The Bitcoin Scaling Debate [Updated]

These weeks are the most important ones for Bitcoin future. The main issue with this cryptocurrency is scalability, that is, the capacity of handling transactions. Today the Bitcoin network is restricted to a sustained rate of 7 transactions per second due to the protocol block sizes of 1MB. To make a quick comparison, VISA handles on average around 2,000 transactions per second (tps), with a daily peak rate of 4,000 tps

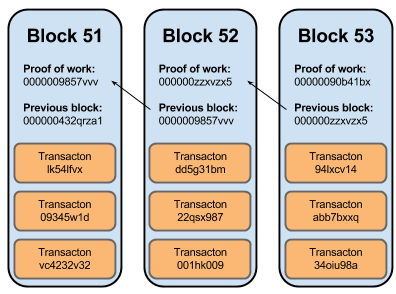

Block structure

Every transaction in the blockchain contains an input address (from where the value is coming), an output address (to where the value is going) and a digital signature (used for verifying the authenticity of the transaction).

This digital signature associated with each transaction takes more than 60% of the space in a given transaction. Another problem by associating digital signature with transaction data is that the signature can be tampered to change the transaction id and later claim for refund. The solution for these problems could be segregating the digital signature from the transaction data. In this way the block containing the transaction is separated from the so-called "extended block", which contains the signature data.

Major Upgrading Proposal: SegWit

Introduced already on the litecoin network, SegWit could provide a boost to bitcoin's transaction capacity among other enhancements. But it has yet to activate on its own. Since all the proposals ultimately support SegWit on different terms, many in the community see this as a sign that SegWit is finally going to activate this summer.

The question is whether it could ultimately lead to a split into two bitcoins.

In fact, some mining pools are showing signs that they want to take aggressive measures to hard fork bitcoin to a 2MB block-size parameter. If that happens, it's possible that bitcoin could split into two competing assets later in the summer.

Timeline:

Segwit2x soft fork: July 21st

It's important to note SegWit was originally billed as a 'compromise', since it increases the block size (though not in a way that changes the hard-coded 'block size').

The idea of a compromise did not please everyone and most mining pools did not upgrade their software in support of SegWit.

That's why in November 2016 Segwit2x was released. Called also, BIP 141, Segwit2x is one alternative proposal that combines SegWit with an increase to a 2MB block-size parameter. Most major bitcoin companies and mining pools representing 80% of the hashrate signed the proposal. Right now, the majority of the bitcoin mining hashrate is signaling support for Segwit2x.

This is a non-binding show of support. According to the technical working group timelines, the code was officially released by 21st July.

If 80% of mining pools run the code for 672 blocks over a period of four to five days, then SegWit will lock in. Although it's non-binding, it's notable that the mining pools plan to lock-in SegWit the day before 1st August.

Three months later, the second portion of the agreement, the 2MB block-size increase, is supposed to kick in. The problem is that if not all users upgrade, this could lead bitcoin to split into two assets. At least some users have said that they don't plan to.

Activation: signaling for the change began on 21st JulyThree months after SegWit is activated, users will need to upgrade their software if they want to support the 2MB block-size parameter increase.

If mining pools lock in Segwit2x by 31st July, then that might be it. Otherwise the following events could unravel.

BIP 148 UASF: August 1st

BIP 148 UASF also aims to activate SegWit, but it takes a different approach.

It rekindles an older way of making consensus upgrades to bitcoin, one that doesn't explicitly ask mining pools for support before pushing through a code change.

Many users and some companies are already running code that could trigger this type of soft fork. At this point, nodes will start rejecting blocks that do not signal support for SegWit.

That's why the idea is controversial. As these nodes reject the blocks, they're effectively pushing them to a different network. It's controversial because it could lead bitcoin to split into two competing cryptocurrencies, like what happened with Ethereum and Ethereum Classic.

Some argue that it has more of a psychological affect. For example, some believe that mining pools rallied around Segwit2x on Monday in response to growing support for BIP 148. The idea is that, if they don't want bitcoin to split, SegWit needs to be activated somehow prior to that date.

Activation: on August 1st, nodes that are running BIP 148 will start rejecting blocks from miners that do not support SegWit.

UAHF: 12 hours after BIP148

This fork is supported by two major mining firms: Bitmain and ViaBTC.

If BIP 148 gets off the ground on 1st August, Bitmain plans to roll out a "user-activated hard fork" (UAHF) in response. According to the company, this could potentially protect users' money in the event of a split, by making the split more permanent. In theory, a bitcoin hard fork could provide protection from a 'wipe out', where transactions on one version of the blockchain might accidentally be erased. Still, mining pools might lose money if they end up mining a competing fork. So, some are calling the the Bitmain UAHF a bluff.

ViaBTC then unveiled a related plan to guard against the prospect that some in the community may not uphold the 2MB increase portion of the Segwit2x agreement.

The purpose is to incentivize the creation of a bitcoin with bigger blocks by raising the funds to do so via an initial coin offering (ICO).

Activation: If BIP 148 triggers, Bitmain will start mining a private chain and open it up to more bitcoin users if there’s enough support.

In conclusion, everything is still uncertain and it all depends on the miners' adoption rate. However, in the worst scenario, Bitcoin could hard-fork into two different coins, leaving the market upset for weeks. That's why it's necessary to store all your BTC on a wallet where you can control your own private keys. By doing this, you will be able to receive the same amount of coins and benefit from the split.

Vote the post if you liked it :)

Follow me on steemit

Source: CryptoBlog.tech