Why so many ICOs fail and it should not be a concern

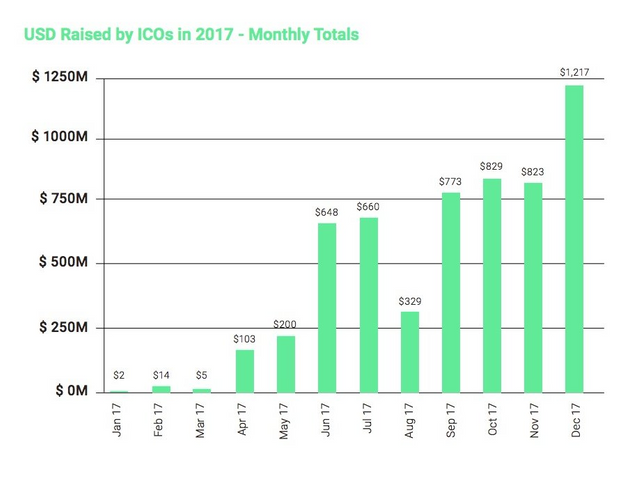

Since the boom in 2017, the ICO market has been a hot topic. Entrepreneurs swear by it as a more efficient way to raise money, most VCs are against the concept and regulators compare it to the wild west wanting to seek protection for "unsophisticated" investors.

One thing that gets highlighted often is when an ICO fails, scam exits or has an issue that ends up costing money to the investors. Obviously those are terrible scenarios for people that invested their hard earned money in an ICO, and it looks even worse when it was estimated by Satis Group that 3/4 of the ICOs are scam and most of them fail to materialize (which is true but only partially). Of course this number is less than ideal, however digging deeper into the numbers it is not as bad as it seems. First of all even if 75% of the ICOs are scams they amount to only 10% of the raised funds and a large part of that number came from a few large scams.

Another report from Bitcoin.com looking at 902 projects from Tokendata claims that 59% of the ICO's have failed, this may look bad however when compared to the failure rate of regular startups backed by VCs or regular funding which is estimated to range from 75% to 90%.

What does this all means?

Investing in an ICO is a risky endeavor, whether it is a scam, the project fails or it accomplishes its mission but still loses money. Even if a negative outcome is possible and likely to happen, it doesn't make it riskier than a regular investment on a startup, it is not shadier or more dangerous (at least with their current track record) and a diligent non-sophisticated investor that does his research should be safe from losing his money due to a scam or failure to launch (still not a guarantee).

It is all part of the risk/reward balance of investing in a new venture. Most VCs have tons of experience and understand this balance, they have a model in which they can have 9 failed investments but the 1 success offsets the loses and even makes the fund profitable. Same thing happens with the ICOs where there are some that have multiplied their value exponentially as well as others that have multiplied their value by 0.

Why all the noise?

There are a few reasons why ICOs are under a lot of scrutiny from the media and regulators. Due to their decentralized nature an ICO that fails has an immediate impact on lots of people, compared to a failed startup which gets their funding from a few investors, an ICO can have thousands of investors that are affected. Also since ICOs are public everyone gets to know what is going on, all startups start as private enterprises and remain private after investment from funds and VCs, if they need more cash they can get it and if they fail it is usually quietly and forgotten quickly as the VC or fund would rather let it die silently and avoid the press of a failed investment. Another reason is the nature of the investors, a lot of people investing in ICOs are not financially savvy and tend to invest money they shouldn't be risky and in some cases are not aware of the risk they are taking, as opposed to a fund where even if they are playing with millions of dollars, its coming from sophisticated investors that can afford to lose the money and are aware of the risks.

Conclusion

Lastly it is worth noting how everything that has to do with cryptocurrencies gets overblown and demonized. There is nothing wrong with giving the opportunity to regular people to invest on the ground floor of innovative startups and get more diverse opportunities to invest. It gives entrepreneurs another tool for funding and access to funds where they had previously nothing. If used responsibly it is as damaging as having an Ameritrade account to buy stocks or loaning money to a cousin to start his restaurant. There is no reason for banning the ICOs, same as there is no reason for banning fire because some irresponsible people get burned using it incorrectly.

There is still room for improvement like making the process more transparent and ensuring that people raising the funds are liable for any wrongdoing (scam, embezzlement, etc) but discarding the process because there have been some issues along the road (which is nothing new and not significant compared to others) is not the right solution.

Investors - Be smart and responsible, understand where you are putting your money and that there is a chance you may lose it

Links:

https://cryptoslate.com/satis-group-report-78-of-icos-are-scams/

http://fortune.com/2018/02/25/cryptocurrency-ico-collapse/

https://www.forbes.com/sites/neilpatel/2015/01/16/90-of-startups-will-fail-heres-what-you-need-to-know-about-the-10/#2e02879d6679

Great article! I found it interesting.

After doing your own research, if you find a good ICO project, it can be very profitable.

I want to share with you guys this new exciting one: RAWG.

Check out this new article where RAWG is mentioned as the "IMDB of gaming" on FORBES, one of the leading global media company, focused on business, investing, technology, entrepreneurship, and leadership.

https://www.forbes.com/sites/andrewrossow/2018/07/16/3-reasons-the-video-game-industry-is-bound-for-blockchain/#69da81c87810

The ICO will start in a short period, and they are at the moment in pre-ICO phase. This is the site: https://token.rawg.io/. It's a video game discovery platform that converts your skills into goods and services (the site is already working, with more than 57,000 games in the database).

Have a look and get some information while doing your own research :)

Another interesting point: RAWG has already secured $5m USD, halfway to hard cap of $10m!