Crypto Market Essentials: Trading vs Investing

ETH 2017 (1 day chart), A crazy good investment. (source: Coinigy.com)

ETH 2017 (1 day chart), A crazy good investment. (source: Coinigy.com)

Before buying any cryptocurrency there is one thing you must decide: Do you want to be a trader or an investor. Understanding the difference is absolutely crucial and will save you from a massive of loss. Being an investor who thinks like a trader, or vice versa is about the second worst thing you can do when entering crypto markets - next only to going to an Internet forum and asking random strangers which coin to buy.

Let's check the difference:

INVESTOR

Investment should always be based on fundamental analysis - an in-depth study of various elements of a digital asset including development team, technical background, business model, future plans and roadmap, supply of the coin (circulating and maximum) and community of possible users, overall social support and visibility, etc.

Places to research it are pages like Coinmarketcap.com, forums like Bitcointalk.org, Slack channels, subs on Reddit, various digital media...

Investment is meant to be long-term

Investor is holding an asset because based on his research he believes his share will grow in value as the project progresses.

Before becoming an investor one should decide what is the minimum investment period and once he makes a buy only go against this plan if he/she suspects project is failing (or of course if the money is needed). Not based on market trends like pumps and dumps.

Investor should not worry too much about short-term trends and devaluations of the asset he/she is investing in.

An investor can allow himself to be emotional about his investment as long as he upholds his initial decision about the investment period.

It is worth noting that so far in the crypto world you didn't have to be particularly smart or informed to make a successful investment - if you simply bought strong coin like BTC or ETH at any time in the past and held it long enough your investment has grown.

TRADER

As opposed to an investor trader doesn't give a damn about the actual quality of the project. He bases his trades on technical analysis whose main purpose is to determine market trends by using data, charts and indicators.

Trader believes all the necessary info he needs on an asset can be derived from observing behavior of asset price.

Good resources for trading are pages/platforms like Coinigy.com, Tradingview.com and of course Coinmarketcap.com which is a useful resource for both traders and investors.

Trades can and often are realized in a very short time-frame like single day, an hour or even within minutes.

However, unlike an investor the trader can be flexible about the length of his investment period. So he can also operate on a longer time-scale. Even if he operates on a comparable time-scale as an investor, a trader still differs in one thing - he is still more interested in market trends than in fundamentals of the project and will mainly watch for trend reversals to buy or sell.

Trading has its own lingo like short and long positions, support and resistance, bulls and bears, ranging or trending markets, trade swings...

Traders must know how to read different charts to derive an understanding of trends. Understanding what graphical representations like candlestick charts mean is absolutely crucial. Understanding of complex technical indicators is secondary to that and usually inferior tool. Typical beginners mistake is to learn how to use an indicator like moving average or an oscillator and then base your trade on it like it is a sure thing. It never is.

Not unlike a poker player trader must be able to control his emotions. If you trade on emotions you will always lose. The house always wins.

Trader usually avoids trading against the trend.

WHAT IS USEFUL FOR BOTH?

Some data, like trading volume and market cap is quite important for both approaches.

WHAT CAN INVESTOR LEARN FROM TRADER

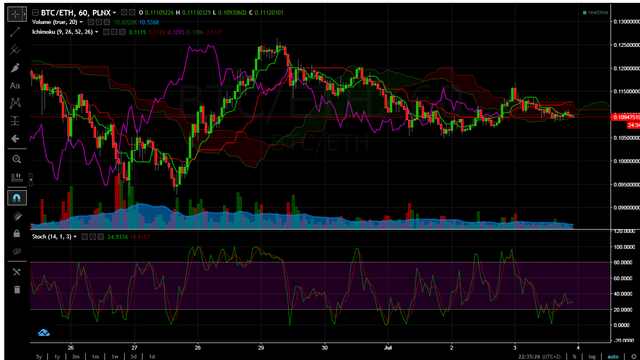

Of course it is quite useful for an investor to understand basic market trends so that he knows when to buy and when to sell. If he's good with predicting trends he can also use this knowledge to grow his share. For an example the image below shows my choice of indicators that I find useful for every buyer of digital asset. Ichimoku cloud determines market trend and Stochastic oscillator determines overbought/oversold market signaling the right time to buy and sell. This is actually one-glance-says-all chart which looks much more complicated than it really is (it signals moderate to strong sell signals). I will explain those tools in the future posts.

Only two indicators make one hell of a mess. It looks as simple as landing a Boeing 747.

Only two indicators make one hell of a mess. It looks as simple as landing a Boeing 747.

(source: Coinigy.com)

WHAT CAN TRADER LEARN FROM INVESTOR

It can be good not be ignorant about the assets. Especially if you operate on a longer time-scale. Being well informed about a coin will help you distinguish between an attempt by a whale to break the trendline from the actual breaks based on news like an important technical update.

CAN YOU BE BOTH?

Sure, you can trade some assets and invests in other. For instance I invest in BTC and trade other coins, among them I have successfully made money on coins like XRP which is a project I really dislike.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by m1r0 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, and someguy123. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you like what we're doing please upvote this comment so we can continue to build the community account that's supporting all members.

Great analysis, thanks!

So if you are an investor shorting when you "know" the market will go down on the coin and re-invest in a different coin, you are a trader as well. And in these days in this fast changing altcoin environment I think the decision to short and "maybe" to re-buy, if the same coin rehabilitates (or other coin presents better growth), could save the investment. Right? :)

If you're an investor you shouldn't care about the short time price fluctuations. What you care about is that the roadmap of the project is being implemented and user base is growing. Otherwise you're a trader. And then again if you're a trader you better know what you're doing.

I've finally decided to jump in after watching for a while and while at first I was more interested in trading since I bought DGB really cheap and got a 4x on my money but then it swiftly went back down and all more profits vanished.

Since I have a full time job (two actually) and don't have time to watch the market all day I have taken more of the Investor approach. I now have 33,000 DGB for the cost of about $600 total (did a really stupid thing and traded the rest of my BTC into more DGB at 2400 soti since I thought it would hit $0.10 at least) and instead of cashing out to save what little bit was left I decided to consider it an investment and count of the fact that in a year or two it should be worth at least double.

My goal now is to get at least a certain amount of BTC, ETH, LTC & DASH to hold long term then take another amount to move around and use the profits to keep investing.

It's classic beginner mistake, I've been there. You could have prevented the loss even without any specific trading knowledge by using stop-limit order on your trade. Once you see you are in the positive area you put a stop-limit in the green zone and sleep calm. You must only keep in mind that if you have plenty of low volume coin you'll want to make more then one order on different levels, otherwise price might just skip your order if going down fast. And of course if it grows tighten the price-noose. Know what I'm saying?

That was an interesting discussion. I will stick with investing thanks!

Great article!

I would add one more important difference. Traders and investors enter the market in a different way. While investors typically get involved in ICOs, traders are more likely to use exchanges. ICOs are often discussed on Reddit and similar forums, while exchanges are judged on their reliability and transaction fees. So it's not unusual to use something like Switchain to compare rates between different exchanges before they make a trade.

I like #Nexty coin (NTY) . Because it is the stature of a tremendous and propelled development.

Nexty has a high ground in the crypto-space: Instant trade, zero tx charge costs and esteem stablisation #nexty #bitcoin

Trader = all about price/market

Investor = all about project