The LAST Guide to OPTIMAL PoSToken mining [UPDATED]

What is PoSToken?

PoSToken is the world's first Proof-of-Stake smart contract token on Ethereum platform. Read their ANN in Bitcointalk for further info.

PoSToken is the first token that can be automined. The basic mining mechanism has been already explained a zillion times, but I'll do it one more time: if you use a client that can interact with contracts (like myEtherWallet), you can use the mint() function from the contract, else, you can send any amount of POS to your own account and that will also trigger minting. Here's a good tutorial if you still need some help: Basic PoSToken Mining Guide.

1st Strategy: Mine every second

Good try, but devs forbid this one. As most of you already know, the reward can only be obtained every three days. From day three to day ninety the reward increases proportionally and after it gets capped.

2nd Strategy: Mine every 90 days

As the reward increases with time, we can think that maybe maybe the best strategy is mining every 90 days to minimize ethereum fees (every time you call the mint function, you have to pay the transaction fee) but thats not true. The cumulative interest makes a better outcome to mine often, because on every subsequent mining you have more tokens. The truth is that you get the most PosTokens by mining as often as possible.

3rd Strategy: Mine every 3 days

This is the strategy that will get you more PoSTokens in the long run. As an example, if you start with 15 tokens, you'll finish the first year with 36,66765.

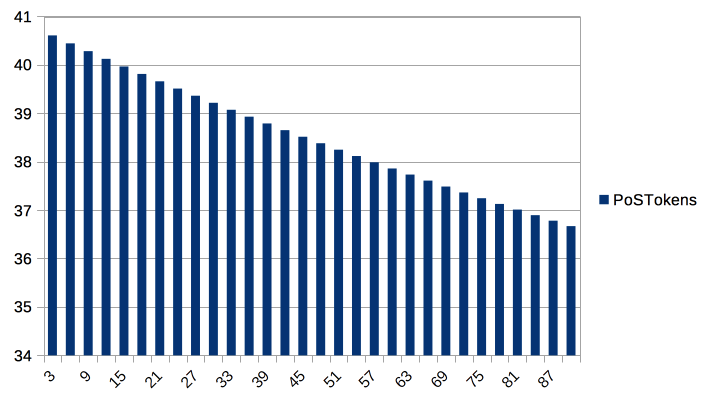

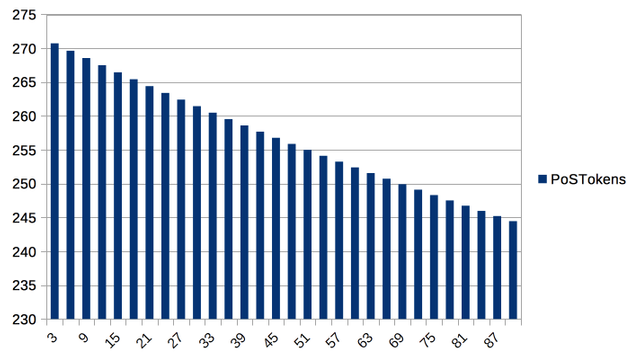

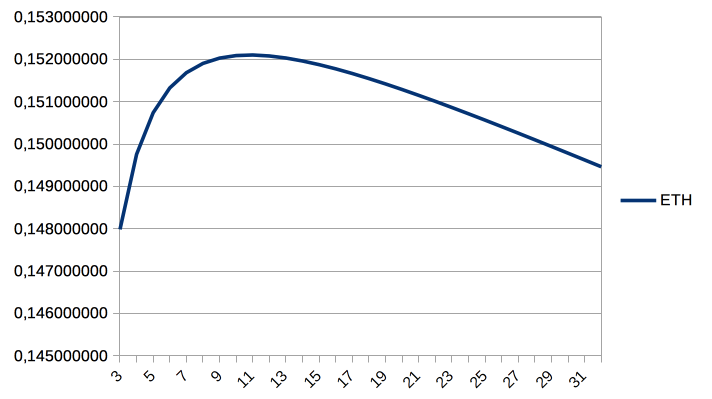

Let's see a couple graphs, Both show the final number of tokens vs the number of days you wait to mine. The first one is with a starting balance of 15 PoSToken:

The second one is with a starting balance of 100 PoSToken:

So this it, we have a winner!

No, not yet :D

This one is also the costlier strategy because we pay a tx fee everytime we do mine. To get an optimal solution to the mining frequency problem we have to take into account the value of the minted tokens vs the cost of minting. I'm afraid but this is where things get more complicated as it depends on the number of tokens you have, the value of PoSTokens vs ETH, and tx fees.

4th Strategy: The Truly Optimal Strategy

To obtain an optimal solution, we'll calculate the value in ETH of the tokens we'll have after a year and subtract the gas paid to mint them.

Using the minimal gas price of 1 Gwei in MyEtherWallet, the cost of minting using the mint() function is 0.00144858 ETH, but you can trigger mining by sending POS to yourself, and (again using 1 Gwei as gas price) that will cost you only 0.000065262 ETH. This is very important: Always mint using minimal gas price in MEW and sending tokens to your own address as mechanism of minting.

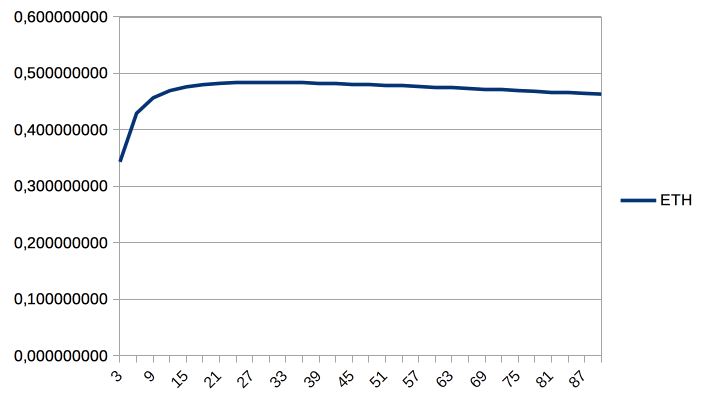

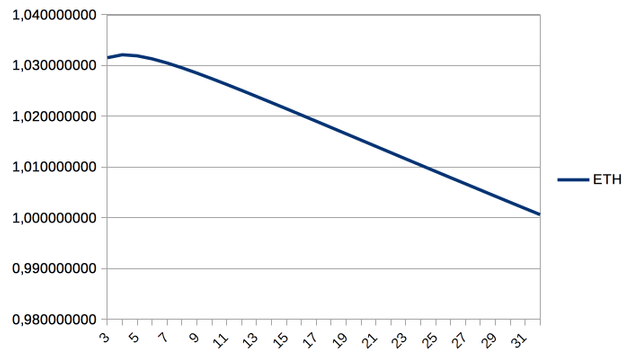

These two graphs show the importance of the mechanism used, starting with 50 POS and using mint(), it is only profitable to mine every 24 days:

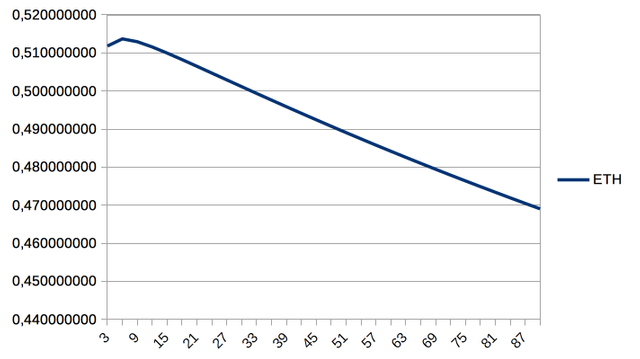

On the other hand, starting with the same quantity, but sending POS to your own wallet as minting mechanism, it is profitable to mine every 6 days!

At the time of writing this post, the value of one PoSToken is 0.00383974 ETH.

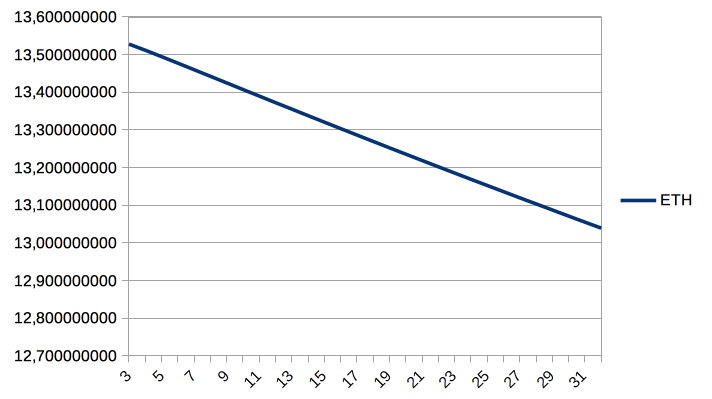

Let's see some graphs again, to get a qualitative impression:

When we start with 15, value is maximized minting every 11 days, as the cost is significant vs the value of the tokens we mine.

When we start with 100, we maximize profits minting every 4 days.

If the value of the tokens increases, it also makes minting more often better. For example, starting with the same 100, if the value of PoSToken raises to 0.05 ETH:

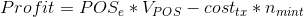

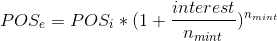

Now that we have a qualitative vision of it, let's show the equations:

Where:

POS e = Final number of tokens

VPOS= Value of one PoSToken in ETH

costtx = Cost of minting in ETH

nmint = number of times you mint

POS i = Initial number of tokens

interest = 1 (100% during first year)

nmint = number of times you mint

Finally, nmint = Total time / Period of mining

As an example, if you mine every 3 days and you want to know the profit after 300 days, nmint = 3/300 = 100 times.

Conclusion

The optimal frequency of mining depends of the number of tokens you own, their value, and the cost of transaction. To minimize the cost of tx, always send tokens to your own wallet as minting mechanism. For the rest of the values, plug these 3 formulas in an spreadsheet and you'll get the value for you now. If you still have doubts, ask in the comments. If you have trouble with the spreadsheet, ask for it, I may upload one if there's any interest on it.

@leighlim why did you downvote the article? Do you think there's something wrong in it?

Thx for this article. I'm interesting by the excel file to optimise my postoken mint :)

So, I've done the excel file by myself :)

In my case, I have to mint every 6 days

Sorry for the delay, I'm still looking into howto create an spreadsheet template in google docs.

Now that was one hell of an interesting article. I truly hope it was an original work. Really well done @mvillar..:)

Really hadn't thought about the effect minting frequency would have on a PoS mining coin..Kudos..

Of course, all of it, it's original (you can even see all the tx of the tests in my eth public account )

Thanks for this article. I'm a newbie at POSToken. Still learning the features...

may you'll interest with my article about pos token here https://steemit.com/ethereumtoken/@hyudien/how-to-mine-pos-token#comments

ссылка на сайт почему то не открывается

Basic PoSToken Mining Guide

i am back pls vote my post and i upvote your post

There is a typo:

nmint = 3/300 = 100 times should be:

nmint = 300/3 = 100 times.