Taxation of cryptos in Germany, Switzerland and Austria - Blockpit

The Blockpit project will help you to face the taxation issue.

I started to invest in crypto without any concern about taxes, because normally when you buy something in the internet, you don't need to pay any taxes extra.

The problem is, that you basically have to pay taxes on every trade. When you trade a cryptocurrency for instance Ethereum to EOS, you have to pay taxes on this transfer.

There are differences between all countries and it's today very difficult to understand the system of taxes for cryptos. In Germany you do not neet to pay any taxes, if you hold for longer than one year, but every transfer resets this duration.

So when you invest in cryptos, you have to pay attention to taxes because otherwise you will have problems, esspecially when you invest more then 10000 Euros.

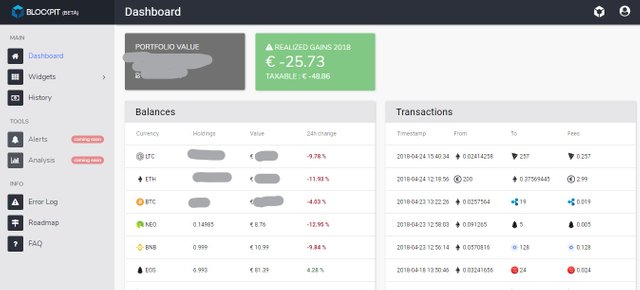

There is a new developing platform, which faces the problems and will be able to make the taxation with one click.

It's working with Binance, Coinbase and a lot of other platforms to import your transaction history. This data is then used to create a taxation document for your country.

The project claims, that it will work with state agencies to make it possible. First Germany, Switzerland and Austria and in the next years with other europe countries and the USA.

Sign up for the project Blockpit. Check it out.

It will also have an ICO this year.

Have you kept track of the taxes?