Grasping Crypto Money from Real Money

As far as the Federal Reserve (The Fed) is concerned only Gold is money. To illustrate my point you need look no further than The Fed's year end reports (but hang with me). Year after year, you see the same aggregate “11,037” million nominal dollars (or $11 billion). This essentially represents the same 260 million ounces of gold FDR repatriated from The Fed back in 1933 (at a book value of $42 USD per ounce). That is, FDR took the gold back into the Treasury, and issued gold certificates acting as a lien against the gold, to be held by The Fed. What’s interesting is that year after year, although the sum of gold certificates remain the same, the amount held between the 12 Federal Reserve banks (branches) is wildly different for each report, evidencing that the gold certificates move between them like money. So, as the dollars flow, so must the gold (certificates) flow because it is the only thing they consider “money”.

Besides meeting much or all of the criteria of money, this is a critical thing that makes Bitcoin so useful; it flows. Gold is hard to move from place to place in physical form — it needs a virtual wrapper. When money used to be backed by gold, the money (or fiat “currency”) flowed easier than gold, and you could always walk into a bank and exchange it for actual gold (before 1933). Sovereign nations could also exchange the US Dollar for gold prior to closing the gold window in 1971. The reason for both gold windows being closed simply boils down to printing (way) more claims (dollars) than physical gold, causing a run on the nation’s gold (twice). We just cannot be trusted to do the right thing by not printing beyond that invisible "limit". Bitcoin solves all of these issues; it flows, and you cannot print it out of thin air — it can only be created from labor (BTW that’s not a bug, it's a feature). Sure, you can "clone" it, but as Bitcoin Cash (BCC/BCH) has learned, cloning Bitcoin (BTC/XBT) doesn't make you "Bitcoin".

When solving difficult technical problems I collect facts and indicators, form a conclusion, and then a solution or two. Not easily done in a world where everything is emotionally driven as knee jerks through social media and propaganda. There is no one-stop shop, you must research for yourself. My research tells me that the US Dollar (and everything else) is devaluing at an exponential rate, and we must print more dollars than ever before. Although it's the same across the globe, the Dollar is the world's reserve currency. So, when the Dollar goes, all others will follow. Similarly, when Bitcoin takes a hit, so do all other crypto currencies because Bitcoin is the reserve crypto currency. At the same time, faith in our nation is being rocked from within, and externally our allies stand against us and support a nation known to capture and hold hostages. Looking past the politics — these are but facts and indicators that faith in the US (Dollar) is and has been deteriorating. When the Dollar descends, something must “ascend”, and to ascend it must “flow” and have limits. No fiat currency will survive unscathed, not even the US Dollar. If not the Dollar, then what?

Be safe and practice safe crypto.

About Early Crypto Geeks

Many people ask me about crypto these days, but a year ago none of them could see or hear me. What most people don’t know is that many (if not most) of crypto supporters/benefactors encountered Bitcoin as part of their journey to learning about our failing monetary system. They were likely libertarian-minded people, constitutionalists, and probably were gold or silver bugs before trading metals in for crypto. They probably read the “conspiracy theory book” Creature from Jekyll Island from that “far-right” author G. Edward Griffin (this, according to Wikipedia). I liken these folks to a unique group of individuals touched by aliens in Close Encounters of the Third Kind; making sculptures of Devils Tower out of clay and mashed potatoes while being shunned and laughed at. Many were moved, some got busy and acted upon that movement, some got the privilege to gaze upon alien craft, and some got to ride in it.

It’s not too late to get a good seat.

About The Fed

For those that are unaware, The Fed is not “federal” and holds no real “reserves”, it’s a private corporation whose stockholders are the nation's banks. They cannot be audited. Like other corporations, they serve their directors and major stockholders, and the rest go along for the ride.

About The 260 Million Ounces Of Gold

Interesting that the gold's book value is obfuscated. That is, the Treasury and The Fed neither disclose how many ounces it represents or assign it a Dollar value within this century (we must do the math and piece it together). This tends to suggest that there is benefit in not advertising how much that gold is really valued (psst, it’s the first line on their balance sheet, over and above the IMF's SDR). Even if you do the math, you will only see the derived "nominal" value of $42 per ounce, as revalued in 1973 following the closing of the gold window in 1971 by President Nixon. (It is important to downplay it's true value such as they have in order to prevent yet another run on it; this so that it can be accumulated for things that make the world go around.)

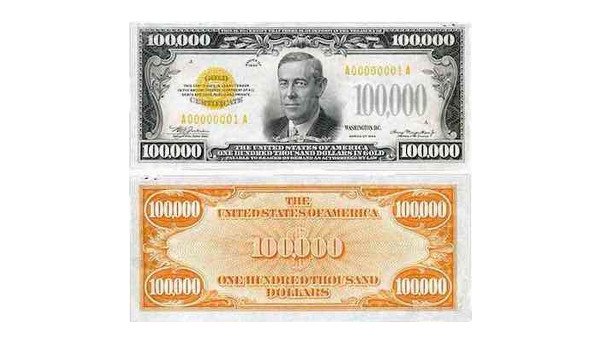

About the $100,000 Bill

When the Treasury issued it's first $100,000 bill in 1934 (gold certificate pictured above), it's only fitting that they put Woodrow Wilson on it's face. It was on President Wilson's watch where our nation's leaders surrendered the power to issue our currency, and to hold our gold. FDR later repatriated the gold, and gave The Fed the paper (for fear that the gold would be depleted).

Gold Games

By today’s standards, at the current spot rate of ~ $1300 per ounce (and not the $42 book value by The Fed), that 260,000,000 ounces of gold would be worth $338,000,000,000 (that's billion). Gold has been revalued at critical times in the West within the last century. So, if the nation’s gold were revalued to repay our national debt of $21 trillion that would equate to ~ $81,000 per ounce, an increase of 62 times. While that does sound pretty crazy, consider that Venezuela revalued gold in early 2018 from 13,464 to 92,304,890 Bolivars, an increase of 6855 times or 68,550%(although I don't know that their Bolivars, or even gold, can buy any food in Venezuela these days).

8/24/2018 UPDATE: 1 ounce of gold is valued at 295,716,600.00 Bolivars. That's triple what it was 3 months earlier when I originally wrote this and 9 times since their currency was reset in February, 2018. During their hyperinflation the value of gold has outperformed the average cost of living by 5 times

Other methods of revaluation include using the money supply, but that requires an assumption that we know the true amount of currency in circulation, which I think is naive to rely upon trusted sources for an accurate accounting of this supply (for instance, Dr. Mark Skidmore, Economic Professor, has documented a "missing" $21 trillion). In the event of a revaluation, they would need to take into account all of the pools of money that are unacknowledged. A revaluation would draw ALL dollars out of hiding, acknowledged or not. Why is this significant? When our monetary system shifts they will likely need to do one of two things:

Back the next fiat by gold: This requires that they show it, and they may not have it. That is, there is a high likelihood of it being leased out, or even plundered. The recent long repatriation timelines of Germany's gold tend to suggest this (we might get a clearer picture as other nations such as Turkey repatriate their gold). Also, in addition to the paper gold, it is quite likely that supplies have been used to smash down the spot price these past 10 years and prop up the Dollar. Or,

Shift to a completely new paradigm: This requires it meet all of the attributes of money, and also have adoption by it's people. Bitcoin meets all of the attributes of money because it was designed to do so. Bitcoin is also gaining on faith, which perhaps was also designed to do so (by running up the price). We have since witnessed a massive investment of Industry capital that depend upon adoption of Bitcoin.

The Enemy of My Enemy is My Friend

Follow me way off the reservation a bit.

Should the Dollar fall out of favor, it is likely that it would be replaced by either the Chinese Yuan, or the SDR with yet another adjustment to the basket of currencies that effectively favors the Yuan equal to or more than the Dollar. On it's face, Bitcoin is sovereign neutral. So, if Bitcoin were adopted by the world, it would allow the Dollar (and the US) to live to fight another day. Globalists also want a unified money (as evidenced by the [failing] Euro). If, by some chance, Bitcoin should rise above all others, I would expect it to be preceded with China taking a harder stance against Bitcoin (overtly), and the US favoring Bitcoin (covertly). This because China would likely be the defacto next of kin to receive the reserve currency status (just as the US received it from Great Britain, and Great Britain from France, etc.).

Another theory is that Bitcoin is an "Op" designed by the the globalists and deep state; in which case we cannot forget about the wildcard of initially mined blocks of the theoretical 1 million "Satoshi" Bitcoins. In such a case, there would be enormous interests to cause a monetary shift in this direction; making Bitcoin the target of far more than $81,000 nominal Dollars per coin. Such an event is mind blowing; imagine a black hole sucking up all fiat currency (and assets, real or chattel). The question is, would those coins be used to enrich, or used to restore the world's monetary system?

What do you think? Am I dancing with myself?!

NOTE: This is a repost from my linkedin page on May 10, 2018