Metamask and its meteoric rise to DeFi’s Number 1 wallet.

In brief:

- How it all started.

- The pitch that led to Metamask.

- Consensys and Metamask.

- How revenue is generated.

- Problems that are yet to be solved.

- The future of DeFi and Metamask.

It did not begin in a single place nor at a single period in time

Long before the debut of Ethereum, the first builders and co-founders met in late November 2014 in Berlin to describe their work and plans for the future of Ethereum at a meetup called Devcon 0.

By this point, approximately a year after Buterin wrote the original Ethereum whitepaper, The Ethereum team had reached a fundamental decision: it would be a non-profit venture.

That decision, led by Buterin, had splintered the leadership team and sent many members off to look for opportunities abroad.

Despite remaining close to Buterin, Joseph Lubin was among many who began to look beyond the initiative and onto larger economic opportunities.

Joseph Lubin, Vitalik Buterin, Anthony Di Iorio, and two other developers, Gavin Wood and Charles Hoskinson, met 11 months ago at a beach house in Miami.

They were there to attend the North American Bitcoin Conference and discuss Ethereum.

During that stay in Miami, Lubin secured his presence at the vanguard of the Ethereum revolution and established himself as the commercially-minded counterbalance to Buterin’s humanitarian and emotional core.

This will prove crucial as around the time of Devcon 0. He had launched a new company called ConsenSys.

The firm was created to find and fund Ethereum-based businesses, assisting in the network’s adoption and delivering its benefits to large numbers of inexperienced customers and businesses.

The conference room pitch, MetaMask origins

Unbeknownst to Lubin, in one of the conferences side rooms, Joel Dietz sat down with Buterin and pitched a precursor to Metamask.

Dietz argued he should receive one of the recently announced Ethereum Developer Grants and create a JavaScript-based crypto browser.

Buterin did not require much persuasion because Dietz had already established a notable presence in the ecosystem. Buterin even suggested a name for it: Vapor.

Fortunately for Dietz, finding developers to build projects with was not difficult because the only users of Ethereum at this point were, well, other developers. Not long after the talk with Buterin, a team forms with Joel Dietz, Aaron “Kumavis” Davis and Martin Becze.

The group quickly made an effort to get entry into Y Combinator, the organization that has supported so many unicorns, to raise money.

You can watch Becze, Dietz, and Kumavis describe exactly what they are attempting to construct in an application video that is still available on YouTube.

Since it did not have the same connotations as it does today, the term “wallet” is not used once in the one-minute short. The team characterizes their project as combining “the browser with the blockchain” instead.

“Unfortunately, we’ve decided not to fund Vapor.

We were impressed by the three of you and the demo we saw, but we weren’t convinced that this would grow large among mainstream users.”

— Trevor Blackwell, partner at YCombinator

Although hindsight is always 20/20, YCombinators’ choice at the time was not unusual. Only a handful that dared to put themselves through the horrific user experience that was cryptocurrency back then saw its massive potential.

ConsenSys and Metamask

Eventually, Vapor died.

Kumavis left the project, citing his co-founders’ lack of effort as the reason. He removed them from Vapor’s Github, Slack and eventually renamed the repositories to “MetaMask”.

Dietz allegedly never received the Ethereum Developer Grants to build Vapor, but Kumavis applied for another grant at the Ethereum Foundation to build Metamask and received $30,000 to support his work.

For a period of time, Kumavis worked alone until he decided to take the project to ConsenSys. There, MetaMask emerged with its future defined by Kumavis, Dan Finlay, and Joe Lubin.

MetaMask became the baby of ConsenSys, a never-ending project built by developers for developers. Understanding the context, it makes sense why MetaMask is a scary tool for new users.

To fast forward, ConsenSys was hit pretty badly after the euphoric rise in prices back in 2017, and they had to fire many of their staff to survive.

Ethereum dropped from roughly $1,400 to $84, yet MetaMask survived the entire turmoil, demonstrating that it had already established itself as a key element of infrastructure.

ConsenSys eventually narrowed its focus, and “ConsenSys Software” would compile the organization’s top technology resources into a more understandable product.

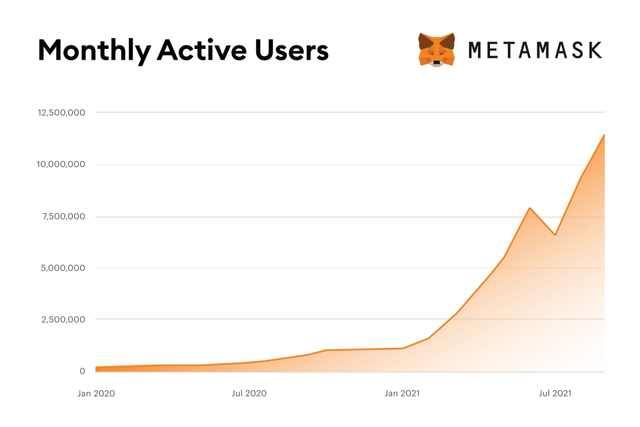

With this newly discovered clarity, MetaMask will become a true priority when its traction surges in 2021, elevating it to the position of one of the most widely used blockchain applications worldwide.

Monetization

As consumers of social media, we use free applications on a daily basis. Facebook, Instagram and TikTok all work because their primary source of revenue is ad money. When you stop and think about it, the entire world of traditional Fintech runs on ad money.

In DeFi something like this is not possible. So how does a free wallet in the form of a web browser extension produce revenue?

The “Swaps” feature was introduced by the team in October of 2020.

Users can exchange currencies through swaps, and MetaMask will carry out the transaction on a different exchange. The average CEX would charge you in the range of 0.05–0.1 percent for this type of exchange, yet MetaMask charges a massive 0.875 percent fee for this service.

Despite the significant variation in costs, the success in monetizing swaps has been of comparable size.

As DeFi exploded in 2021, Metamask reported revenue of $200 million in the same year. In comparison, DeFi staples like Sushi only made $70 million within the same time span.

There were reportedly 31 million users of crypto wallets three years ago; today, there are around 80 million.

It’s important to note that MetaMask’s customer acquisition cost is basically null. Zero. Since Metamask has no token incentives or emissions, their revenue is essentially cost-free. Their profit margins are very near 100%.

Overall, MetaMask deserves a lot of praise for managing to survive and profit from the hyper-drive of 2021. But to maintain its position as the leader, it must change to meet new obstacles.

Obstacles and challenges of the future

Imagine being delivered a box of LEGOs. You have to open up the box and assemble your own LEGO piece before you can have some fun and really understand what’s going on.

The same goes for your first time using MetaMask, it takes time to use the application with some confidence and ease.

For some of us at Faculty, it took weeks or months before we became confident in using decentralized wallets. Even today, new chains pop up where you have to learn which bridge to use at what chain so you don’t lose your funds.

Blockchain, DeFi and MetaMask use a ton of terminologies many are still not used to. Terms like tokens, approvals, staking, networks, chain, multi-chain, gas, DEX, CEX etc.

Are you able to explain to your parents what the difference is between a network, account and a wallet in DeFi? Probably not.

Every day, someone new falls victim to paying hundreds of dollars on a TX fee simply because they chose the wrong time to send some tokens across Ethereum.

Not to mention all the wallets being drained simply because approval has been left open on some code on some app that has not been audited. This makes DeFi and extension, MetaMask, feel like the wilder west of the wild west that is crypto itself.

In conclusion, MetaMask’s greatest weakness is that it isn’t user-friendly, and it does not offer an intuitive experience. But then again, it’s not its fault, that’s just how DeFi in its current state is.

Onboarding the next 100 million users

MetaMask historically focused on developers. ConsenSys’ strategy for attracting users is to help developers build more dApps, attracting more users along with a handful of new developers.

This process then repeats with the new wave of developers.

Bearing this context in mind, and because of how MetaMask hasn’t changed in five years, makes it a good thing for the conservative mindset most institutions are in. This makes them much better positioned when it comes to forming regulatory compliance between TradFi and DeFi.

“I’m a believer in Metamask as a developer tool.”

— Mike Demarais

MetaMask doesn’t care, nor does it have the need to catch new waves coming into crypto. It has already established itself as the most popular option.

Users don’t download MetaMask to use MetaMask, they download it to use dApps that are integrated with it. Indirectly making the wallet even more popular.

In this logic, any future wallet that manages to onboard the next 100 million users with a user-friendly and intuitive interface will have to be integrated with MetaMask and any technology ConsenSys has to offer.

MetaMask isn’t beautiful, but it works.

Although MetaMask might not be able to snag every fresh wave of users entering the crypto space, it has positioned itself so that it won’t necessarily have to.

In a future with increased competition, adoption, demand across networks, and use cases, MetaMask is here to stay.

This article is originally from Medium by Faculty Group.

Your post was upvoted and resteemed on @crypto.defrag