Why is Bitcoin completely undervalued? - 5 reasons!

Hello dear readers,

Especially in times of falling and constant cryptocurrency courses is repeatedly talked about the death of the cryptocurrency market, but so far this has always been shown as wrong. On the contrary, because such times are the best time to increase its cryptocurrency stock low, before new hype phases are coming.

There are many reasons why Bitcoin and some other cryptocurrencies are still completely undervalued, and five of these reasons have been worked out well in a new article on BTC Echo. That's why I want to share this article here today.

Here you can find the original article in German:

https://www.btc-echo.de/5-gruende-wieso-bitcoin-unterbewertet-ist/

Picture Source Shutterstock and BTC-Echo

While some pessimist Bitcoin sees zero, other Bitcoin even consider undervalued. The predictions of dazzling figures in the ecosystem could hardly be more bullish. Legendary, for example, is the glass ball prediction of Mr. "I-know-Satoshi" McAfee. The ex-presidential candidate once bet his best bet that BTC will be worth one million dollars by the end of 2020.

While the latter forecast is barely achievable, some indicators actually suggest that Bitcoin is heavily undervalued at around $ 5,500. Here are 5 reasons why the Bitcoin price will rise in the long run.

1. Scarcity

Bitcoin is the scarcest asset in human history. As Crypto Researcher Hasu explained in an interview with BTC-ECHO, there can only be real shortages in the digital world. Finally, the 21 million cap in the code can be verified with mathematical certainty.

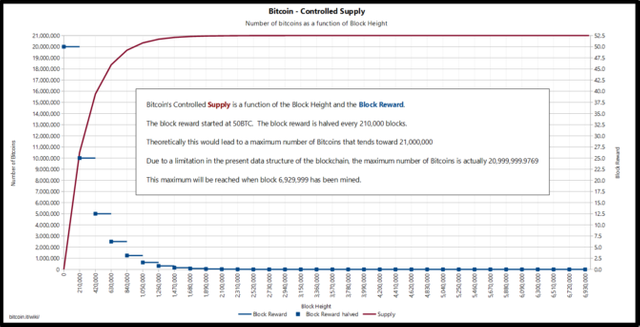

Bitcoin's supply is approaching asymptotically at 21 million BTC. Every four years, the inflation rate halves. Image source: BitcoinWiki.

While comparable goods such as gold or silver are responding to an increased supply demand (with higher gold demand, gold mines are increasingly digging up the precious metal to increase supply), Bitcoin's offer is stiff. One speaks of the so-called price elasticity of the offer - and that is with BTC as less as nowhere else. An increased demand is thus certainly on the course, because even if in a demand shock more miners go to the net, the quantity can not inflate. Only the difficulty increases, so that a block is emitted on average every ten minutes.

2. Coinbase Reward Halvings

Bitcoin price development is cyclical. The good thing about the blockchain's transparent structure is that models can be built for the future course of the Bitcoin course. This is what happens in the so-called stock-to-flow model. Twitter user and crypto market analyst PlanB has been propagating the connection between the boom and bust cycles of the Bitcoin course and the four-year Coinbase Reward Halvings for quite some time.

Accordingly, the mere expectation of a shortage of supply in the run-up to halving leads market participants to accumulate coins. In the retrospective, the stock-to-flow model painted a seemingly accurate picture of the BTC price history. There are about 13 months to go before the next reward halving - and behold, the prices are slowly rising again. The model provides for a price of at least $ 55,000 for the top of the next cycle.

3. Network effects

This is also the starting point for the third price driver: the network effects. Technologies that work best in a network show exponential growth. That was true for the distribution of telephone connections as well as for the Internet alike.

Trace Mayer first pointed to the network effects likely to boost the spread of the Bitcoin protocol. There are seven in number:

- Speculation: Hodler speculate on rising prices and accumulate in bearish phases

- Acceptance in Retail: cheaper and faster payment

- Consumer acceptance: for example, through discounts on Bitcoin payments

- Security: Above reasons lead to the entry of miners. These ensure increased security in the network.

- Acceptance in the Traditional Financial Sector: The classic financial sector will not miss the returns of the best asset investment in a long time.

- Open Source Structure: Bitcoin is a distributed open source project. The more individuals are invested, the more people have an interest in the success of the project.

7th World Reserve Currency Bitcoin: Yes, Bitcoin has the makings of a world reserve currency for all these reasons. All transactions are consensus among all participants in the network and therefore unquestionable mathematical truth.

4. Proof of Work

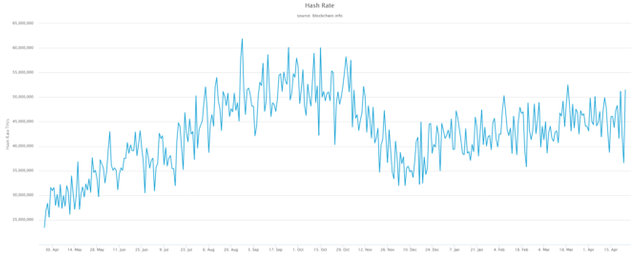

Where there is much room for improvement, one of the fundamental reasons for the positive price development of Crypto-Currency No. 1 is, in fact, that Proof of Work makes Bitcoin the safest database in the world. Entries can only be changed with so much energy expenditure that an attack on the network is hardly economically feasible. Furthermore, the expectation of an upcoming Coinbase Reward Halving - thus halving the pay of the miners - leads to a rise in computing power in the run-up to halving. After all, the miners want to accumulate as many BTCs as possible in advance. This ensures an increase in the hash rate and thus secures the network in addition - a sheer ingenious interaction of a number of incentives.

BTC hash rate over 1 year. Source: Blockchain.info

And lo and behold: in fact, the BTC hash rate has been rising again for quite some time.

5. Use

Logically, an economically meaningful incentive structure alone is not enough. Rather, bitcoin must propagate a value proposition that attracts more attention through higher prices. The Price Driver No. 1 is therefore the actual use case of Bitcoin. And here, one suspects it, the ghosts divide. Bitcoin is not least a narrative. The benefits of Cryptocurrency No. 1 can take various forms for the individual. For the citizens of Venezuela Bitcoin can be a kind of hedge against the increasingly devalued Bolivar. For citizens of the West, however, does not reveal the value proposition of BTC at first sight and thus serves as a speculative object.

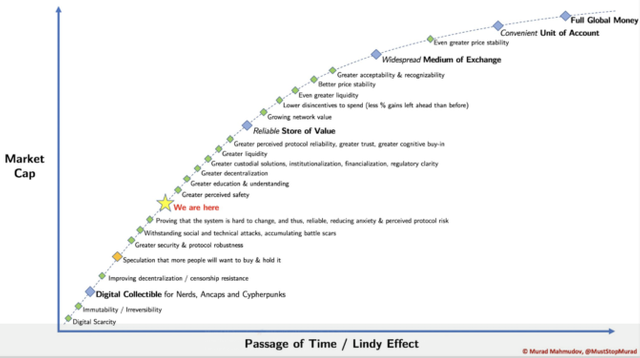

Bitcoins (possible) way to global adaptation. Source: Murad Mahmudov (https://twitter.com/MustStopMurad).

Bitcoin users in this country are regarded as bank critical and are looking for a new form of money, with which they can hedge against economic crises. But for Bitcoin to go beyond the status of a value store, volatility must first drop. Until then, Bitcoin's benefits to people living in countries with a well-functioning financial system remain vague.

Source: https://www.btc-echo.de/5-gruende-wieso-bitcoin-unterbewertet-ist/

Greetings and hear you in my next article.

Michael Thomale - @michael.thomale

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.