Bitcoin Forks Chronology – The Ultimate List of Forks

Cash, Gold, Segwit2X? All these Bitcoin forks create more confusion for you in this crypto world? You have nothing to be afraid with the right knowledge. It happened before and it will happen again for sure. You should accept that this is how the technology works, and if you believe in a decentralized future, the freedom of creating your own Bitcoin is one of the rights anyone in the space has. Here’s your complete list of Bitcoin past and current forks.

Bitcoin creation – The Genesis Block

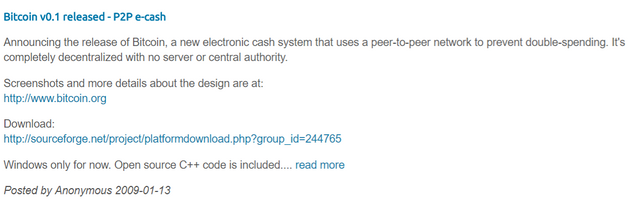

In January 2009, history was made when the mysterious Satoshi Nakamoto released the first software program implementing Bitcoin. Description:

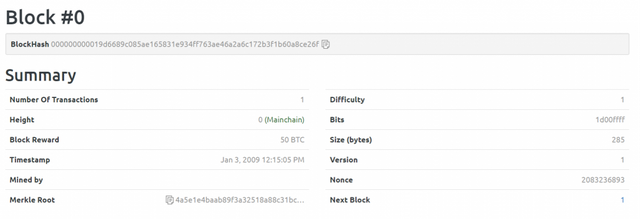

Following the release of Bitcoin, Satoshi mined the first Bitcoin block (also called the Genesis Block).

As you can see from the picture, the software is version 0.10. This means that it will be greatly improved and constantly updated in the future. When Satoshi was the only one mining Bitcoin with a few pioneers, this wasn’t a problem. When the network grows to a few million, then billions, of dollars changes become much more sensitive. Moreover, Bitcoin is aimed to be free of centralized authority so it cannot be one person or group who alone decides what should be updated.

Features

Block size: 1 MB

Algorithm type: Proof of Work (based on Sha256)

Speed of a block mine: 10 minutes

Difficulty time: every 2,096 blocks (~2 weeks)

Number of transactions per second: 7 max (4.4 on average)

How to improve the Bitcoin Software?

For an update to be implemented, anyone can submit a BIP. BIP stands for Bitcoin Improvement Proposal. It’s a pretty straightforward proposal. It proposes to update some of the Bitcoin code (the protocol itself or its documentation). Bitcoin Core is the team maintaining the most popular Bitcoin client, so they review the proposal with the community. If there is general approval, the code can be pushed out to the next version of the Bitcoin Core client. Then nodes and miners can decide if they want to update their software to the next version or not.

Most changes aren’t too important so they do not require much attention, and it doesn’t matter if users update their software or not. This is not always the case though. Some changes are so important that they require everyone to change their client for the system to work properly. In this case, we need a fork. When a fork happens you a creating, temporarily or permanently, a new blockchain by splitting the initial one into two parts. One chain with the new software, one chain with the old. Ultimately, the longest chain wins.

Hard Fork

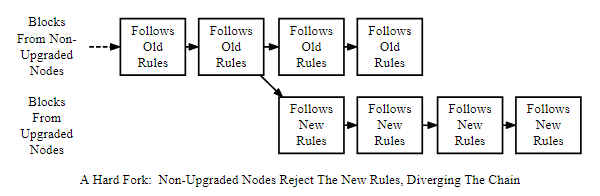

Now we have two types of forks. The easiest one to understand is the hard fork. When a hard fork is implemented, the new version of the software rejects all transactions from the older software. We also refer to this as not being backward compatible.

Soft fork

The other type is soft forks. These are backward compatible. So if I were to make a transaction on the old software, the new software would be able to accept the transaction. However, the transactions made under the new software won’t be understood by the old software.

Bitcoin XT

The Genesis of Bitcoin XT

Bitcoin XT is the first “bad boy” of the Bitcoin hard forks. The first client was initially launched by Mike Hearn in December 2014, to implement some new features including some of his BIP 64 (which is still in use in the current Bitcoin Core). The real drama started to happen when they planned (with Gavin Andresen) the implementation of BIP 101 (by the way, Gavin and Mike were Bitcoin Core developers who had major roles to play, especially Gavin in making Bitcoin what it is today).

What did Bitcoin XT try to achieve?

Their goal was to reach 24 transactions per second on the Bitcoin network by increasing the block size to 8MB.

How was Bitcoin XT received?

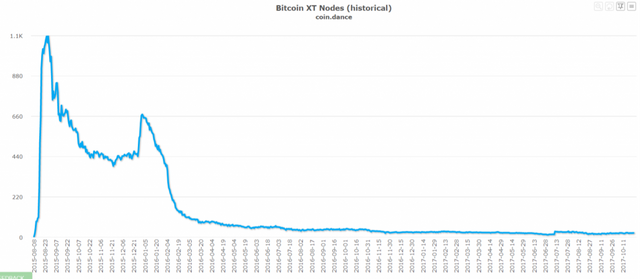

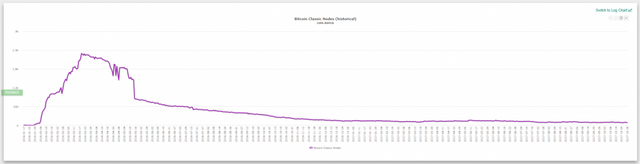

After the first release, it was very successful, and there were 1,000 nodes running their implementation in August 2015, but as you can see on the graph below it has been in a sharp decline since.

Current Status of XT

Bitcoin XT had over a thousand nodes at its creation. In early 2016, the project was pretty much dead, and Gavin withdrew BIP 101 when they realized they couldn’t get the 75% acceptance rate they were looking for. Bitcoin XT is still maintained, but it is minor.

Today there are less than 30 XT nodes running

(https://coin.dance/nodes/xt)

Features

Hard fork of Bitcoin core

2MB block, then market driven block size

Bitcoin Classic

How did Classic come about?

After the failure of XT, there was still a will in the community for bigger blocks, so some developers created Classic in February 2016.

What does Classic Support?

They had the intention of increasing the block size to only 2MB. Despite receiving some support from large companies it didn’t really get the traction it needed to proceed with a hard fork. About 8 months after their launch, they changed direction and started promoting a market-driven blocksize.

Features

Hard fork of Bitcoin core

2MB block (later: set by users)

Is Classic Still Relevant?

Today, they have about 100 nodes left, but had over 2,000 nodes for a few months in 2016. The project still exists. They have a long-term vision over the next 5 years, so we’ll see if they can make a comeback.

A Similar trend to Bitcoin XT (https://coin.dance/nodes/classic)

Bitcoin Unlimited

Bitcoin Unlimited is still hot, although not as much as it used to be when it started in January 2016. However, it is constantly lurking behind Bitcoin Core (650 nodes at the time of the writing).

Forking Strategy

Unlimited has an interesting strategy. They released the code, but haven’t given clear instructions about what type of fork to implement. Companies like ViaBitcoin has offered solutions to create a fork mechanism. They pointed out that it would need over 75% of the miners to signal in the favor of unlimited.

Features

It’s a hard fork.

Miners decide on the size of their block.

Nodes and miners can set a limit to the size of the blocks they accept. By default, this excessive blocksize limit is 16MB. This value can be customized.

Reliability

There have been some serious issues with Bitcoin Unlimited’s reliability. One day 70% of Bitcoin Unlimited nodes crashed because of memory leaks. Ren Zhang has gone into deep details to highlight the security flaws of the protocol.

We can see the correlation between bugs and the number of nodes (https://coin.dance/nodes/unlimited)

No Coin Now, Only Futures

Now if you want to buy Bitcoin Unlimited, it is possible even though they do not really exist (yet?). Bitfinex created some futures which people can purchase. It is difficult to predict what the future of Bitcoin Unlimited will be like. You can check out their progress on GitHub or on their website.

Segregated Witness

Who invented Segwit?

Segregated Witness (Segwit) was first presented as an idea by Core Developer Peter Wuille during the Bitcoin scaling event held in Hong Kong in December 2015. It had immense popularity and was proposed as BIP 141 by Eric Lombrozo, Johnson Lau, and Wuille a few weeks later.

What the hell is Segwit?

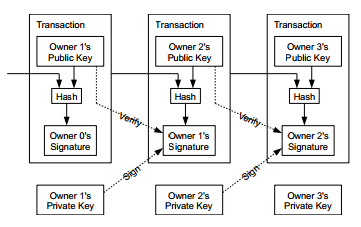

There is no simple answer to this. It is some sort of “hack” which reduces the size of each Bitcoin transaction. A Bitcoin transaction is composed of several different elements, including a signature.

To reduce the size of the transaction, SegWit removes those signatures which, according to Dr. Peter Wuille (the creator of Segregated Witness), account for about 60% of the entire Bitcoin blockchain! The signature is instead stored into another data structure called an extended block, but we don’t have to worry about these now.

There are also other advantages to Segwit including a fix to transaction malleability (an old Bitcoin bug). This is very important because it allows for the development of second-layer applications such as Lighting Network and Atomic Swaps. If you want to learn more about the benefits of Segwit, you can find more about it here.

How was it implemented?

Segwit was introduced to the Bitcoin network as a BIP 9 soft fork. It needed to receive 95% approval from the Bitcoin miners in order to be activated. Segwit was activated on August 24 2017.

Features

Soft fork

Implements the features of the Segregated Witness, proposed by Peter Wuille

Bitcoin Cash

Why Bitcoin Cash?

A lot of people don’t like Segwit or Segwit2x. When it became clear that Segwit was happening on the Bitcoin main chain, some users concluded that the only solution was a sudden hard fork.

How was it implemented?

The Bitcoin Cash fork didn’t wait for support and affixed a specific date when it would branch off Bitcoin. After August 1st, 2017, Bitcoin Cash wallets started to reject Bitcoin blocks and transactions.

With Whom?

This fork was It quickly gathered a lot of support from major influencers, like investor Roger Ver and Beijing-based Bitcoin miner ViaBTC, early on. Then some of the major wallets and exchanges, like Kraken, decided that they would provide Bitcoin Cash to their BTC holders. You can find all of the partners on their website. Interestingly, it is supported by Bitcoin XT, Unlimited, and Classic

Who is mining it?

What is interesting about Bitcoin Cash is that miners can very easily switch from Bitcoin to Bitcoin Cash mining. There is an interesting phenomenon we can call “opportunistic mining.” When Bitcoin Cash becomes more profitable, many miners will switch their devices to Bitcoin Cash from the Bitcoin main chain, and vice versa.

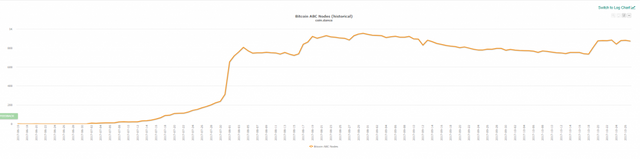

How Many Nodes are Running?

The number of nodes has more or less been stable since the fork on August 1st. There has been between 700 to 900 nodes running.

Bitcoin ABC nodes (https://coin.dance/nodes/abc)

Price Evolution

The price has fluctuated a lot since its creation. It has reached up to over $900, but now has stabilized around the $300 mark. It is important to keep in mind that a lot of the Bitcoin Cash from the fork hasn’t been claimed, but it is still calculated in the market cap. So if Coinbase, for instance, releases the Bitcoin Cash out of all their BTC wallets, it will have a tremendous impact on the price.

Features

8MB Blocks

No Segwit Activation

Emergency Difficulty Adjustment Mechanism

Bitcoin Gold

Is Bitcoin Gold a Scalability Answer?

Bitcoin Gold is an implementation of Bitcoin who’s fork model is based off the Bitcoin Cash fork. It had a fixed block, at which it decided to split from the main chain. This is the first fork where the main focus isn’t scalability. Instead, it aimed at reducing the importance of big miners on the network.

What’s the status of Bitcoin Gold?

They are currently implementing a mining framework which would allow anyone with a GPU to mine Bitcoin at a competitive price. Bitcoin Gold should be released at the beginning of November. You can find out more about Bitcoin Gold in our last article.

Rhett Creighton is working on an alternative Bitcoin Gold “protest fork”

There has been a lot of criticism about Bitcoin Gold because they decided to premine some of the new Bitcoin Gold to finance their dev team. A developer called Rhett Creighton created a new Bitcoin client which simply removes the line of code for the pre-mine. It’s very uncertain that it would work, but it would play more into the spirit of decentralization.

Features

Hard fork

New Mining Algorithm (Equihash)

Mining difficulty estimated every block

Segwit2x

Segwit2x (2x) is the hottest topic at the time of this article’s release. Bitcoin Gold is nice, but it nowhere near has the same level of attention that 2X has right now.

How did Segwit2x Come About?

The outline of 2x is laid out in the New York Agreement signed by some of the most important CEOs in the Bitcoin scene. This proposal was motivated by the will to find a compromise to end the war between the big blockers and the Segwiters. The proposal is to let Segwit activate and implement a hard fork which would increase the blocksize to 2MB.

What was the reaction to the New York Agreement?

Needless to say, the Bitcoin community didn’t really like a shady reunion between important people deciding the fate of their decentralized playground. Instead of making everyone happy, everyone was unhappy because big blockers who want to keep the original Bitcoin now have Segwit imposed on them, and proponents of small blocks now have blocks which are twice as big.

Discontent was especially visible during the Breaking Bitcoin conference where the Hashtag #NO2X appeared everywhere; on social media, T-shirts, stickers, caps, etc.

Now, 2X is probably going to happen but more companies are backing out. Recently Coinbase said that it was going to list the new chain as Bitcoin2x.

What’s The Deal With Replay Protection?

Replay attacks are basically duplicates of a transaction from one chain to another. So Bob sends Alice two Bitcoin2x to Bob and this transaction is subject to a replay attack, as opposed to regular Bitcoin transactions.

The 2x developers have no plans to implement replay protection because the developers assume that 2x will be the main chain. So, they assume that Bitcoin Core needs to implement it. This is very risky because it can cause a transaction on one chain to be duplicated to the other. It’s also pretty arrogant and has caused plenty complains against 2x.

Features

Hardfork

Implementation of Segregated Witness

Raise the block size to 2MB

No replay protection

source

https://howtotoken.com/bitcoin-forks-chronology-ultimate-list-forks/