THE PERENNIAL DIP Bitcoin

The past week has been brutal for cryptocurrency investors. The Red Sea that has enveloped the cryptocurrency markets of late has many newcomers to the space scrambling for the nearest exit.

But before you submit that sell order, it’s worth pointing out that this is nothing new for experienced crypto investors. In fact, it’s become something of an annual tradition. Let’s take a look.

On January 8th, 2016, the markets peaked at a little over $7.5 billion. By January 16th, they had declined 27% to $5.9 billion. It would be 43 grueling days of uncertainty before investors who bought at January’s peak would see green again.

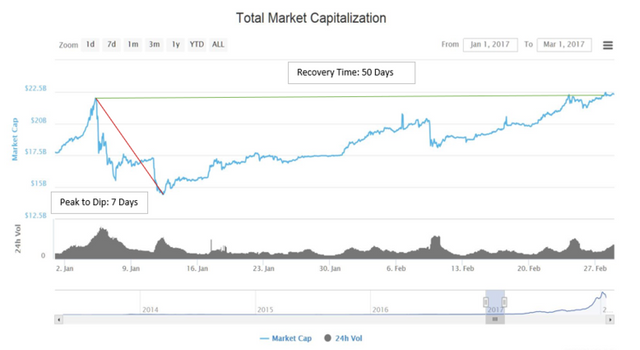

In 2017, the markets peaked on January 5th at $22 billion, only to bottom out a week later at $14.38 billion - a total decline of 53%. Again, there was a substantial lull as the markets climbed back to their former glory; a trek that took a total of 50 days to complete, and concluded in mid-February of 2017.

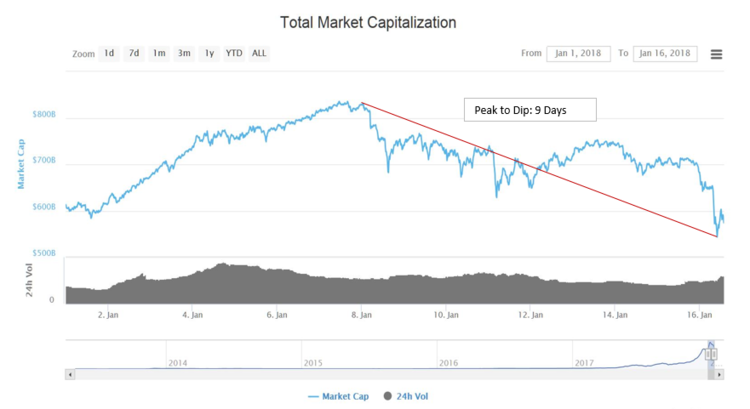

The peak this year occurred on January 7th, when the combined market cap for all cryptocurrencies climbed as high as $835 billion. Now, 9 days later, we are (hopefully) nearing the bottom of the valley, as we exceed 55% losses.

There are a number of factors that could be contributing to this perennial cycle of volatility. Here are a few:

THE HOLIDAYS

It has been postulated that the Chinese Lunar New Year could be a contributing factor in the market’s decline. The logic goes that Chinese investors are cashing in on their investments in order to travel and bestow gifts upon their relatives. Considering Asia’s influence over the crypto markets in the past, this is a reasonable assumption - but unlikely to be the predominant catalyst.

TAXES

For investors who have seen significant growth in 2017, but don’t want to pay taxes on it until 2019, delaying any transactions until the calendar rolls forward could be a motivator. Granted, the tax jungle is an easy place to get lost for a crypto investor, and this strategy wouldn’t work in every case, but there are enough scenarios where this would be an effective way of delaying the inevitable that this is likely to play a role in market volatility.

Interestingly enough, these two factors might also explain why the market tends to swell in February and March each year.

The same investors who are pulling their profits to give to family are also the most likely to encourage their family to invest the contents of their little red envelope back in to crypto. And for every tax payment, there is a tax refund.

FEAR, UNCERTAINTY AND DOUBT

This year’s dip is also being fueled by rumors and wondering about the future of crypto in Asia. From South Korea’s flip-flop on banning it, to China’s latest tightening of the regulatory vice grip, the seasonal and circumstantial factors have aligned to produce a maelstrom of uncertainty that continues to drain the market.

But whenever the current ebb starts to make you nervous, just remember that there is a flow coming.

For those who have not lived through this sort of volatility, it’s easy to think that crypto is dead, their investment is gone, and it’s time to move on. For the rest of us who have weathered these storms before, this is just another January.