ETHLend - Lending with The Power of Decentralization on The Ethereum Blockchain

There are these moments, when you feel like you want to buy something, to invest in something you really really want, you trully need, but there is a giant financial wall in front of you, stopping you from making your wish possible! These moments make our life a true nightmare, they make us feel desperate, unhappy, unconfident and unsatisfied with our current life conditions. You finally found a lucrative investment, which will turn your life 180 degrees to a opposite direction, to a positive direction, finally finding a way to a financial freedom. But then you finally realize, that you have not enough finances on your bank account to even think about the investment of your life, about things, you could have built, about money you could have made. Then, you decide to take a loan in your bank, you make a loan request and ask a bank to borrow some money for your investment, but they refused. After that you were lost, lost in a total oblivion. There comes ETHLend Decentralized Lending services!

Ok, I have carried away a bit...

ETHLend is a fully decentralized Peer-to-Peer lending Smart Contract on Ethereum blockchain for lending Ether by using tokens as a collateral.

Smart Contracts

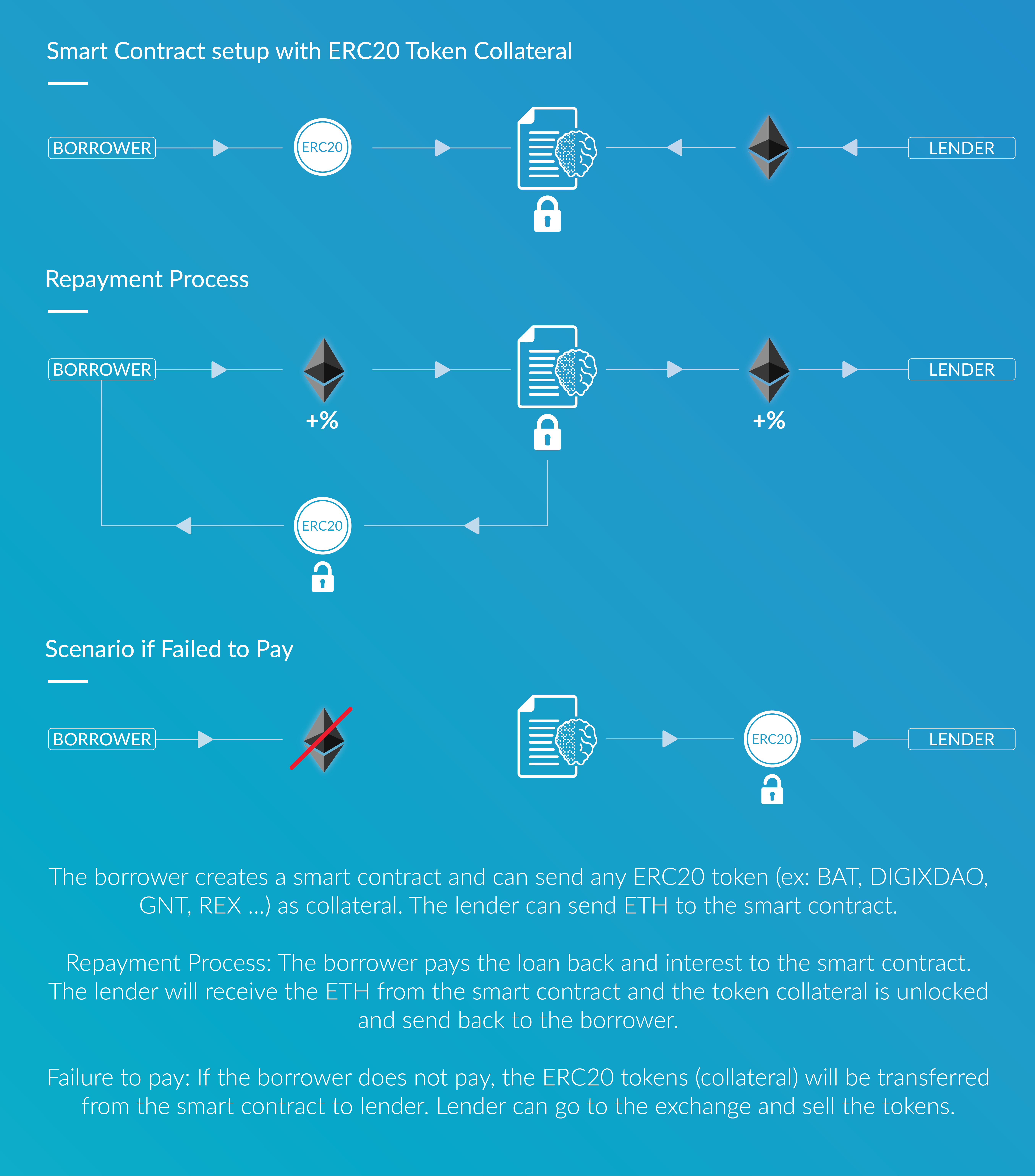

Each loan creates a decentralized smart contract on Ethereum blockchain. Everything is 100%-ly decentralized (well, of course, it's Ethereum network xD) which makes loans completely secure and transparent.

Credit Tokens

For every 1 ETH that is repaid, the borrower receives 0.1 ETHLend native Credit Tokens (CRE). CRE can be used to access unsecured loans. For every 0.1 CRE you can easily borrow 0.1 ETH without using any collateral. This makes a ratio of 1 CRE = 1 ETH!

Collateral Tokens

Loan repayment is secured with any ERC20 Token. If the borrower does not pay the loan back, tokens are transferred to the lender.

ENS Domains

Collateral is an important part of the ETHLend ecosystem and that's why there is also an alternative way to secure a collateral - Ethereum Name Service Domains (.eth). ENS Domains contain deposits which can be used to back up 100% of loan collateral.

Unsecured Loans

EthLend will implement uPort for providing self-sovereign identity based lending as 3rd alternative. Lenders can access higher profits by funding unsecured loans.

KYC

EthLend will adopt Know-Your-Customer policies and make KYC process easy and secure and tha will make lending a borrowing super easy to adapt.

A borrower places a Loan Request which is in a form of a Smart Contract on Ethereum blockchain. You have to fill important information (data) regarding your desired loan, such as how much ETH you wish to borrow, for how many days, your ERC-20 token as collateral, etc. Here is a preview of the Loan Request ticket.

And here is a more detailed scheme of the ETHLend ecosystem:

They have also made a video explaining ETHLend ecosystem in details:

Important Links and Social Media channels to follow:

Website: http://ethlend.io

White Paper: https://github.com/ETHLend/Documentation/blob/master/ETHLendWhitePaper.md

Discord: https://discord.gg/gcc7vpa

Slack: https://join.slack.com/t/ethlend/shared_invite/MjAzMTM0MzEyNzA3LTE0OTg0MDk0NDItOGY0MTlkMTlmZA

DAPP Bitcointalk Thread: https://bitcointalk.org/index.php?topic=2013399

Telegram: https://t.me/joinchat/FWu2CQ0ZRCeWfey4eP8VhQ

Reddit: https://www.reddit.com/r/ETHLend/

Twitter: https://twitter.com/ethlend1

Facebook: https://www.facebook.com/ETHLend/

Congratulations @makulo123! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP