How Balanced Cryptocurrency Portfolio Looks Like: Investment Tips

A large number of investors have started to purchase cryptocurrencies as a short-term and long-term investment, a safe haven asset and an experimental investment to develop a proper understanding of the market and the technology behind cryptocurrencies such as Bitcoin.As a result, even the initial coin offering (ICO) market, which is yet to showcase a viable product or a decentralized applications with an actual active user base, have begun to attract hundreds of millions of dollars in the past few months.In fact, Tezos, Bancor and EOS, the three largest ICOs to date, have raised more than $485 mln, with the ICOs of EOS and Tezos still ongoing. However, none of these three ICOs have completed the testing phase of their software, leading many analysts to describe the ICO market as a bubble.Still, the vast majority of investors in the cryptocurrency market are purchasing cryptocurrencies such as Bitcoin, Ethereum, Litecoin and Ethereum Classic as long-term investments.A large portion of investors within the cryptocurrency market wholly support the monetary policy, vision and purpose of popular cryptocurrencies that have evolved into useful alternative financial networks and decentralized infrastructures for decentralized applications.

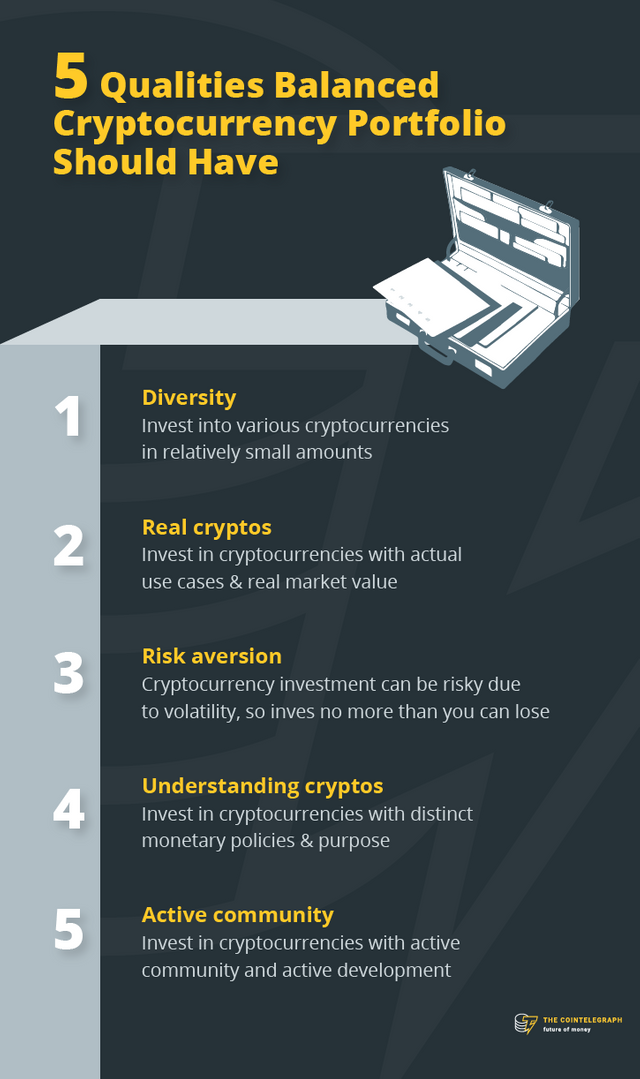

What is a balanced cryptocurrency portfolio?

As mentioned above, the purpose of investing in cryptocurrencies varies greatly for investors. Most Bitcoin investors consider Bitcoin as a safe haven asset and a digital currency and have purchased Bitcoin expecting it to become a major alternative financial network which could compete with global banking systems and reserve currencies such as the US dollar in the far future.If an investor remains unclear about the structure, purpose and monetary policies of certain cryptocurrencies and is investing in specific cryptocurrencies as an experimental investment to learn more about the market and various cryptocurrencies, it will be smart decision to maintain a diversified portfolio of a few different cryptocurrencies.

great post, getting into many assets can def help out, long as you don't stay long term in the dollar , it just loses value over time

https://steemit.com/steemit/@goldsilverguide/losing-money-by-saving-money

I plan a post for this weekend comparing buy-n-hold plan vs balanced plan vs scaled plan. I will post a link when its up.

that will be good

I just posted this article https://steemit.com/altcoin/@toadslinger/here-s-how-to-beat-buy-and-hold-returns

@oowiliams

Good Post!

Thanks for sharing.

Nice post and totally agree with you. Many simply jump into the market and buy into one cryptocurrency. Were that one asset to fail you would lose everything. It's all about spreading your risk.

The infographic you added is great too and all 5 points are great. I would add 3 more.

6 - Have a look at the charts

7 - Find good sources for crypto news and read it

8 - Read the white paper of ICO's you would like to invest in (and others if you really get into it)

Getting used to how a crypto reacts to the news can greatly reduce the chance of selling everything prematurely just to see the prices push for higher highs just because you panicked. You will also know what is being said about your assets. And the same goes for looking for chart patterns on the charts.

Reading the white paper will help you understand what the ICO would like to achieve and how it would like to achieve it. Granted you may not understand everything but as time goes by you will be able to compare one to another and you will learn a lot about cryptocurrencies.

Happy investing :)

Good post, thank you. Upvoted, following and resteemed!