Why Dollar, Pound, Euro and Yen replacement is inevitable

In the late 60s a Swedish economist published a paper stating that as every currency in history has eventually failed the only sensible option was to remove the currencies from a gold/silver standard and print banknotes like crazy.

By removing the standard, governments would be free to print money without going to the expense of holding a percentage in precious metals to back the currency. This would eventually mean the currency is worthless but in the meantime the country could ride the wave of money printing and reap the benefit of heavy investment in infrastructure, energy, technology, etc.

This idea was fully endorsed by an American economist, Alan Greenspan... as you may know he became Chairman of the US Federal Reserve in 1987. Subsequent Fed chiefs Bernanke and Yellen are also devotes to this system.

When the US came off the gold standard in the early 1970s the dollar became unbacked. As more notes were printed it devalued the worth of the currency. The increasing money supply and the corresponding decreasing buying power of the USD is well documented elsewhere.

The Bank of England, The US Federal Reserve, Bank of Japan, ECB and every other central bank has done the same thing (in the UK they try to hide this by calling it ‘Quantitive Easing’ rather than money printing, but it is effectively the same thing).

The governments have to try and devalue their currency (usually by inflation) because of their crippling debt level caused by money printing and the interest payments required to service these debts.

All of this would be problematic at the best of times but there two more factors that make this possibly cataclysmic: Levels of interdependency in derivatives and the end of the petrodollar.

(This website gives a good idea of the size of the derivatives risk: http://demonocracy.info/infographics/world/lqp/liquidity_pyramid.html)

When the US came off the gold standard in the 70s, the dollar wobbled as the world’s reserve currency. Henry Kissinger brokered the petrodollar deal with Saudi Arabia to stop the collapse. Basically this meant that Saudi would only accept US dollars in payment for their oil. In return the US would not invade and seize their oil fields and would instead protect them militarily from any aggressor.

The deal meant any country wanting to buy oil had to first exchange their own currency for dollars. Saudi would then deposit these dollars in US banks like Citi and Goldman Sachs, and buy US Treasury Bonds and an obscene amount of US military hardware, thus giving the illusion of a strong dollar.

That has all changed this year. You may have seen the atrocious Saudi/Yemen war, Saudi/ Qatar breakdown of relations, Saudi/Russia billion dollar arms deal, Saudi/Chinese Yuan oil agreement, Saudi named as financiers of 9/11, etc, etc. All of these, to differing degrees, show the changing Saudi/US dynamic.

The US will also lose its unique veto power within the IMF to the BRICS nations on Sunday 15th October (next Sunday)... they have held this veto since the second world war... and the timing may or may not be significant depending on which insider you believe.

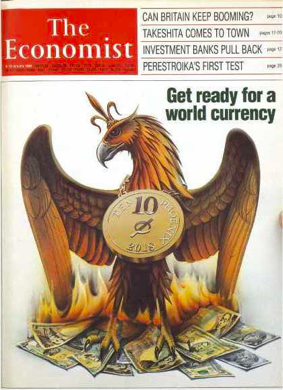

This has all been planned for a long time (see the economist cover from 1988).

I now have little doubt the new world currency will be digital but it depends on the timing whether it is an SDR currency provided by a centralised authority (e.g: the BIS, IMF or AIIB) or a decentralised one such as Bitcoin.

If the coming conflict/strife is great enough and the carrot appealing enough the global masses will accept a centralised currency without understanding the ramifications. The financial trap will be sprung and we will all be truly caught and enslaved.

However if the pain inflicted is too great and the loss of current wealth destroys trust in central authorities then other options become more viable... a cessation of endless wars and economic tyranny for example.

All of this of course follows the demise/reduction to local token status of the dollar, pound, yen, yuan, etc.

How you approach what is coming is obviously your choice but I would suggest the bank bail-in legislations that were enacted in Greece, Cyprus and Malta were tests for a much larger worldwide event that will soon take place. As a result the last place to trust with anything you value is a bank, pension provider, financial institution or government.

Good luck!

Please upvote my posts also :)