Banks vs. Crypto

Hi, guys. In last article I told how it is possible to do money using cryptocurrency. Now I offer to reason a little and immerse yourself into utopian future when the cryptocurrency will be instead of banks.

So, let’s begin.

First Bank of the United States. Founded in 1791.

Traditional modern banks undoubtedly have huge functional for customer.

For example:

- Online bank account

- Debt and Credit cards linked to account

- Deposits

- Loans

- Open-end funds

- Currency exchange

- Various services for legal entities and individuals

and lot of others.

From Wikipedia

The supreme management body of the Bank is the shareholders (participants). To it bank board of directors and revision committee are accountable.

Board of directors:

- defines general directions of development of the bank,

- considers the plans of the bank activity,

- opens and closes branches of the bank.

The executive management body, directly supervising the bank’s activities, is the bank’s board, which usually includes representatives of the largest shareholders (participants) of the bank.

Put simply, shareholders are the owners, and the board of directors is a hired team (managers). And since the system is not transparent, of course, supervise this team should be auditors (revision committee). These are intermediaries who are in this case a third party, who do not have positions in the structure of the bank, but still remain people with their weaknesses. They are chosen by the shareholders of the bank. They should check the financial and management work of the bank at least once a year. In my opinion, this is not enough.

But why do I care about their weaknesses and frequency of checks? — you ask.

Everything is very simple. For example, the bank have my deposit, and I want to be sure that it really have and interest is on it. But given that it is dangerous to trust people, I am very worried every time for my deposit. Eventually, employees of the bank, can running various frauds to clean up depositors’ accounts, pull up stakes and get the hell away. =)

And this is not nonsense. I personally experienced difficulties when employees of my national bank tried to steal $ 1000 from my account. Actually, they did not even put the money into the account, but simply put it in their pocket according to the standard scheme in the hope that I would come for it when I can not prove anything by law. I was lucky, I had only one document and I came earlier. I had write at a third-party forum about fraud and threaten with the court. I eventually was able to return this money, but I felt really bad after that. What about less skilled people? Do they can back their money? And If the fraud will be on a larger scale, what then?

Generally, this is not the only negative of banks. Eventually, reserve of the traditional banks generally lower, and in the UK, for example, there is generally no mandatory reserve requirement for commercial banks.

Also, financial crisis of 2007–2008 showed that in the case of a threat of bankruptcy of large banks, governments are usually forced to “save” it at the expense of taxpayers’ money, risking otherwise paralyzing the whole system of monetary circulation.

In addition, from my experience, I can say that I do not really like it when the international WIRE/SEPA transfer lasts 2–5 days and for it I have to pay about 40–50 USD. Also, I must follow the limits and hope that my account will by mistake not block the foreign exchange controls that the state imposes. After all, if it will block, I have to waiting for a very long and fun story of unlocking or returning money to my hands.

Now let’s move on to the cryptocurrency.

Cryptocurrency has done a lot of noise over the past 10 years. With each new cycle of bitcoin followers are getting bigger. And people increasingly understand that the cryptocurrency is not only a wonderful speculative tool, but also, perhaps, the basis of the future world. Eventually, the cryptocurrency has a lot of advantages:

- cheap and fast transactions, which allow you to comfortably pay around the world

- Private wallet with many various function

- Transparent system

- Independence of regulation

- Possible be anonymous

- Investments in the future

and lot of others.

And It can not do without negative, because any system has its disadvantages, for example:

- Danger of attack 51%

- Hacking wallets of sloppy users

- Overload of network, and, as a consequence, long and expensive transactions

- High volatility of classic cryptocurrency, with the danger of dumping rates.

- The excessive centralization of some projects, but however, this also the case with banks

- various bags

and other problems.

Despite that, some problems are solve, already solved or will solve.

For example, protect from attack 51% is carried out using special algorithms applied to a newborn blockchain. Till the alternative blockchain is do not mine to N blocks, clients (wallets, nodes) will not be apply it, so team have time for protection realization. And attack becomes is not profitable for hackers, so they take off powers.

The problem of volatility is solved already using stablecoins, which about I wrote earlier, and the centralization of project via DAO. About the DAO I wrote in previous article, also.

In general, the niche does not stand still, develops and solves problems as that arrive.

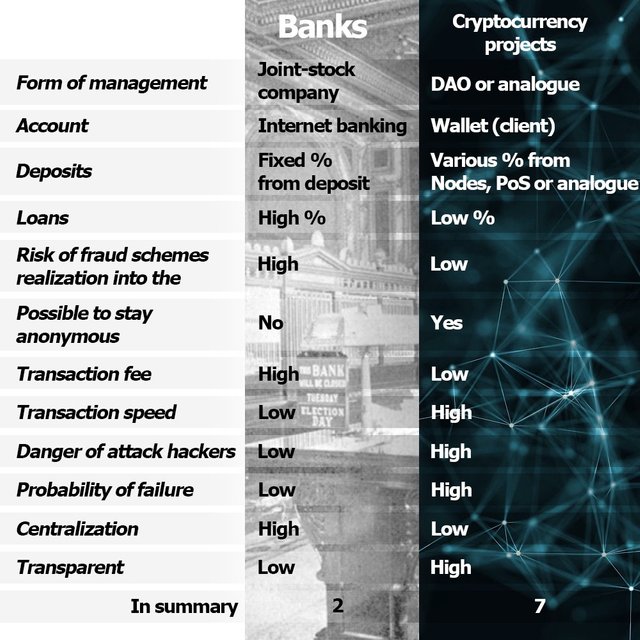

To not burden you with text once again, I did comparison in the table form.

And now, as tradition, I suggest you dip into an utopian future with digital money replacing banks. As a basis take LibreBank project, which about I wrote earlier.

The growing new generation will be show interest in cryptocurrency more and more, part of them decide to invest it.

Meanwhile online trade will become occupy most of market, and subsequently be leading.

Modern people will not to need to touch and consider the products before buying. Online stores will go to move towards each wealthy people, which ready to pay goods with cryptocurrency (however, we can see tendention at the moment). People will need to more and more stability and comfortable, so into the circulation becomes to go LibreCash with stable rate and free from inflation. It is important, also. By the way, why stablecoins will be most popular, I wrote in previous article.

Banks will not be exist in habitual form, new projects like a LibreBank replace it, which at the heart stay DAO principle or analogues. These projects will can perform previous functions and, for example, give the loans, which using traditional banks, but with low interest through liquidation a large number of intermediaries like a auditors and employees. It will be replaced by the usual transparency of the system and smart-contracts that regulate the proper operation of the system. As a result, costs will decrease and such projects will be more competitive and in demand on the market.

What about regulation by the state?

Of course, like any other sphere, the states of different countries will try to regulate such projects. But in general, it would be inappropriate to shut this down, it is better to take advantage of it and rebuild its economy to a new digital mode. The banks which near governments, most likely, will change their structure, and compete with new projects.

In the end, it is not entirely clear whether the principle of “divide and conquer” remains, because at now only the blind could not notice the developing globalization in many niches. One thing becomes clear: the world will change, and with it the banking niche.

Read how to earn money using LibreBank tokens (LBRS).

Read about LibreCash stablecoin.

Buy LibreBank tokens.

Subscribe me on:

Medium: https://medium.com/@max_profit

Telegram: https://t.me/max_prof

Twitter: https://twitter.com/maks_profit

Golos.io: https://golos.io/@maxprofit