Bitcoin Crypto Trading Bot: Risk

Portfolio Management for Profit Trailer

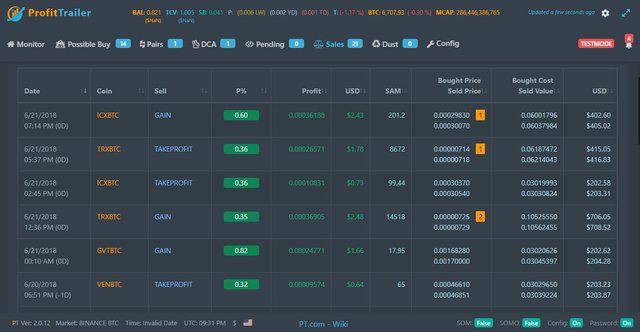

Using the Profit Trailer bot in a challenging and risky scenario of open market volatility, with an adaptive setup that responds to extreme fluctuations, it is possible to accrue 0.3% - 2% daily compounding profits even during bearish conditions, with a starting balance of 1 Bitcoin ($6150 USD at time of writing). This makes $500 USD per month on the low end.

Is such a strategy adequate for me? What if I am here to collect bitcoin because I believe it is possibly more valuable than gold? I do not wish to trade it into fiat currency such as US dollars. What do I need to do to make it happen for me?

I live on an island where I can observe water. It keeps me healthy and at relative peace when trading crypto.

Allocations, Analysis and Style

What is the budget? Will I be adding to it along the way? Do I have a separate source of income to support trading?

What are the time allocations? How much time per day do I expect to trade? What are my time frames for generating profit? For example, do I need to withdraw my monthly rent and basic necessities requirements from the available balance at the end of each month?

What is my trading style? Scalping by the minute (I renamed it to “cherry-picking”), daily trading, swing trading, investing short-term, investing long-term. Is it a combination of all of these?

What is the market I wish to trade in and on which exchange? Altcoins against BTC on Binance. Or perhaps altcoins against ETH on Bittrex. Or maybe USDT against BTC…

First of all, since Bitcoin is a 24/7 market, I allot only a certain percentage of my daily life to cryptocurrency bot trading. I create time for the life which this trading is to support: family, friends, other professional work, continued schooling, personal interests such as art, nature and sports, and leisure time. The founding values of Bitcoin pioneers support a vision of personal inclusion and thriving. That is also why I resonate with this movement in general.

My trading strategies are based on understanding myself and understanding the blockchain revolution, only then do I apply fundamental research and technical analysis. I put effort to participate in and be passionate about at least one field of knowledge that is being disrupted by advancements in distributed ledger technologies of which the Bitcoin blockchain is but one, such as the arts, developer, and open-source energy sectors. I do not invest in nor do I allow a bot to trade any coins on a given market for mere profit. In this way even if the cryptocurrency market prices fall to zero I can remain happy to have participated in an effort to support business and technologies which add value to life on the planet. My investments and trading styles reflect this. For example, I may choose to designate a portion of the budget towards assets which form the basis for next-generation platforms with multiple network effects, such as Decentraland’s MANA or Steemit’s STEEM.

Example of cryptocurrency investment considerations

As part of my fundamental research of selecting cryptocurrencies for consideration in trading, I put effort on using the services of those companies whose “shares” I purchase. I also make sure to meet the team, or at least learn about the key players involved in the organization.

The human values of the blockchain revolution are increasingly more social psychologically and made manifest through technologies. The thin red line is somewhere between the definition of personal agreement done in what I call “moist reality” between people and network consensus of the digital age. The tectonic shifts of decentralization make for a rich discussion always to be continued. An entire psychological paradigm shift in terms of business development has occurred especially in regards to collaborative transparency.

Previously I would invest in companies doing well in a particular industry with high barriers to entry. Blockchain technology can place a company at the hands of the people outside of all jurisdictions without any barriers to entry other than skill, motivation and basic financial resources – all of which can be crowdsourced if the idea resonates with the movement. This is happening on a massive scale and it is barely being mentioned in the media.

Most of the companies in the blockchain space are allies at heart, in the sense of excitement about actually deploying thir innovative visions over time.

There is much less closed circles of centralized power. Transparent consensus design for corresponding governance is a featured debate at many conferences.

Companies may have competitive advantages over others but the principle of global open-sourcing is powerful and beyond that which a single company can handle, unless it runs on such a new model itself, as in the case of ConsenSys.

Institutional and insider ownership is made impossible by the very nature of the open-sourced code of distributed ledger technologies on which the platforms and services are based. Publicly viewable trustless accountability is a concept that takes some time to digest.

Categorizing cryptocurrencies to map the shape of the revolution

Actual Cryptocurrencies: LTC, XMR, ZEC, DASH, BCH, BCN, NANO, XVG

Code: LSK, STRAT, TNT, AION

Knowledge Hubs: ADA, OMG, KMD

DAO Building: ANT, ARK, WINGS, WAVES

Digital Art: POE, VIBE, SNGLS

Cybersecurity: NCT, TRI

Legal Marijuana Industry: POT

Market condition and indicators for buy and sell signals

Available Buy and Sell strategies for PT

As of June 2018, the following are the various available buy and sell strategies to be used standalone or in combination within Profit Trailer:

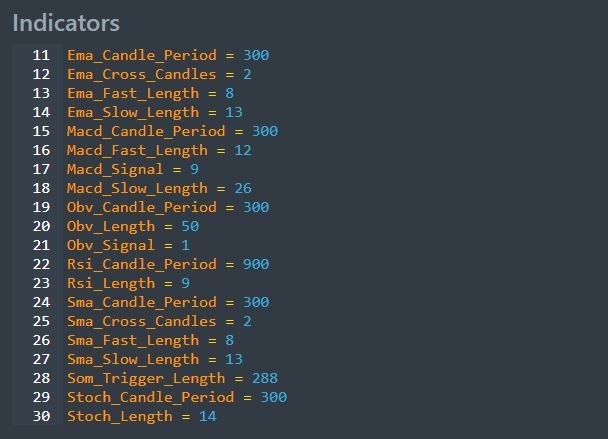

GAIN, LOSS, LBB, HBB, BBW, RSI, STOCH, STOCHRSI, OBV, EMA/SMA:GAIN, EMA/SMA:SPREAD, EMA/SMA:CROSS, MACD.Indicator periods and lengths can be custom set for these strategies.

Methodology applied

The proportions of the type of analysis I use for the basis of buy and sell decisions of select cryptocurrencies.

13% Intuition

I simply know what to do without using the ordinary mind.

33% Fundamental Analysis

I research the people and the ongoing work behind the project. Only then do I set my bot to buy those crypto currencies which are real and support the values of the blockchain revolution.

33% Manual Technical Analysis

Which actual indicators will I use and at what timeframes? This is based on the Trading style decisions, which are based on my psychology and human-machine interaction aptitudes. As a daytrader I will use 5-15 minute candles. I look at the price line, map resistances and supports, check for trend channels and look at recent candles for trend change patterns and general patterns such as wedges. I can look at the volume depth, orderbook and actual market trades. Moving Averages (SMA/EMA) and MACD to check for emerging uptrends and downtrends. I then look at possible Elliot Waves and Fibonacci retracement levels with extrapolations. Other tools I may use include Bollinger Bands to measure volatility, RSI and STOCHRSI to measure momentum, OBV to measure volume changes. Ultimately I may use more advanced indicators such as Ichimoku Konko Hyo for the prediction of future price. Some indicators may be personal math secrets.

10% Automated Technical Analysis (bot algorithm)

Bot settings I use are based on manual analysis research and the work of others in the field.

20% real-time manual adjustments to the automation

I live in a time when I must do the learning for the bot, as I must assume my deeper psychology is more powerful than the supercomputers of the planet which run the flow of the Internet, otherwise I should not be trading cryptocurrencies because it would be naïve, foolish and irresponsible to bet against self-running artificial intelligence designed to take money from me. By experience I know that my natural subconscious realm is unfathomable by human-built artificial intelligence that is why I am in the game.

As a radical yet experiential example, it is possible for some people to remotely view private keys with a part of their mind. No standalone artificial intelligence will be able to do that in any forseeable future. Moreover, the type of human being it takes to accomplish this may not be the type of person who will do it for their own benefit or public display.

Fund Allocations for Variable Trading Periods

These are types of fund allocations I can resort to in order to spread my available trading and investing balance around various profit seeking opportunities.

Daily: cherry picks (formerly called “scalping”, an unnecessary, misunderstood and derogatory term), bot. These feed the short term investments by certain percentage from profits.

Weekly: short term investments have higher profit level targets than daily trades and they feed long term investments when sold at profit.

Monthly: long term investments. These are fundamentally sound assets with major network effects, vibrant communities and mass interest.

Yearly: How do I wish to live: within the existing system or in the new realm of opportunity enabled by the emergence of cryptocurrencies in which I am personally responsible for my own financial sovereignty? What do I wish to support with the profits? At what point do I ultimately sell any investments and remain happy? What is my plan if I make millions in a short timespan? Do I know how to file capital gains taxes for my jurisdiction?

Notice: the entire market may change if new energy technologies are open-sourced or quantum computing is released.

Personal withdrawal plans based on lifestyle and vision

Daily profit allocation strategy:

1-3x (1-2.5K EUR) cherry pick (FIB) for 9-40% profit.

Compound 1-3% profit back into cherry picks.

1-3 times per coin 0.75-3% profit (bot or manual)

Since we are compounding profits back into the total current value (TCV), we are increasing our purchasing power since this is also based on a percentage of the available balance.

Weekly profit withdrawal Strategy:

Every 500 EUR profit, withdraw to external PRVKEY wallet.

- account for exchange fees (ie 0.05% – 0.1% Binance trading fee and bitcoin mining fee (about $1USD throughout June of 2018) .

Monthly profit withdrawal Strategy:

From each 1000 EUR made withraw 3-5% for investment in physical gold on the blockchain (ie DGX gold).

- account for exchange/BTC fees.

Transfer basic needs from Private Key wallet to bank (ie cryptocurrency exchange connected to a bank), in order to withdraw to the bank and then proceed with necessary ATM withdraws.

- account for BTC fees/exchange/bank/ATM.

Transfer 3-5% to localbitcoins.com and cryptodebit card (ie TenX).

Note on Taxes

If I combine the deeper psychological values of financial sovereignty, privacy and security with intelligent cybersecurity practices then I can remain anonymous and not be on the taxes radar.

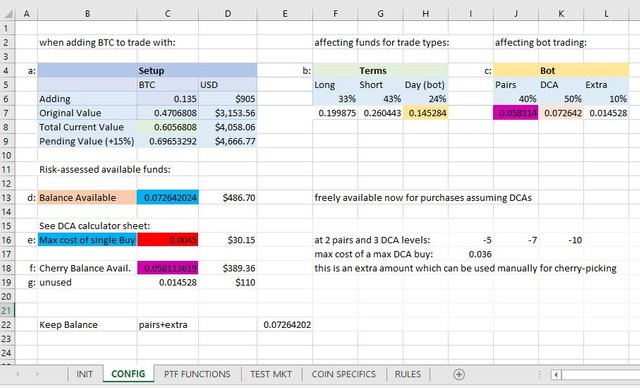

Percentage calculations for budget

Entire trading budget should be as much as one is willing to play with and loose from all personal funds. If 100K USD is amount of personal funds available, perhaps 10% or 10K or 1 BTC is the amount to play with. From this 1 BTC:

Long term: 33%

Short term: 43%

Day trading: 24% - this is the Bot.

Within the Bot:

40% New pairs (cherry picks and day trades only),

50% DCA (for pairs which drop in value) : max cost of single pair (new buy is based on number of pairs allowed and maximum DCA levels), maximum cost of a single buy is also set.

10% unused emergency savings.

Stop losses set at 2-3% maximum in worst case scenario.

Profit Trailer Feeder crypto asset trading setup in the Bitcoin market

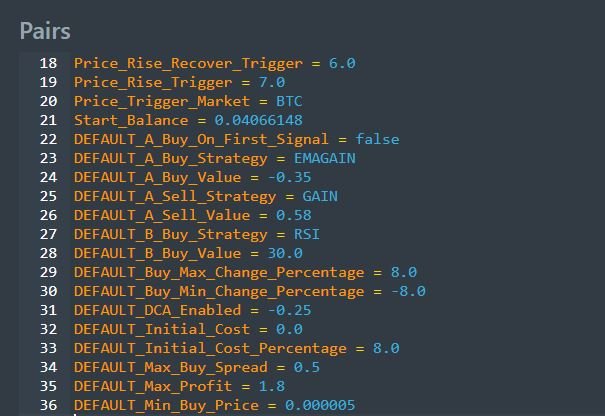

After all of the above considerations I create the default and coin-specific strategies for the bot. The following are an outline of the possible logic within the trading bot algorithm. Actual code expands into deeper functions not listed here. A maximum of 5 strategies can be combined under each of the categories of buy, sell, DCA buy, DCA sell) and once they are all true for the category, trailing is calculated in real-time.

Indicators: candles, lengths, maximum cost per initial purchase (based on DCA pairs and levels)

Default Buying Setup example: consider price, volume (24h in basecoin), spread, orderbook, rebuy time.

If the price change of the asset in 24 hours falls between a fluctuation.

A Strategy (Trend) EMAGAIN between -0.75 to -4

B Strategy (Momentum) RSI between 30 and 0

C Strategy (Volatility) LOWBB between -5 and -30

D Strategy (Volume) as per coin

Default Selling Setup example: Enter sell-only-mode? (SOM) or immediate panic sell?

If in profit % x time with x volatility, sell now.

If at profit % independent of strategy, sell now.

Stoploss % with rebuy timeout.

If not sold for x time, place pending order at target %.

If certain profit % reached, cancel pending orders for pair.

A Strategy (Trend) GAIN 5%

B Strategy (Momentum) RSI between 75 and 92

C Strategy (Volatility) HIGHBB

D Strategy (Volume) as per coin

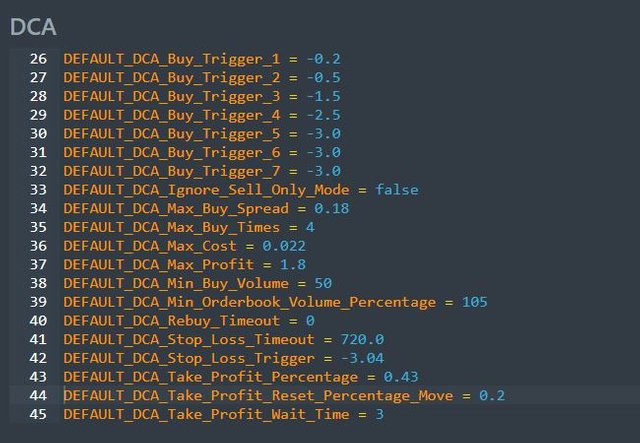

Dollar-Cost-Averaging (DCA)

Enabled at all? Enabled at a certain %?

Ignore Sell-Only-Mode (SOM)?

Max cost of single purchase.

Number of trigger levels (Buy times)

DCA Buy: Consider minimum buy volume (24h in basecoin), orderbook, spread, rebuy with timeout.

If asset price is in % change range over 24h.

A (trend)

B (Momentum)

C (Volatility)

D (Volume)

Buy values (loss%) based on DCA level with Buy % per level

-0.2%, 100%

-0.5%, 75%

-1.5%, 50%

-2.5%, 25%

DCA Sell

If in profit% x time, sell now.

If max profit % reached, sell now independent of any strategy.

Stoploss % (if all DCA levels reached, or if maximum cost reached, or if budget does not permit)

If not sold for x time, place into pending order.

A (trend)

B (Momentum)

C (Volatility)

D (Volume)

Sell values (ie RSI) based on DCA level of particular strategy.

Profit Trailer Feeder Offsets and Overrides

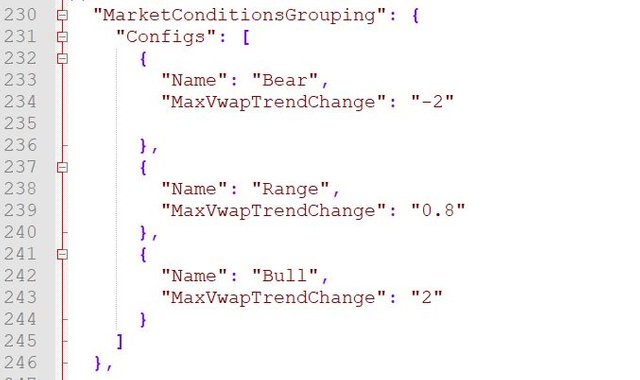

It is possible to stop the bot at any time or place it in "instant sell" mode or "sell-only" mode. It is also possible to manually override any of the settings and keep them manually overridden. The following are coin-specific adjustments saved every time the market condition is checked. Each grouping can have multiple triggers, each with their own offsets and overrides.

Price: if the price of a asset is in a certain range.

Volume: if the volume of the asset over 24 hour period on my exchange has changed in this way.

New Asset: if the asset’s age is this.

The following can be used simultaneously for regular time ranges, medium time ranges and long time ranges:

Price Trend Change: if price of asset changed less than this minimum over time range.

High Low Price Percentage: if the variance of the price from the norm was this.

Downside Volatility: if the price is dipping at a certain average % for each candle.

Upside Volatility: if the price is bouncing at a certain average % for each candle.

Upside Downside Volatility Difference: if the difference between the upside and downside volatility falls in this % range.

Average Candle Size: if the addition of the upside and downside volatility falls in this % range.

Profit Trailer Feeder Function Sequence

The following are the main sections within the algorithm for consideration when running the Feeder assistant program for Profit Trailer.

1) Initialization: allocation security. Start balances and balances to keep, specific assets to trade, sell-only-modes preset, trailing buys and trailing profits.

2) Feeder rules: how should feeder change all values? How often to check market condition, what are its trigger percentages, at what time frames, and based on which basecurrency or top coins?

3) Functions and properties: a most exhaustive amount of default or coin-specific adjustments can be made for buying and selling purposes.

4) Market settings: default general offsets and overrides for any market definitions such as bear, range and bull and super-bull can be set here.

5) Offsets and Overrides: can be set as coin-specific here.

My sequence of checks on a trading day

This is the sequence in which I go about manually daytrading with Profit Trailer’s assistance.

Myself and life around me.

World news: major political events in cryptosphere?

Bitcoin: 1hour, 5 days, 6 months.

Bot operations: smooth running? any coins peaking?

Assets and investments: asset calendars, asset twitter lists.

Signals: various group summaries for the day.

Actual manual daytrading: ie: any Fibonacci-level cherry picks available based on top gainers?

Actual bot trading: ie: adjustments based on the daytime market condition fluctuations.

Conversations: outsource and ask for help if needed, ie. Improvemements on trading strategies.

New manual technical analysis: tradingview analysis, workshops, youtube, articles, books.

New fundamental research: real meetups, websites, twitter, podcasts, youtube.

Articles in this series

Previous: Bitcoin Crypto Trading Bot: Example - Profit Trailer

First: Bitcoin Crypto Trading Bot: Foundations - Mob Theory

About

I’ve been an independent blockchain researcher since 2016. For the real deal, please read, meet, or listen to people such as Trace Mayer or advocate groups such as The Chamber of Digital Commerce. I can only aspire to understand and share like they do regarding deeper investigations into the ongoing breakthroughs.

This article series will be the basis for future posts, workshops, and live broadcasts. Your support in the form of comments, likes and donations helps me combine my thirst for the demystification of the blockchain sciences with the job of organizing and presenting the knowledge of human solutions in the form of articles.

Links

Personal website: http://www.meshcode.ca

Sole Proprietorship: https://www.theskyishigh.com

A proof-of-concept niche crowdfunding platform for clean, renewable, fuel-less open-source energy technologies on the blockchain.

Twitter https://twitter.com/meshcode

LinkedIn https://linkedin.com/in/meshcode

Binance: https://www.binance.com/?ref=26021518 (referral)

Profit Trailer referral link: https://www.profittrailer.com/pt/de/?campaign=meshcode (referral)

Profit Trailer Feeder: https://cryptoprofitbot.com/shop/pt-feeder/

PT Feeder Strategies https://discord.gg/PrHBCmT (discord)

Golden Sun Signals https://t.me/joinchat/AAAAAEWIl1er4I31j5GssQ (telegram)

Advanced Profit Trailer Crypto Trading

https://www.facebook.com/groups/advanced.profit.trailer.crypto.trading/ (facebook)

Blockchain Science Human Solutions

https://www.facebook.com/groups/blockchain.science.human.solutions/ (facebook)

BTC 13uMuecDkSEps8kGhh1BpVdAHafsEQnqeY

ETH 0x0deca25b0e8f075f63c15c2537d3ae4f838a39fe

Congratulations @meshcode! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Great article! I found it very interesting.

Talking about ICOs, after doing your own research, also finding good ICO projects can be profitable.

I want to share with you guys a new exciting project I have just discovered: RAWG.

Look at this article where the team explains:

“Why the games market needs RAWG”

https://medium.com/rawg/wp-bits-1-why-the-games-market-needs-rawg-ccf039c0bae7

The ICO will start in a short period and they are at the moment in pre-ICO phase. This is the site: https://token.rawg.io/. It's a video game discovery platform that converts your skills into goods and services (the site is already working, with more than 57,000 games in the database).

Have a look and get some information while doing your own research!