Ripple Files Motion Requesting SEC to Hand Over Documents Related to Ongoing Complaint

The company wants to force the agency to disclose why it views XRP differently than bitcoin and ether.

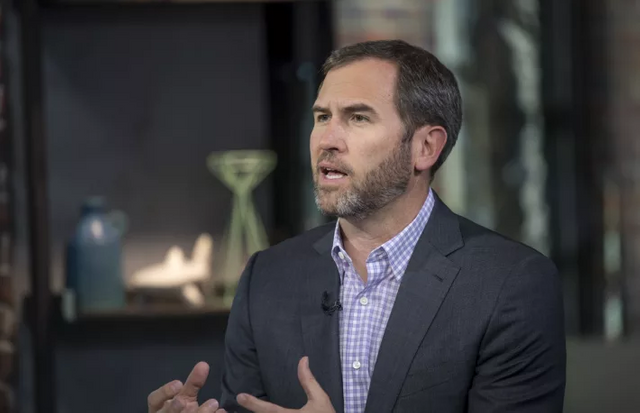

Lawyers representing Ripple Labs, its CEO Brad Garlinghouse and a co-founder, Chris Larsen, filed a motion Friday to compel the Securities and Exchange Commission to produce two sets of documents that the company requested earlier this year.

The documents relate to SEC communications with third parties regarding bitcoin (BTC, +2.72%), XRP (+4.36%) or ether (ETH, +6.18%). Ripple is seeking to force the SEC to disclose why it came to the conclusion that bitcoin and ether are commodities, not securities like XRP.

Last December, the SEC filed a complaint alleging that Ripple raised over $1.3 billion through an unregistered, ongoing digital asset securities offering. The agency is seeking injunctive relief. "We allege that Ripple, Larsen, and Garlinghouse failed to register their ongoing offer and sale of billions of XRP to retail investors, which deprived potential purchasers of adequate disclosures about XRP...,” said Stephanie Avakian, Director of the SEC's Enforcement Division, in a December press release.

On April 6 and May 6, United States Magistrate Judge Sarah Netburn of New York’s Southern District had ordered the SEC to provide the documents, but the agency has yet to comply, citing relevance.

The two sides have met independently five times to try to resolve the issue, most recently on June 1, according to the Ripple motion.

At CoinDesk’s Consensus 2021 event last month, Garlinghouse said he felt the case had broader repercussions for how cryptocurrency is viewed in the U.S.