How safe is USD Tether? Noble Bank, Bitfinex and Tether

There are plenty of worries surrounding Tether and whether Noble Bank is actually the main banking partner of Tether and Bitfinex. In addition to multiple stable coins being released recently with backing of compliant audits, it brings Tether into questionable territory.

It could be well timed FUD or is there something more substantial to these worries.

Lets take a look at what we know:

US Regulators are investigating but have not revealed what was in the subpoenas:

30th January - https://www.bloomberg.com/news/articles/2018-01-30/crypto-exchange-bitfinex-tether-said-to-get-subpoenaed-by-cftc

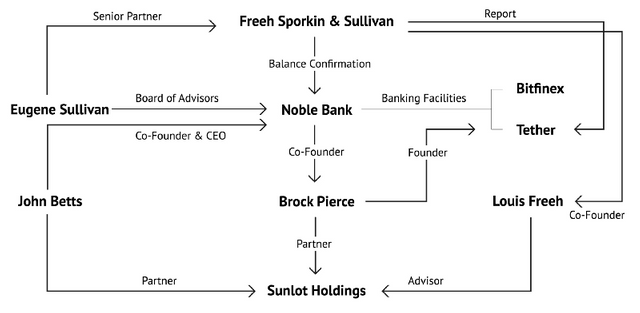

Indirect connection between the founders of Noble Bank, Tether and BitFinex raised doubts whether the Tether project is legitimate or not:

Brock Pierce, who is the founder of Noble Bank, also co-founded Tether. Eugene Sullivan, who is in the board of advisors of Noble Bank, also happens to be the senior partner at Freeh Sporkin & Sullivan, a legal consultancy which served as auditors to Tether and Noble Bank. An independent blogger drew the connections between the firms concisely.

Have a look:

Noble Bank seek buyer:

But note the article states that Bitfinex and Tether are no longer clients. But previous blogger whom connected the dots stipulates that Brock Pierce is the founder of Tether and Noble Bank. So how can you leave your own bank, where do the funds go to?

Or are the funds just frozen?

According to Noble Bank themselves, "NBI is a non-fractional reserve bank. This means that NBI does not lend or re-hypothecate client assets; rather, assets are legally segregated in the name of the client and bankruptcy-remote, held at NBI’s global custodian, BNY Mellon."

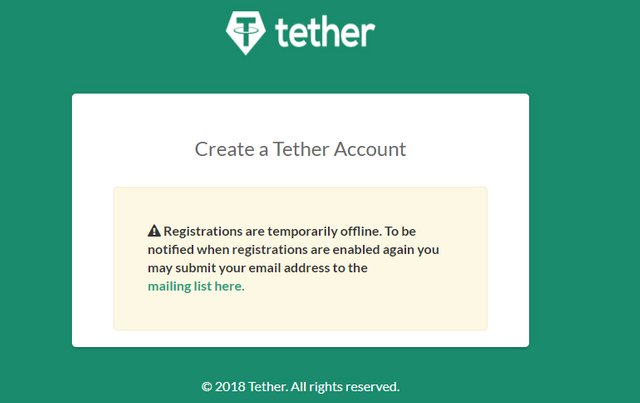

What about the state of Tether.to itself. According to its website, they are not accepting any new registrations:

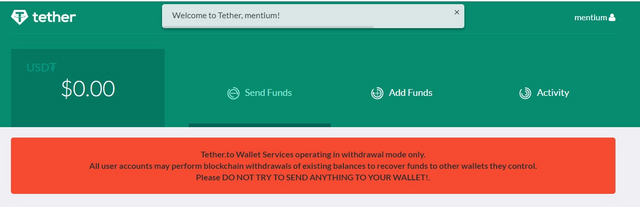

Further if you do have an account, they are only allowing USDT Withdrawals, and this has been the same since Wells Fargo and Co dropped banking facilities.

What about Bitfinex?

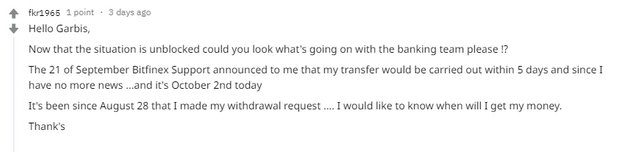

They have methods to accept Fiat and withdraw Fiat. But according to this Reddit thread, a number of users are reporting being ignored by support and are forced to escalate publicly, the delays via Bitfinex's banking method. With some users reporting bounced payments, or not receiving payments from Bitfinex:

https://www.reddit.com/r/bitfinex/comments/9iqpp9/finance_tickets_escalation_thread/?sort=new

All of this kind of supports the idea that Tether and Bitfinex are having banking issues.

Are Tether printed from thin air?

Due to the superficial audit back in June 2018 by a law firm - Freeh Sporkin and Sullivan LLP. It only confirms that on that date USD was in two bank accounts that seem to cover USDT tokens in the market place. But the banks were not named and the Law firm is not an accountant, and did not follow compliant methods of a typical audit.

https://www.coindesk.com/tether-review-claims-crypto-asset-fully-backed-theres-catch/

So what happens if Noble Bank go bankrupt?

Panic may ensue due to the lack of comments and transparency from Tether and Bitfinex. Causing traders/investors to flee to Crypto on Tether only exchanges, and then exiting to Fiat on other exchanges. Eventually causing inflated crypto prices to USDT then a price dip.

But this may be short lived and is not clear at the moment. It all depends, on BNY Mellon (One of the biggest banks in the world) if they decide to announce that they have the Tether backed assets and that regulatory restrains restricted them from announcing this earlier or that they don't.

Either way, Noble seem to have a short life span ahead of them, especially as they are seeking a buyer, just at cost of a banking license.

And if no clear message is sent to the market, fear and panic are likely outcomes. Kind of a perfect storm for institutions. I.e Market dips due to lack of information. Institutions then buy as they may know more information on BNY Mellon's assets. Then BNY Mellon step in and confirm that they have these assets, then price rebounds. But only after the Retail market is punished one more time.

Note this is merely my opinion and would love for more clarification from the market. What do you think?

We appear to have broken out above the longer term triangle, still need a confirmation on longer time frames, but if we rise to $6800, then $7400, if Noble go bankrupt - it will effect this mini bull run prematurely