Read these tips before starting your crypto trading adventure

Since the big influx of new traders in 2017, we have some people that got burned really badly past month. I've read messages about people suiciding because of their crypto losses, and this is for me a big alarm bell to give my biggest tips and warnings about crypto trading.

If you take these tips to your heart and apply them, you will naturally become a better trader. I have quite some experience into crypto and forex trading, and I have experienced my share of big losses and emotional rollercoasters aswell. Been there, done that. Now it's time for me to prevent you from burning yourself trading cryptocurrencies!

1. Take full responsibility

The very first step is realizing you are the ONLY ONE responsible for anything you do. Stop making excuses such as "But Bob told me the price would go up...", "But Alice told me to HODL...", "But Peter said I would be missing a big opportunity...". You are the one pressing the buy or sell button, so do not base your decisions on opinions of other people.

Same goes for blaming the market ("The prices just go down because I bought..", "Screw you, Bitconnect! It's your fault I have no home now!", "Stupid thieves stealing my private key, now I am broke!"). Yes, there are scammers out there, but no matter how big of a victim you would be, it is still your responsibility to be your own bank!

Once you start realizing that YOU are the only one to blame for your actions, and you start learning from your mistakes, you will head into the right direction!

2. Get ready to accept the possibility of losing everything you invest

It saddens me to hear people mortgaging their homes, pulling credit card debts, lending from friends or family etc.. just to purchase crypto in the hope of getting rich quick. This is a highly irresponsible (see point 1) way of investing. Yes, you might get lucky and double the money.. BUT, the chances of ending up with no money and a huge debt is real!

The mere fact that people are suiciding because of their crypto losses signals a big warning that throwing your life on the line for something highly speculative is digging your own grave. Most people won't be able to deal with emotions of suffering losses of those big proportions, so don't ever lend money to invest!

Even if you aren't actually losing everything, you will experience so much stress during the time the trade is active, it's very unhealthy! So please, only trade money you are ready to lose!

3. Get protected against theft

Get a hardware wallet to store your HODL crypto's, and use 2FA authentication for exchanges. Regularly make sure your computer is virus- and malware free, and never use the same password for multiple sites. These are the basics for keeping your money safe.

Whenever you are making a crypto transaction, triple-check the receive address on every screen. Also, make sure you are trading on the legitimate website (bookmark it).

Never share your seed or private keys with ANYONE. These give access to your money, and should it fall in wrong hands, you will end up with empty wallets.

4. Have a professional attitude

Don't ask people "Will the price of BTC go up?", "Do I need to buy or sell?", "What is the price of BTC in one year?". Nobody has a crystal ball, and everyone will probably say something different. Even the biggest professional traders are wrong on a regular basis.

If you have a question, do research to answer it yourself. Research coinmarketcap, the website of the coin, their whitepaper etc to get more insight in whatever you have a question about. If you still have the same question, ask it, but take all responses to your question with a grain of salt. Never base your trade decisions on something someone else says, always research their answers.

5. Be wary of your biased opinion on your favourite coin(s)

Nearly everyone has one or a few favourite coins. They nearly never speak anything negative about that coin, because they hope it will fly to the moon and easily dismiss all negative news and think it is "just FUD". Try to stay neutral, and be receptive of both good and bad news.

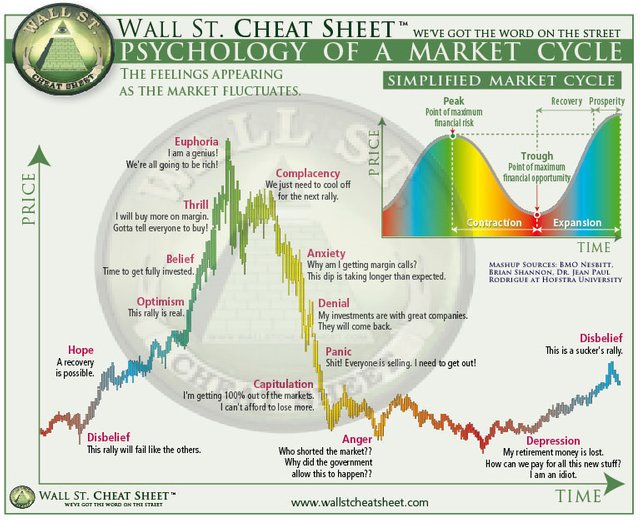

6. Don't fall into an emotional trap

Whenever you want to buy or sell something, you most likely feel like buying when the price is rising, and selling when the price is falling, right? Look at the chart above. Do these emotions feel familiar? Trading based on emotions will net you with losses. If you buy when it's high, or sell when it's low, you are already too late to the party. This is why you trade based on analysis from a neutral point, rather than jumping on your gut feeling.

People commonly experience the "Fear of missing out" syndrome (FOMO). They see a price skyrocketing up, and don't wanna miss the ticket to financial freedom, so they jump in right before the rocket runs out of fuel. They first keep HODLing because they refuse to sell at a loss, until they finally give in and sell at a very low point. Been there, done that.

7. Understand what you are trading

Don't just buy a coin because it looks cool or its idea looks appealing. Do thorough research on all aspects: The charts, Coinmarketcap, Their website, The team behind it, The whitepaper, The roadmap, Social media (Twitter, Facebook, Reddit), Google etc.

It is important you fully understand what you are trading because you are backing your trade with fundamentals instead of emotions. Emotion-backed trades will never last, because sooner or later you will make a terrible decision based on your feelings.

If you fully understand the fundamentals, you have a much clearer view whether and when to buy a coin or not.

Hopefully these 7 tips will make you a profitable trader. If you think these tips were valuable to you, please leave something in my tip jar below:

XRB: xrb_1zeu15meyuuor1m91u7ghasmgor5gw9n3hmj4t8ukzxhskh9a6gkokn7k9fp

BTC: 3N9xg5WnXK1CNbk56FULHNtjFr5L5TPKEb

ETH: 0x214A81b54a1539Bc9f4Cb7C112b2E6d7EE16650E

BCH: 12zFXTFit6QNfjHcaRShM7k1tKwmjYA4dd

DASH: XdxAatS5a1MK7VcZegi2kL2bngHjfbQCEj

XLM: GCWBYEISPEJSNLI7UK4R32A2XK3CU6MBLR6S24TRG5S3SA4YZS5GYVNV

XRP: r3fFirRfGqVWLpvjciPF9ScfVEvu5rzqTe

Expanding on #7, I think it is very important to understand the utility of the tokens you own...what does the token actually do for you by owning it? Not simply looking at it as a buy/sell situation. With crypto, the goal is to eventually live in a world where we are using these tokens.

For instance, what does it mean for you when you own ETH? How does it get its value? Well, ETH is the gas that makes Ethereum go. dApps that build on the Ethereum blockchain need ETH to process transactions, allowing their apps to run. Without ETH, this is not possible. So by owning ETH, you basically own fuel (that is in limited production) which will be used by business owners who have chosen the most popular blockchain to build on.

Compare that to something like BNB - a token that gets your discounted trading fees on Binance. If you are only trading on KuCoin or Bittrex, what good does owning BNB really do?