LENDLEDGER: LOAN ACCESS FOR INFORMAL BORROWERS

INTRODUCTION

Assessment of the creditworthiness of potential borrowers by commercial banks is an important element of loan processing. Business-owners are expected to have official documented credit histories in order to access loans. However, a significant number of businesses are not registered, not to talk of having official bank statements. Without an official credit history, traditional banks will refuse to give out loans. As a consequence, business –owners are forced to seek loans from friends, family or even loan sharks. On the other hand, most business-owners may make utility bills payments digitally or have a mobile Point-of-Sale (PoS) machine for his customers. All these transactions can amount to credit history, significant enough for creditworthiness.

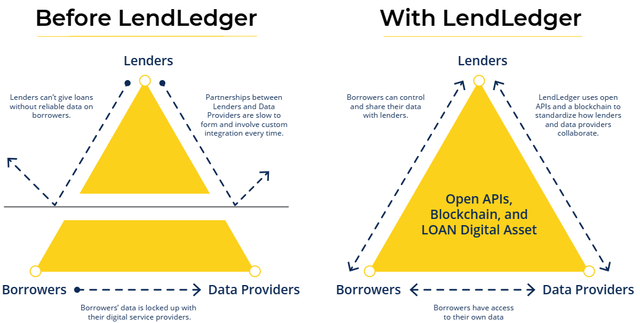

To solve this complex problem, LendLedger was created to connect potential borrowers’ unused digital credit history to help bridge the lending rift between traditional lending institutions and informal borrowers. LendLedgers on a grander scale connects informal Borrowers, Data Payment Services and Potential Lenders in an open but secure global ecosystem.

THE VALUE OF THE INFORMAL SECTOR

The informal sector is the future of lending. This is because, the informal sector accounts for the employment of majority of people. Even formally employed persons have informal businesses that they run on the sides. However, the inaccessibility of borrowers’ digital transaction history, which can serve as official credit history, makes it hard for lenders to assess borrowers’ creditworthiness.

THE LENDLEDGER SOLUTION

• Difficulty in assessing creditworthiness of informal borrowers

Large banks have delegated much of informal sector lending to Microfinance Institutions. These institutions form organized groups for the purpose of loans. However, this system requires too much resources, meetings and borrowers cannot access loans speedily. As the adoption of digital means of payment increases, there arises a need for Banks to be able to evaluate informal borrowers.

• Inaccessibility of digital credit data of informal borrowers

The adoption of digital payment services by informal business owners increases daily. The widespread use of smartphones have had a multiplier effect as business-owners depend heavily on digital payment services to run their businesses. When the times comes for expansion, these digital transactions that can inform lenders of the success and potential growth of small businesses are inaccessible. Thus, they resort to other sources of lending that often comes with high rate of interests or embarrassment. LendLedger then provides a reliable means of accessing and evaluating digital financial data of informal borrowers, without which they have limited lending options.

• Unconventional Financial Data-Sharing

The lending market is plagued by distrust. Sharing user data with potential lenders is a complex procedure. Digital payment services have to assess the reliability of the lenders, interest rates and loan approval ratings. Form a relationship between digital payment services and potential lenders can be very complex, resource-intensive and time-consuming. From experience, LendLedger has what it takes to make these partnership deals.

• Software Solutions

All members of the LendLedger’s network will have access to the LendLedger’s Software. This software will give members access to the interface from which they can access the LendLedger ecosystem. The software is easy-to-use, participants do not need to have any technical expertise in order to operate this software. There are software solutions on the roadmap such as L-Lend and L-Data.

CONCLUSION

By ensuring access of potential lenders to digital financial data on informal sector borrowers and small business owners, LendLedger would have created a new profitable lending market for Lenders, Digital Payment Services and the Informal sector. The LendLedger ecosystem will enable formerly invisible informal business-owners to experience business growth as a result of LendLedger’s sponsored-access to creditworthy Borrowers.

For more information on this platform, please visit:

Website: http://www.lendledger.io/

Technical Paper: http://lendledger.io/images/LendLedger_TechPaper.pdf?pdf=LendLedger%20Tech%20Paper

Telegram: https://t.me/lendledger

Twitter: https://twitter.com/LendLedger

ANN: https://bitcointalk.org/index.php?topic=4424652.0

Thanks for reading. I am fedben on Bitcointalk.

Profile link: https://bitcointalk.org/index.php?action=profile;u=2284561

Stellar Address: GDNXG7N2ZK2RKJHJAYRLXTAF7DKOCFKMNAT3LLP7TYUOXJ3ELBQ3OVTK

Congratulations @mcfeddy! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!