Regulation: Catalyst or Catastrophe for Innovation?

The blockchain and cryptocurrency ecosystem has come a long way since its early days in 2009. From being largely associated with seedy dark web nests and esoteric gaming enclaves, it has evolved into a vibrant ecosystem of varied projects ranging from currencies, to enterprise solutions, platforms, and/or privacy solutions, applicable across various industries. Yet, with the meteoric growth the ecosystem has seen, and the increasing institutional involvement in the space, there is a need to talk about the regulatory elephant in the room.

Regulation could come in various forms, and while different in their approaches, they do share a common trait; namely, the provision of structure. Structure may seem counterintuitive to fostering an innovative space, however throughout history, structure has proven to be crucial to the growth and survival of any sort of innovative movement.

One such example is the argument for Net neutrality (the principle that Internet Service Providers do not discriminate against content in any way) as introduced by the Federal Communications Commission’s Open Internet Order in 2010[1]. These principles arguably facilitate an innovative environment by allowing freedom of expression to the masses without any form of discrimination. The FCC’s Open Internet Order structures an even, competitive playing field for all actors, from MNCs to SMEs.

Placing this topic in a cryptocurrency context; a spectrum of regulatory approaches has arisen within the ecosystem. There is the ‘hands-off’ approach as adopted by the Monetary Authority of Singapore, which has largely chosen not to regulate cryptocurrencies, except for ICOs with tokens sharing similar traits to stocks (for the purpose of investor protection) [2]. Other economies like Japan have taken a more measured approach, banning ICOs while remaining supportive of the crypto market, and even going so far as to declare Bitcoin as a legal currency[3]. And in some extremes, a blanket “ban-it-all” approach has been adopted by countries like Pakistan, with central banks banning all banks and financial providers from working with entities engaging in cryptocurrencies [4].

It is important to note that Government bodies are not the sole proprietors of cryptocurrency regulation. The recent years have shown an emergence of self-regulating bodies such as the ICO Governance Foundation [5] or the Japanese Cryptocurrency Exchange Association [6]. Instead of looking to a centralised authority for direction, these community-led entities move the onus of oversight onto themselves.

Today, the bulk of cryptocurrency activity comes from more progressive and regulated markets such as Japan, Korea and Switzerland [7]. All these countries have seen a spike in blockchain and cryptocurrency talent and adoption since their introduction of market-friendly directives. Meanwhile, the harsher climates of China and India have led to a talent ‘brain drain’, with numerous blockchain and cryptocurrency projects departing for greener pastures. As observed, regulation if done right, has the potential to bring about 3 main benefits:

Regulatory policy can aid in punishing companies exhibiting malicious behaviour, and encourage trust and stability in the community.

The numerous scams and questionable conduct within the community argues that oversight is needed in the ecosystem. For instance, the presence of existing legal institutions allows for punitive actions to be taken against deceptive practices in the market (i.e. corporate fraud or ponzi schemes[8]). Many cases have already been documented (For instance, the CFTC Charging Entrepreneurs Headquarters Ltd [9]), and the punishment of fraudulent schemes has served to encourage new and existing investors toward the crypto space. Stability and structure will only foster greater public trust and confidence in the blockchain ecosystem.

Regulation can help to make ICOs more transparent, thereby encouraging investor confidence.

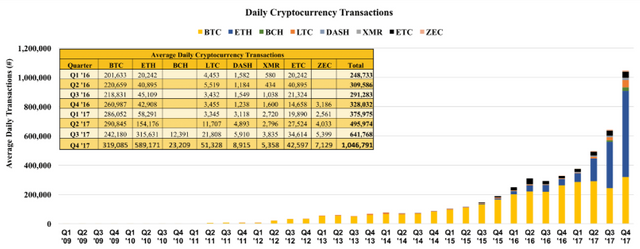

With the trust and stability brought about by a regulatory presence, more investors will be encouraged to participate in ICOs and the secondary market. This in turn will increase the investor base, make the crypto market more liquid and encourage a higher volume of activity within the market (see figure 1 below). Instances of Government bodies acting to protect investor interests are not uncommon. Looking at the US Securities and Exchange Commission as an example, the authority was created “to protect investors; maintain fair, orderly, and efficient markets; and facilitate capital formation” [10]. This organization’s actions in the blockchain ecosystem arguably puts forward a strong case for regulatory involvement. Over the recent months, the SEC has probed cryptocurrency companies for disclosures on their ICO process [11], so that investors would be better equipped to perform their due diligence and make more informed decisions. Improving the transparency of ICOs has an added benefit of encouraging a more efficient allocation of funding towards more deserving projects.

Figure 1: Daily Cryptocurrency Transactions have been drastically increasing over the past 2 years. Notably, a significant portion of these transactions are made in Ethereum. This may be attributed to most ICOs only allowing for ETH and BTC buy-ins. [12]

A healthier market attracts talent.

The surge in ICOs over the recent of years has changed the landscape of the cryptocurrency and blockchain ecosystem into a state of vibrance. With so many notable events happening by the minute, there is never a dull moment in the market. One such observable trend is the influx of talent into the industry, talent attracted by the premise of rapid, large-scale fundraising for a wide breadth of projects. The ecosystem has even attracted top talent from leading financial institutions and technology groups (for instance, the recent hire of the former CFO of Commonwealth bank by EOS [13]). While the blockchain technological movement is still in its infancy stages, having more regulatory input will improve the quality and health of the blockchain ecosystem (i.e. trust, stability, investor base), which in turn will attract more talent to the booming industry.

While the introduction of regulation into the ecosystem does have its benefits, it also introduces some potential risks of its own, namely around the threat of excessively restrictive policies arising as result of introducing regulation.

Innovators and entrepreneurs can be bogged down by red tape.

One highly plausible risk would be red tape requirements impeding innovators and entrepreneurs. The adherence to regulatory policy may result in companies facing excessive red tape [14,15,16], discouraging anyone from pushing boundaries or challenging paradigms. This could in turn lead to a decline in disruptive innovation emerging from the ecosystem and an eventual brain drain.

Regulatory policy may not be able to keep up with a rapidly changing landscape.

Implementing new policies can be a long and arduous process, depending on numerous qualitative (controversialness of the topic, public opinion) and quantitative (models/projections, costs) factors[17]. One such example is the publishing of the Formaldehyde Emission standards by the Environmental Protection Agency. This act was signed by President Obama in 2010, drafted by the EPA in 2013, and finally published in December 2016 [18]. Since its inception, it took 6 years to become effective.

In a high growth blockchain and cryptocurrency ecosystem, change occurs at a breakneck speed, making it imperative that regulations keep up with new developments. The deliberate and often lengthy process of introducing policies through traditional regulatory channels could potentially put policies at risk of obsolescence by the time they are finally approved. Adding further to this risk, regulatory bodies may opt for a blanket ban to attempt to reinstate control and/or buy themselves more time to better understand the situation. This has presented itself in recent disruptive technologies in the sharing economy space. For instance, organisations such as Uber and Airbnb have found themselves being declared illegal in certain countries and states [19,20,21]. Such drastic action would cripple innovative movements and cast doubt on a corporation’s foreseeable operations.

Selfish or malicious regulatory bodies may push their own agenda.

Another highly plausible risk of surrendering the regulatory power to regulatory bodies is the risk of these bodies lobbying for and introducing self-serving agendas of their own instead of looking out for the best interests of the ecosystem (for instance, the controversy surrounding the FCC and Ajit Pai’s repealing of Obama-era Net Neutrality rules [22]). Unfortunately, not much can be done to prove/enforce honest and unbiased decisions among institutional regulatory bodies. In this regard, it is up to the people to fight and ensure that their views are fairly represented, and each member of the community is given an outlet to voice his or her opinions.

This is not a question of should we regulate the future, but rather, how do we regulate the future? Regrettably, the pros and cons do not cancel out to give a definitive answer. Regulation done right could structure the technological movement and allow it to be the enabler that the community envisions it to be. Done wrong, and the technological movement could be snubbed out and written off as a bubble of irrational exuberance. Ultimately, regulation is not to be feared; but rather fostered collaboratively by all those involved.

While existing regulating bodies have a powerful role in facilitating or impeding this paradigm shift, the onus too lies with the community making fair representation, open dialogue and unbiased education with uninformed stakeholders and key decision makers alike. As Uncle Ben once said, “with great power comes great responsibility”, now it’s up to us to each take that responsibility seriously and collaboratively strive for a happier and healthier regulatory environment.

About the team

We are a Singapore based team of consultants with experience working with leading blockchain and technology companies around the world. With backgrounds in fintech, recruitment and strategy consulting, we look to provide a holistic and unique perspective on topics relevant to the blockchain industry while continuing to play our part in growing the ecosystem. Reach out to us if you’re keen to connect, we’re always open to meeting new people who are passionate about the space!

Francis-John Ho

https://www.linkedin.com/in/francis-john-ho-a3727bb5/

Jonathan Ng

https://www.linkedin.com/in/jonathan-ng-01a652128/

References

[1]https://apps.fcc.gov/edocs_public/attachmatch/FCC-10-201A1_Rcd.pdf

[2]http://www.mas.gov.sg/News-and-Publications/Parliamentary-Replies/2018/Reply-to-Parliamentary-Question-on-banning-the-trading-of-bitcoin-currency-or-cryptocurrency.aspx

[3]https://www.cnbc.com/2017/09/29/bitcoin-exchanges-officially-recognized-by-japan.html

[4]https://btcmanager.com/india-and-pakistan-crackdown-on-cryptocurrencies/

[5]https://icogovernance.org/

[6]https://www.newsbtc.com/2018/04/24/japanese-cryptocurrency-exchange-association-aims-to-restore-public-confidence/

[7]https://www.tokentarget.com/countries-leading-the-blockchain-innovation-movement/

[8]http://www.visualcapitalist.com/infographic-stock-fraud/

[9]https://www.cftc.gov/PressRoom/PressReleases/pr7674-18

[10]https://www.sec.gov/about.shtml

[11]https://www.wsj.com/articles/sec-launches-cryptocurrency-probe-1519856266

[12]https://www.coindesk.com/research/state-blockchain-2018/?slide=16

[13]https://cointelegraph.com/news/cfo-of-australias-commonwealth-bank-quits-role-to-join-eos-token-developer-blockone

[14]https://doi.org/10.1111/padm.12098

[15]http://www.oecd.org/site/govgfg/39609018.pdf

[16]http://fortune.com/red-tape-business-regulations/

[17]http://thehill.com/blogs/pundits-blog/the-administration/242468-why-does-it-take-so-long-to-issue-a-regulation

[18]https://www.epa.gov/formaldehyde/formaldehyde-emission-standards-composite-wood-products

[19]https://www.politico.com/states/new-york/albany/story/2018/06/26/airbnb-under-microscope-as-council-considers-controversial-regulatory-action-490484

[20]https://detroit.curbed.com/2018/2/8/16991266/detroit-banned-airbnb-zoning

[21]https://www.independent.co.uk/travel/news-and-advice/uber-ban-countries-where-world-taxi-app-europe-taxi-us-states-china-asia-legal-a7707436.html

[22]https://www.cnbc.com/2018/06/11/fcc-chairman-ajit-pai-skeptical-of-state-efforts-to-save-net-neutrality.html

Congratulations @perspectivecove! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @perspectivecove! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!