The Greediness of the ICOs in Crypto World: Bat, Bancor, Status, TenX, Tezos and the rest

ICO = Initial Coin Founding

All of you lately, noticed the hype in the Crypto world, with Ethereum rising from 8 $ in Janury to 400$ in June and with the Bitcoin being adopted as “national currency” by Japan.

It was inevitable for another Alt Coins to submerge. We all got used with new Alt Coins and with Plenty of Ico’s, but the amount raised by the latest Ico’s in Crypto, in unprecedented.

Excluding ill-fated Dao which lead to the Ethereum hardfork.

Dao that collected over $150m from more than 11,000 members, back in April-May 2016.

During the crowd sale, many people expressed concerns that the Dao code was vulnerable to hacking

“By Saturday, 18th June, the attacker managed to drain more than 3.6m ether into a “child DAO” that has the same structure as The DAO. The price of ether dropped from over $20 to under $13.” - coindesk.com

So that was the end of the biggest ICO known to mankind. But that was in 2016.

The year 2017, witnessed the highest funded crowdfunding projects to date.

Here is a list.

- Bancor protocol, June 12, 2017 - $152,000,000

- Status June 21, 2017 - $103,000,000

- AEternity Jun 9, 2017 - $62,500,000.00 (pahase 1 and 2)

- MobileGo May 24, 2017 - $53,069,235

- Basic Attention Token May 31, 2017 - $35,000,000

- Aragon May 17, 2017 - $25,000,000

All of them had Soft caps, Hard caps, Hidden caps or 24 hours’ time to end, after the Cap was reached ....and so on. They arranged and managed the Ico’s in such a way as to rise as much cash as possible to the disadvantage of the investor. I’ll explain that later on.

None of them had a limit on how much each individual address is allowed to buy so they made way for whales to buy as much as they wish. And so they did.

As an example, in Bos’ Ico, the limit that an individual Btc address could invest was 300 BTC.

Not such a thing happened with the Ico s mentioned above, so forget about “decentralized” and “equally spread” and fairplay.

Bancor, “the winner” of them all, had an incredible initial funding target of 250,000 ether.

Even after the Cap was reached they extended the minimum time from 1 hour to three hours, because of “Due to overwhelming demand and traffic, and massive malicious attacks many have not been able to get their transactions through, including us.”

They ended up with 390,000 ether or $153 million in ether, for 200 lines of code and Alfa platform.

As a result, the top token holders hold nearly 85% of the tokens.

Status. An Ethereum app in its infancy.

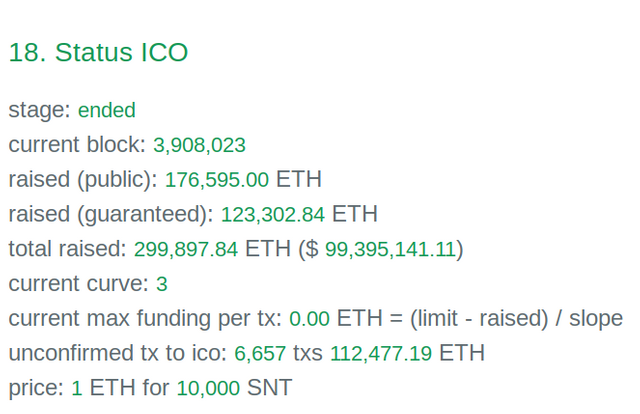

Same story. Soft cap, Hidden cap. Status collected over 299.000 ether, and managed to clog the ethereum network with its greedy and bad designed Ico. The huge number of high gas fee transactions did the trick.

One good thing that Status did was to highlight the inherent flaws of Ethereum’s Blockchain and MyEtherwallet. It was a disaster.

That clearly shows: High transaction volume cannot be handled properly.

Not on Ethereum Network, anyways.

Aeternity. Over 21 Million CHF as a cap.

They only have one developer working on the project. Namely Zack. They collected a total of 62 million dollars. That’s at least 3 more times than Ethereum. And Ethereum had Vitalik !

An I can go on, but I’ll stop here.

All of them, collected unnecessary cash, and as all unnecessary cash it will be spent unwisely.

It is pure greediness.

Who is getting hurt here?

The “contributor” as they like to call us. The investor.

Because, they don t leave much room for growth.

Just compare them with the biggest players.

Bancor has already a capital of 320 million dollars, to start with.

Status with its 7 billion coins has a huge capital too.

And the same all the other mentioned ones.

Julian Hosp from Tenx, mentioned that its target of 200,000 Ether is not too high.

$67 Million they want for a piece of code, a smile and a promise that they will make arrangements with banks. Of course in the future. For now they want your $67 Million.

That besides the fact that he lied, plain and simple, about Vitalik Buterin, being an direct investor in Tenx.

“Vitalik Buterin is listed as a General Partner at Fenbush Capital. He told us: “Fenbushi is an investor. I personally am not.” We asked whether he thinks it is fair TenX lists him as an investor, with Buterin’s reply being a simple “I’ll talk to them.” http://www.trustnodes.com

This is just another maneuver to attract investors.

All in all, 2017 brought us in the Crypto world, much greediness and very little professionalism and also allowed the big pocket investors to enlarge their pockets to the disadvantage of the small investor.

The "winner" of them all I guess will be Tezos. With its great marketing and its no cap Ico, being backed by Tim Draper.

It shouldn’t be like that. Crypto was about decentralization and fair play.

The latest Icos ruined all that, in my opinion.

I was huge on Ethereum and still am, I definitely think this ICO situation is bad though. Although many great projects have had a great ICO there have been several scams and just irresponsible token sales overall. Like I said ETH is a good project but I believe is overvalued due to current ICO situation

Eth is a good project, with a lot of room for improvement, but the way they designed and managed these later Icos it is simply put, despicable. Nothing but money orientated.

Thank you for your comment.

Good article. Good to see I'm not the only one who thinks like this. It's facinating how people invest 10's of millions of dollars in "just an idea". I really advice people to take a look at: https://www.coincheckup.com Every single coin can be analysed here based on: the team, the product, advisors, community, the business and the business model and much more. Check: https://www.coincheckup.com/coins/Bancor#analysis For the Bancor Detailed report.