrowers and lenders promising a three-fold saving on conventional mortgage application times. Block66 aims to become the world’s most sophisticated platform for brokers, and lenders to operate efficiently to the satisfaction of borrowers. All loans will be issued on the blockchain, and funds are drawn down via the resulting smart contract. All documents related to the mortgage transaction will be validated and stored on the blockchain providing immutable history and authenticity. Storing a hash of documents relating to the loan ensures full transparency from both lender and borrower while creating a much cleaner path during a regulatory audit and spot checks.

Problem :

The mortgage market in the USA is $9.9 trillion dollars, $32.9 trillion worldwide, and growing but risk-averse institutions are reluctant to lend to many creditworthy consumers. Willing small lenders struggle to enter the space at scale. Existing processes and technology are cumbersome and siloed, compounding the problem for borrowers.

The purpose of project (Solution given by Block66) :

Block66 introduces the first platform where lenders can access a marketplace of vetted borrowers looking for mortgage finance. This marketplace is public, transparent, and highly automated, so lending is streamlined, with lower costs, and lower risks.

Block66's blockchain and smart-contract technology make it possible for lending contracts to be tokenized, and the flexibility and liquidity provided by Block66's asset-backed tokens will open the mortgage market to a more diverse pool of investors.

A digital trust fund (DTF) ensures the safety of the underlying loan agreement, represented digitally as PoL tokens, by acting as custodian for the loan and collecting repayments - including accrued interest.

Block66 infrastructure will be implemented as a decentralized application (dApp), and run on the Ethereum network. Brokers will be able to list clients as lending opportunities on the platform, after being thoroughly vetted by Block66 through proof of residence, credit reports, license verification, and criminal record checks.

Block66 software and API integrations will automatically verify the majority of files, limiting the need for an underwriter. These same checks will go a long way toward reducing incidences of mortgage fraud by flagging contentious applications.

Key features of Block66 :

Identity Checks : Block 66 works by using third-party APIs to send out identity checks (KYC) to verify the borrower’s identity. This helps brokers detect fraud and meet regulatory requirements.

Virtual Underwriters : The system sends an application to a virtual underwriter if it’s unable to make a valid borrower file automatically. The broker or client will pay for the fees in ETH.

Block 66 Network Tokens : These tokens are used to pay for services conducted on the Block 66 Network. With them, you can have faster access to mortgages on its platform.

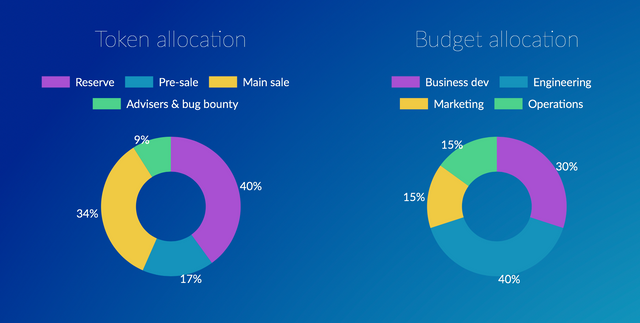

Token Details :

B66 is a limited supply token that when stored in a special smart contract generates the network’s native token - BNET, that is then sold via the platform to network users (i.e mortgage brokers). The revenues generated by the sale are distributed to BNET holders.

- Token : B66

- PreICO Price 1 B66 : 0.10 USD

- Price 1 B66 : 0.15 USD

- Platform : Ethereum

- Accepting : ETH

- Soft cap : 3,000,000 USD

- Hard cap : 20,750,000 USD

- Country : Singapore

- Restricted areas : USA, Canada, China, Iran, North Korea

Advantages :

- The Block66 platform will be capable of browsing through hundreds of lending offers to find a selection of best possible deals for the broker and the borrower.

- Lenders will gain exposure to the global mortgages market, including emerging economies.

- The ability to trade fractions of loans.

- Block66 eliminates the need for a bank account, overcomes geographical lending restrictions and reduces counterparty risks.

- Team has great financial and technical experience: ING, Virgin, Goldman Sachs, Deutsche Bank, Brown University and etc.

Verdict :

The project is very interesting and the team is strong and capable to to carry it out. Moreover it’s the first project in mortgage lending. However the hype level is low, Block66 has a small community that is a disadvantage. Also it is hard to evaluate the project without MVP, according to the roadmap it will be launched in Q1 2019 and the mainnet will be in place in Q3 2019. In our opinion we should wait untill the pre-ICO will be finished, to evaluate the investment potential of the project.

For more information :

- Website: https://block66.io

- Whitepaper: https://block66.io/themes/b66/assets/Block66_Whitepaper_English-update.pdf

- Telegram Group: https://t.me/block66_Official

- Twitter: https://twitter.com/Block66_io

- Facebook: https://www.facebook.com/Block66Official

- Bounty: https://beta.bounty0x.io/hosts/Block66

- Medium : https://medium.com/@block66

- Youtube : https://www.youtube.com/channel/UCHBDzsJ5aKcYr02lrDVxoag?view_as=subscriber

Author: Raghav

Bounty0x User Name : raghav078

Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=2235966