Bitcoin is not a volatile asset

One of the main weakness about bitcoin which critics, regulators, academics, bankers and people like Jamie Dimon are quick to point out is how volatile it is. They cite it as one of the reasons why it will never have widespread adoption or be a good store of wealth as people wouldn't want to hold something that it's value lacks stability.

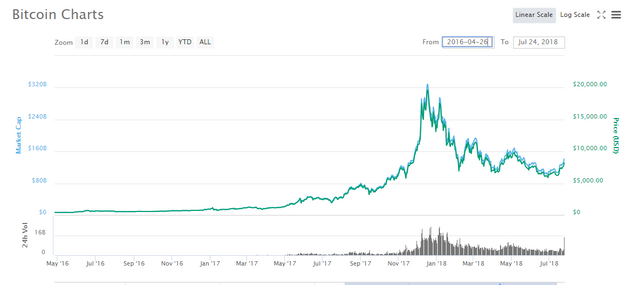

At first sight they are right, Bitcoin price has been extremely volatile since inception going on crazy runs, from $0.30 to $32, dropping to $2, reaching $266 then dropping to $50 and the price kept behaving like a roller coaster, most recently reaching $20,000 a few months ago, only to drop to $6,000. According to Mark T. Williams in a presentation for the World Bank Conference in 2014 "Bitcoin exhibits price risk 7 times greater than gold (18%), 8 times greater than the S&P 500 (15.5%) and 18 times greater than the U.S. Dollar (7%)". It is worth noting that in the same presentation he claimed that Bitcoin was a hyper asset bubble in the process of deflating because it reached a peak in November 2013 of $1,200 and then lost 70% of its value afterwards (adding the link below as it is hilarious how off he was). Anyways the point is clear, the fact that the price of bitcoin is volatile makes it useless as a store of value or for payments.

To this I ask, is the volatility in price a characteristic native to bitcoin or to the market itself?

To answer that question let's start with the basic -

What makes an asset volatile and why?

A simple definition is an asset that has movements on its price, pretty obvious. Now to answer the why, lets take a look at assets that are volatile and some that are not. For example companies like Coca Cola and Walmart are seen as low volatility assets, the reason is that they are huge companies with a proven business model, recognized brands and they have been around and stable for several years. There is not a lot of uncertainty on whether they will be around in the next year or 5 years as we can at this point kind of expect how much money they are going to make in the next quarter or year with a certain degree of confidence. Same thing with the US dollar, even if we don't know how much money will be printed, there is a stable institution backing it which has been around for more than 200 years and is the strongest economy in the world. We can expect that as long as the United States is managed by competent people it will still be a strong country backing the dollar hence the stability of its price.

An example of volatile assets are the companies in the pharmaceutical industry, these companies get their revenue based on the drugs they develop, however to get the drug on the market they have to go through a very expensive R&D process, testing and getting the drug approved which is very difficult and not at all certain. If they successfully do all that for a particular drug they stand to make a lot of money, if it doesn't get approved they lose a lot. Therefore the price of a pharma company either goes up or down significantly depending on whether their drugs hitting the market or not. This uncertainty makes this particular asset volatile, we can't expect to know how much money they are going to make or whether they will be around in the future as a bad streak getting drugs on the market or a huge lawsuit on an existing drug can destroy the company. Another example of a volatile asset is the Venezuelan currency, the Bolivar, even if it is a currency like the US dollar the institution backing the Bolivar is not as strong as the United States dollar and the country has been managed ineptly over the past 20 years, this combined with the lack of certainty on how much money is going to be printed makes this asset extremely volatile.

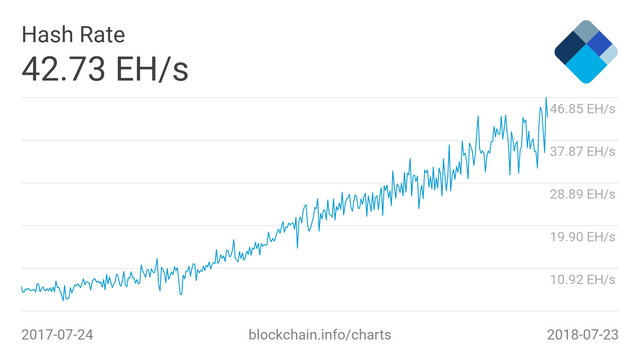

Now looking at Bitcoin for comparison unlike the US dollar or the Venezuelan Bolivar, there is no uncertainty as to how much money will be printed, there is a schedule of how many BTC will be mined since its inception until 2140 and there is a cap on how many will be created as opposed to the dollar or Bolivar which is whatever their Central Bank feels it needs. In addition to this there is no institution that manages Bitcoin which means there is no risk for the management to deteriorate like it did in Venezuela. The bitcoin protocol is already programmed leaving no room for uncertainty and even if it doesn't have a country behind it like the US Dollar or a product and predictable revenue streams like Coke or Walmart, it does have trillions of Hashes (computing power) behind it ensuring that it will remain working the way it does.

In comparison Bitcoin does have a very predictable and certain behavior which should make it less volatile than even the US Dollar given the fact that it will behave exactly as we expect it to behave as opposed to the dollar or any other asset we are using for comparison.

Then, why is the price so volatile?

Well, there are a lot of reasons and none of them can explain 100% the volatility but they can provide some context.

- Is a relatively new asset.

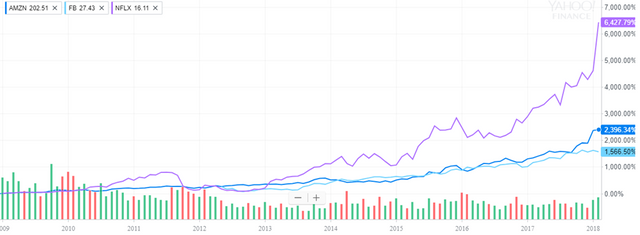

When Williams was comparing Bitcoin's volatility with other asset classes he was comparing a new asset, one of a kind that has been in existence for 9 years (5 at the time of his presentation) with a currency that has been around for more than 200 years, an index of stocks that has been in existence since 1923 that are among the most stable in the world, bundled together to be even more stable and which the youngest company (Twitter) was founded 12 years ago (most have been around for decades) and was only added to the index last month once it was big enough, lastly he is comparing Bitcoin to gold which has been used as a store of value for thousands of years.

A new asset is more likely to be volatile than one with a long track record, this doesn't mean it is something that will forever remain or that it is part of Bitcoin's characteristics. More likely it is a temporary facet and once it goes through its price discovery and matures as an asset it could be even more stable than gold or USD.

- It has a small size in comparison to other major asset class

There are more than $1.5 Trillion dollars in circulation, the market cap of gold is larger than $7 Trillion and the 500 companies composing the S&P have a valuation north of $22 trillion, in comparison the market cap of Bitcoin is around $140 Billion (at the time of writing). A move of $15 Billion is more than 10% of BTC capitalization, for the dollar would be around 1% and for the others even less. The point is that the smaller the size, the easier it is for the asset to be volatile as any change will have a larger effect on its price.

That is also why when critics point out that the growth of Bitcoin is unprecedented and compare it to the returns one would get from the S&P which are on average around 7% a year, it is an unfair comparison. A few years ago a coin was $15 and investing $100 would have given a profit more than $50,000, the market cap grew from $225 million to $150 billion today. This is impressive but in net terms is less than what Facebook grew from 2013 to today - from $100 Billion to $618 Billion. Another example is Uber which raised money in 2011 at a valuation of $49 Million, 3 years later it had a valuation of $40 Billion, in other words $100 invested would have netted $81,000 in 3 years! Again the point is that Bitcoin's rate of growth, even if it is not sustainable given the size it currently has, is not unprecedented by any means when compared with others of the same size, hence the volatility in price as it grows.

Here are some examples of other known companies growth from small to large. Currently there are considerably less volatile than at inception.

- Liquidity is low

Another factor is the low liquidity, on a single day there is an average of $5-$10 billion worth of bitcoins traded. The NYSE can have up to $60-70 billion worth of shares and this is only one of multiple exchanges and on top of that there is a market of derivatives (options, swaps, etc) on the back of those stocks worth billions of dollars a day as well. Liquidity plays a factor on the stability of the price, same thing as in the size of the asset, a smaller amount of volume can sway the market in one direction or the other more drastically if the volume is smaller.

Summary

Overall, these are only some of the factors that affect and increase the volatility of bitcoin. At this point it is true to say that the market of bitcoin is extremely volatile if we compare it to established asset classes like Gold, the US dollar or the S&P. However it is incorrect to say that Bitcoin itself is volatile in its nature, its future behavior is already mapped out and there is no uncertainty on what its going to happen with Bitcoin as a criptocurrency, the fact that it's price is extremely volatile says more about the size of Bitcoin (very small in the previous years and even now relatively small), the time it has existed which is short in comparison to other asset classes or companies and due to low liquidity. Also there are many external factors (regulations, adoption, news) that are more dynamic and more impactful for Bitcoin's price given is a new asset and we are still debating what it can do and be.

Still in the short term future, the price will remain volatile as we keep speculating onto how big it will be and how it is going to fit in the world but as it matures as an asset and becomes more widespread, the volatility should drop. It is foolish to make a prediction as to when this will happen but it should still take a couple years of growth and development, also it should keep growing to become a multi trillion dollar asset in order to have a volatility compared to gold, the dollar or the S&P.

In the meantime as we discuss bitcoin's volatility we should differentiate the volatility on the current price due to the current conditions in the market with the volatility inherent on the asset due to its nature which compared to most other assets should not make it a volatile asset.

Links:

http://www.bu.edu/questrom/files/2014/10/Wlliams-World-Bank-10-21-2014.pdf

https://coinmarketcap.com/currencies/bitcoin/#charts

https://www.blockchain.com/charts/hash-rate?

Twitter - https://twitter.com/Mvais3

The author's statement is right on the money.

Thanks, its been something that has been bugging me for awhile whenever I hear someone criticizing the volatility without looking at it within its context

Congratulations @mvaisberg! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

@mavaisberg

We really appreciate your this blog... Nice Information.

Pls FOLLOW @important-to-us