Bitcoin: I'm not convinced we're not going to drop to $5000 or below 📉

While we're going through the equilibrium phase of Bitcoin price movement, I can't help but shake the memories of the bubble of 2013/2014 and the long bear market that occurred afterwards. Let's compare the bubble charts and think about the future.

2013/2014

Bitcoin had several major bubbles so far, but one of the most famous was the 2013/2014 bubble when Bitcoin first peaked to about $1200 each, only to subsequently slowly dwindle back all the way to the $200 range when it was finally declared dead often enough to disappear from most people's radars.Of course, results from the past offer no guarantees for the future and none of this is financial advice, but all things considered the historical price movement of Bitcoin does provide us with some relative insight into what might happen or is happening.

I took some screenshots from tradingview to compare the two bubbles side by side, as I like to do from time to time. Take a moment to look at both charts and notice the similarities:

A few things stand out to me. First, it's very noticeable how both charts have more or less the same shape. In both cases Bitcoin went parabolic, though it does appear the 2017 bull run was more stretched out and more gradual from the skyrocket that happened in 2013. Both seem to have an equilibrium pattern playing out, with a set of fast declining lower highs and what appears to be a series of higher lows gradually forming.

I remember this period well from back in the day. Enthusiasm had dwindled a little bit, but it was generally still high and another bull run was expected once 'the correction' was over.

Of course the price in 2013/2014 fell even lower after the above chart, leading to the infamous long winter in crypto. Still, the bulls were right: After the correction is done, we'll go back up. It just took a much longer time than anyone expected. It took about three years before Bitcoin would reach and breach it's previous all-time-highs. See the chart below to see how it played out.

If Bitcoin today follows the same pattern as in 2013/2014, then I consider it to be possible, perhaps even likely, that we'll go down much further than we have gone so far. In the above chart I made a quick & dirty sketch of where, by comparison to last time, we may be currently in the pattern. If the same time length is used, it could mean that we may drop further down and it may take up to one year to get back to the levels we are at now.

Notice how in the chart above Bitcoin dropped as much at 50% from the point where, according to the pattern, we may be again today.

When I look at market sentiment, as I said above, I feel like deja vu in some ways. Sentiment is still relatively high in crypto, which is both good and bad. It's good because it helps it's popularity, but truthfully... it's terrible for the market price. As long as enthusiasm remains high, there will remain some buying pressure to keep Bitcoin from truly tumbling down. This is what happened in 2014 too - hodlers were too convinced in hodling and remained stubborn about the recovery and their stubbornness only dragged out the process of Bitcoin bottoming out. It took many months of bear market to truly dishearten even the most confident bull. Forget about the dips you've known so far - time and patience is how you truly shake out the weak hands.

( source )

By the time we truly bottomed out last time, there weren't any believers left to 'Buy the Fucking Dip'. There was no huge buying spike when Bitcoin dropped to $200. No, instead people said you'd be crazy and several years late with going that route. Bitcoin was dead.

When I look at the current market, we're simply not nearly there yet. The FUD and bears are strong but sentiment is simply too high. As long as there are armies of people waiting for Bitcoin to drop to X amount of dollars in order to buy in, it's not going to be able to bottom out. The market doesn't nearly feel desperate nor boring enough yet to have bottomed out.

PERSONAL PREDICTIONS

Now, in my opinion there's two ways this may play out. Either we follow last bubble's pattern and we still have many months of bearish action to go through, or 'this time it's different'. I put the latter in quotation marks on purpose, in order to make you stand still by the validity and strength of the position.It could be so, that this time it's truly different. There's more technology, more wealth, more investment, more development, more media attention and more everything in Bitcoin and blockchain now. Not to mention the diversity in altcoins and the excitement they bring with them. Still, I feel like every bubble graph looks the same and in my experience generally 'this time it's more of the same' applies more often than 'this time it's different'.

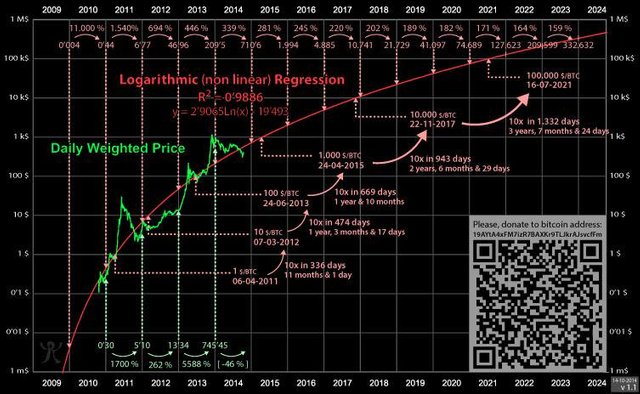

Let's look at the Log chart in comparison, often overlooked but oh-so-interesting and useful:

The Logarithmic chart takes away the time-component and instead focuses on price fluctuations only. It paints a different and some say more accurate picture of price movement. From the logarithmic chart a sort of channel becomes obviously clear between the two peaks. It also shows how we're still quite a bit away from reaching the bottom of the channel, and if you continue the line and guesstimate where it would hit the bottom, I would instinctively put the bottom somewhere between $4-5K per Bitcoin. Perhaps even a bit lower than that.

The Logarithmic charts are actually significant. You may have heard of 'famous' investors who 'correctly predicted Bitcoin would pass $10K' and are assumed to be geniuses, but really what they did is just simply apply the Logarithmic chart to predict the market. The Logarithmic chart is, for example, also the basis for the predictions that Bitcoin will pass $100K per Bitcoin in 2020/2021. It's merely a continuation of the pattern we have been following for the past years.

Take for instance this couple-years-old Bitcoin prediction which I found on Tuur DeMeester's Twitter feed:

As you can see, the Logarithmic chart has been rather spot on in predicting the future price. And if indeed, the same pattern is to be followed, we will hit and surpass $100K per Bitcoin. But in my opinion it would require a much longer bear market with a much lower price per Bitcoin.

Ever since hitting the peak, I've kept my ideal buy-in price at about $4500 per Bitcoin. We haven't hit that yet, and sometimes it looks like we'll never hit it. But I just can't shake this feeling that we just still might hit it and it would in fact be surprising to me (although positively so!) if we didn't eventually drop down to it. Also, I still feel that the bottom of exactly $6000 that we hit earlier this year is not the true bottom - it just felt unnatural. And far too soon.

Now, I don't want to advice anyone or tell you what to do, merely to help people expand their viewpoints. It is also good to point out that I am in no way a professional trader or technical analyst and all of these opinions are merely my own, based on my own experiences.

Although I consider it likely that we may drop lower than we are now, I am still not confident enough to sell in order to profit from it and I would recommend against you trying. Simply put: my experience has taught me that the risks of missing the train far outweigh the risks of missing out on maximizing trading potential. I could very well double my stack if I sold now and re-bought later, but it does not compare to giving up my entire stake and being left behind. This is the lesson I learned as a hodler.

What I do recommend is to keep some money on the sidelines, just in case the logarithmic trend continues. I surely will be. If Bitcoin drops to $4500 or below, I'm definitely buying. That is what it truly means to 'buy the dip'. I made this commitment to myself ever since it first passed $7000 and I intend to keep it. But I also know that when it actually does drop that low I will probably feel very different and instead would prefer to not 'throw my money away' (as it would seem at that point). With this knowledge in mind I have decided I will go against my future self and stick to my plan to buy even when the market is bleak. Or especially when the market is bleak, rather. But for now? I don't think it's nearly bleak enough yet.

I hope I am wrong, though. I'd love to visit the moon sooner rather than later...

There are too many BTFD lovers to let the Bitcoin go too low.

Yes, that's the problem...! They keep Bitcoin from bottoming out, causing a long drawn out winding down process like last time, I fear!

Very interesting post! I think the chance of a long term (24-36 months) bear market is quite low. Two very important influencing facts for me are the all-time-high equity & real estate markets + more and more regulation.

The first one tells me that portfolio managers will look for decorrelated assets to diversify and are hedging for a crash. Bitcoin (or crypto in general) seems to be quite decorrelated. And when a portfolio manager comes across a decorrelated asset class, the risk in is being NOT exposed to that asset class.

The second reason is the fact that in 2013/2014 virtually no significant parties were really talking about crypto regulation and there sure wasn't any guideline. Nowadays there are and there need to be. Without clear rules, entrepreneurs and existing companies will not risk breaking the law.

I feel reason 1 and 2 are building up, especially in the last 6 months. The next 6 months we might see the magic intersection of the both, resulting in the next bull market!

;-)

Thanks!

Good point about the other markets, I feel too that there's a good chance they may enter bear markets and may seek something decorrelated. However.. is Bitcoin really decorrelated? I haven't done my research on this so I truly don't know but is there any actual good data backing this up? Because it wouldn't surprise me to see crypto crashing alongside with the rest of the economy - although of course I would prefer decorrelation. #pessimism ;)

Actually, as long as I've been in crypto there have been talks about regulation and integrating with the existing order. Like the Bitcoin ETF plans from 2013 and 2014 as well. Or the 2014 New York Bitcoin regulation stuff or the Chinese regulation stuff in 2014.

Personally I am not so sure today's sentiment is that different from back then. It feels like more of the same, but on a slightly bigger scale (with a bigger price to match, but still the same pattern).

I hope to god you're right though! Timing is certainly important and I hope the stars align correctly this time around. Truthfully I wouldn't really mind Bitcoin dropping to $4K either because then I get to buy more for cheap. But still, I can't shake the trauma from 2013/2014.

Also, I see a potential decoupling of altcoins from Bitcoin coming up. I consider it a potential path for Bitcoin to follow it's logarithmic chart and go down, but altcoins decoupling and perhaps skyrocketing for a while.

I say this because it makes sense with all the excitement surrounding Ethereum and the likes. And also, I believe that every crypto investor goes through the same evolution: first you discover bitcoin, then you discover altcoins, but in the end you go back to bitcoin. I think 'the herd' was in stage 1 until now, and they may be entering stage 2. This would let Bitcoin ride out it's long bear cycle, until the herd discovers that decentralization is the only true valuable thing in blockchain which could then drive the next bull run.

About the decorrelation, check website out: https://www.sifrdata.com/cryptocurrency-correlation-matrix/ and check the 365-day correlation between BTC and SPX (S&P 500 index). It is pretty much 0 and in the last 9 days it was even quite negative :-)

And I agree there were talks already on 2014 about Bitcoin and crypto, but those were mostly that, talks. Nowadays countries like Canada, Singapore, Switzerland, Japan and China have quite some clear regulation (even though a lot more has to come). Also Bitcoin Futures are actually there and legal on the CBOE and CME. Next to that, I feel there is a lot more pressure from the financial status quo + entrepreneurs for clarity on regulation than in 2014.

Interesting thoughts about the decoupling of altcoins from Bitcoin. I havent's put in much thought on that one. As long as there are no mainstream use cases in which altcoins are used on a daily basis (and with and actual business model), I don't see any reason for decoupling though. Everything is just speculation until then. But as I said, I haven't looked into it that much yet. I generally look at things from a macro-economical perspective :-)

actually, I just got thinking on what I just wrote about how I wouldn't consider it strange if Bitcoin would go into the long slumber, but altcoins might skyrocket. Then I decided to give the ETH/USD logarithmic chart a look to see if that theory would hold any merit, and lo' and behold below the ETHUSD log chart.

Notice how there is a channel too, but as opposed to Bitcoin which is halfway on it's way down, Ethereum's log channel looks like it has reached the lower support. This could indicate that we may see serious bullish action?

Like I said, altcoins in 2018-2019, Bitcoin in 2019-2020 wouldn't surprise me at all.

Thanks for the brief history, as a crypto newbie it helps in planning future moves. I sure hope you're wrong tho, I too would rather visit the moon as early as possible. :)

Thanks for the reply!

I hope I'm wrong too! But for me, it helps to plan for the worst. I myself am just going to hodl my Bitcoin, no matter what. Patience really is key in crypto!

I've mostly been on the sidelines for the last 5 years and have never owned any bitcoin which is maybe a mild relief considering the roller coaster ride. I have however been following the developing alt coins and feel they are going to render bitcoin for the most part obsolete. Sure the sentimental will probably never let it die but I don't think its going to be the main focus. Dapps and utility will be the focus of innovation as well as regulatory adherence. Universality is also going to be a large part of success for a prosperous community driven ecosystem. I feel the Neo block chain is being developed with the ability to foster these areas. I personally would sell my bitcoins and spread it around some of the promising alt coin developments. I just think bitcoins hay daze are about done. I am a newbie that cant really be trusted to know how the future will unfold so just bouncing thoughts. Although, sometimes you don't need a crystal ball to see the writing on the wall

There are too many BTFD lovers to let the Bitcoin go too low.

When you lover reaches too far in your wallet. You may be less in love.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by pandorasbox from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

I don't have a whole heap of bitcoin but I do hope it doens't drop that low for all those who brought high.

Congratulations! Your post has been selected as a daily Steemit truffle! It is listed on rank 22 of all contributions awarded today. You can find the TOP DAILY TRUFFLE PICKS HERE.

I upvoted your contribution because to my mind your post is at least 24 SBD worth and should receive 88 votes. It's now up to the lovely Steemit community to make this come true.

I am

TrufflePig, an Artificial Intelligence Bot that helps minnows and content curators using Machine Learning. If you are curious how I select content, you can find an explanation here!Have a nice day and sincerely yours,

TrufflePig