How to Crypto: Assume the Worst but in the Best Way Possible

One thing you must never forget in crypto is that the only person who is looking out for your well being is you. Obviously not everybody on the internet is a thief, charlatan, or a hacker, but there are enough of them in the cryptosphere that its best to always assume the worst. This doesn't only apply to only people but also coins, tokens, exchanges, lending platforms, websites, news articles, mutual funds, investment platforms, twitter, facebook, EVERYTHING. Not just EVERYTHING related to crypto but literally EVERYTHING that has any relation to crypto. With that said I am not your financial advisor. Nor any kind of professional. I'm just some guy who happens to be really fucking awesome that has made hella mistakes and likes to share them so hopefully you don't have to as well.

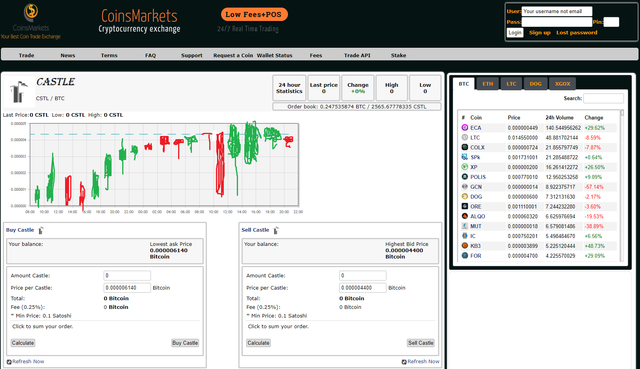

Our last installment of "How to Crypto" was about understanding shitcoins. Today we are going to build upon that understanding through the use of a situation/example that many in the crypto community are already familiar with. A few months back there was an exchange called Coinsmarkets that closed its doors due to "Database Problems" as well as trading volume in excess of what they could handle.

Quiz time

Other than the candlesticks being made in ms_paint and the lack of recent trade info, what about this picture screams, "Nigga we're bout to rob you!"?

I remember when I first discovered this exchange, I had stumbled across a thread on http://btctalk.org about the coin B3, which at the time had a huge community with tons of crypto-youtuber support, and lots of activity on their preferred social media channels. What really caught my attention though was the grade A marketing. Figured that if anything I could at least learn from that. So I head over to the the only exchange they were sold on to buy, and instantly I see red flags. Not with B3 but with the exchange itself.

Before getting into what the red flags were, I want to make sure that everyone understands that there is no such thing as huge profits without an equal amount of risk. To some what I'm about to mention may sound ridiculous. To others it may sound like something they do everyday, so when judging things like this it all comes down to how much risk one is willing to take. The only stupid trade is the uninformed one so long as you know what you're walking into and you're comfortable with it, then do it. Every single time. Don't let your friends who are more risk averse scare you away because in the end they're not the ones who's money and is at stake. That said, within seconds of visiting http://coinsmarkets.com I noticed many red flags. Most of them minor, but there was one that made it blatantly obvious that this exchange was not one that should be easily trusted.

What was the Big Red Flag

Now I know, a lot of you are thinking, "WTF? Every exchange should offer POS, they're probably already collecting on our coins and not paying us", well the validity of that is moot because regardless of whatever the exchange tells you, those coins that you sent to the exchange wallet that you don't own the private keys for, aren't yours anymore. What is now yours is a number that represents how many coins the exchange owes you, but the coins themselves are no longer yours, and wont be until you withdraw them from the exchange. It is because of this that it used to be common knowledge to remove your coins from the exchange ASAP.

Proof of Stake sounds like a great idea, but when I saw this I literally burst out laughing and said to myself that it sounded like an awesome way to convince people to leave their coins on the exchange and pull a huge heist. Honestly I'd love to tell you that there was no heist and that I was paranoid but as usual, I was right.

Earlier I mentioned that one doesn't get crazy profit without taking crazy risk. Coinsmarkets was exactly that. I quickly fell in love with this exchange regardless of the risk was because of the ridiculously high profit margins on extremely low cap coins that hadn't been hyped yet. The exchange had a ton of dead coins as well as complete scamcoins but if you could sift through all of the crap to find the hidden gems, you would find projects such as Castle the airdrop platform, which gives you other coins based on how many CSTL coins are staked. It was nuts how much money there was to be made there; lliterally coins going for less than a satoshi when I first began using the exchange that later peaked at over 4000 sats.

Sure, Coinsmarkets gave legitimacy to my paranoia by disappearing with every bodies crypto, but if you manged to keep your wits about you, you could have very easily turned a small some of $500 into Lambo money.

Hello mlgcrypto!

Congratulations! This post has been randomly Resteemed! For a chance to get more of your content resteemed join the Steem Engine Team

Nice post sir