RE: The truth behind Decentralized Exchanges and the ongoing fight against Mass Surveillance

I think the most obvious benefit of a DEX is the same as with any decentralized application, which revolves around the philosophy of eliminating intermediaries and returning interactions to models without permission among peers without central authorities. More specifically, decentralization creates resistance to censorship, which in the case of decentralized exchanges means that no central authority could forcibly impose regulations, or even prohibit currencies and / or the exchange itself. This is especially important considering that many countries are restricting the cryptocurrency trade. For example, the two most populous countries on earth, China and India, have banned cryptocurrency exchanges, while countries that include Mexico, Russia, Saudi Arabia and Brazil have restricted cryptocurrencies.

Without decentralized exchanges, the ability of people to invest in cryptography is subject to governments, so cryptocurrency does not become more democratic than traditional asset markets. Governments can exercise control over centralized exchanges, and users are subject to authorities who can track and impose taxes on users at any time, or prohibit currencies.

From privacy, to security, to resistance to government interference, decentralized exchanges are way ahead of their centralized counterparts and yet they’re not capturing the public imagination.

Cryptocurrency and blockchain-based technologies are flourishing. The volume of transactions has reached $ 20B per day, the market capitalizations have skyrocketed and the adoption by users has reached a truly global scale. The increasing utility of Blockchain in various use cases is bringing the world closer to an economy without trust, eliminating the need for third parties to exchange goods and services.

Paradoxically, more than 99% of all cryptocurrency transactions go through absolutely centralized exchanges on platforms such as Coinbase, GDAX, Binance and Bittrex. That's right, decentralized assets are stored and traded in centralized platforms that operate as guarantee deposits for their clients and do not record transactions in the block chain. This has led to massive security breaches and the unsafe handling of funds, private keys and personal data. Only in 2018, hackers have stolen more than ~ $ 730 million in cryptocurrency.

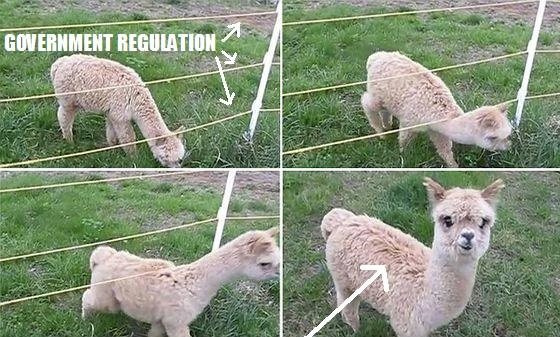

I absolutely love your comment @orphism. And this photo put such a huge smile on my face hahaha :)

Thank you for sharing your view on this issue and DAX.

Oh I didn't know that. It really seem that most big players around the world do not like those new solutions that comes along with blockchain and crypto.

Your knowledge is clearly just out of this world. One of the best comment's I've read today.

BIG THX buddy

Piotr

That Image is adorable! I personally think it's getting much harder to bypass government regulation and it will continue to get harder over time. For now, certain governments are having a relatively easy time of outright banning Cryptocurrencies (technically they can't stop Crypto but there they can stop centralized Exchanges). With DEX's like Komodo and ResDex, once they gain more traction over time, Governments are definitely going to take interests and will most likely do everything they can to get rid of them. We as the community are sick of security breaches and faul KYC practices. We definitely need more DEX's regardless if the development of these services are slow. At least we have more options on deciding where we wanna trade our cryptocurrencies. Great comment by the way! Thank you for your feedback @orphism