Predictions For Crypto In 2019

2018 was not the year we expected from crypto but at the same time, it was probably the year that we needed. While 2017s dizzying price highs embedded HODL into the public conscience, 2018 was the year that BUILDL became a trend in the industry.

I think it goes deeper than that. I think a lot of things happened this year that were glossed over or not given proper attention because everyone was obsessed with the price and what the price was doing. With that said, I think there are some macro developments going on that will really start to manifest themselves in 2019.

2019 is going to define cryptocurrencies in a way different than how 2018 and 2017 did. We're in a new market. Crypto has made some evolutions and I'm extremely excited for the striations of possibility that lay before us.

So, to capatilise on this let's talk about some of these trends going into 2019 and what they mean for us. Now, it's important that we also look behind us and appreciate what this past year meant and I'll cover that in another post, but for right now, let's be future looking. Let's try to grasp what the future holds, and no, I'm not going to make any price predictions.

The Dev Leavening

So, to kick things off, my first observation is related to the recent trend in the news that I've seen. Have you noticed it? Ethereum Classic just lost a group of developers, Bitcoin Cash just split itself apart with greed, Oyster Protocol (PRL) was blown up by its founder going off the rails, Cardano's chairman of the foundation's counsel stepped down after 6000 signatures demanded his resignation, and now, the co-founder of EOS, Daniel Larimer want to move away from the project.

Though he's not leaving yet he certainly seems distracted. Larimer is notorious for moving on from projects to projects before his work reaches its complete vision. Many of its investors were concerned if Larimer would be able to stick with EOS for the time needed for its network to reach its full potential. I think those fears may be warranted after Dan posted a message proposing a new idea he's been thinking about. I'm not trying to spread FUD. I think it's important for the community to keep an eye on the matter and confirm that these posts are even real. That said, for a billion dollar ICO this team needs to be held accountable. Clearly, Daniel Larimer is a smart guy, but when it comes to creating projects he leaves them half baked.

I don't think its entirely his fault losing interest in projects. Building companies is hard. More entrepreneurs are going to face numerous obstacles as they build their company regardless of the funding path they choose. Most startups fail so we shouldn't be surprised when this happens in the crypto industry too. It's all well and good to get excited about a project as it's in initial phases and fundraising capital, but that's a very different phase than actually building things. When it comes to a lot of these ICO's their capital runways are running out.

Most crypto companies raised funding in 2017 that would allow them to run for maybe a year or two, but, as we've seen, a lot of these companies are at the end of their runway as we push into 2019. Either they solicit more capital from beleaguered investors, find some way to be acquired, or they have to shut down. I think a lot of this stems from the fact that there's a dearth of usable technology with adoption today and I think that going into 2019 that trend is only going to continue to get worst. It's going to be a real test of the longterm vision and capabilities of these projects.

The Survivors Are Here To Stay

Projects that survive 2019 are mostly here to stay. The most important years of a startups life are the first 2-3 because this is when the majority of most startups fail outright. Whether it be poor management, running out of funds, not being able to deliver on their promises; there's a myriad of reason why a startup will fail. I know that's not a comfortable or fun topic to talk about, but it's something we need to address collectively because coinmarketcap is slowly turning from this green field of fun promises into a red graveyard of broken dreams.

The good news is that if projects are able to make it through this gauntlet that means they have some staying power. So, I would encourage you to thoroughly investigate the projects you are invested in because the last thing you want is projects you're invested in going to zero. If you're not seeing constant updates from the team or constant community involvement and discussion or seeing anything listed from that project on coinmarketcap, those are all red flags and I'd encourage you to employ risk management with your positions.

I know the last thing you want to hear is after a year of suffering we might still have more to come. We definitely will, but it has a purpose. The projects that survive 2019 are going to be here to stay and I think that relates to a larger trend that is my next prediction.

Reality Check

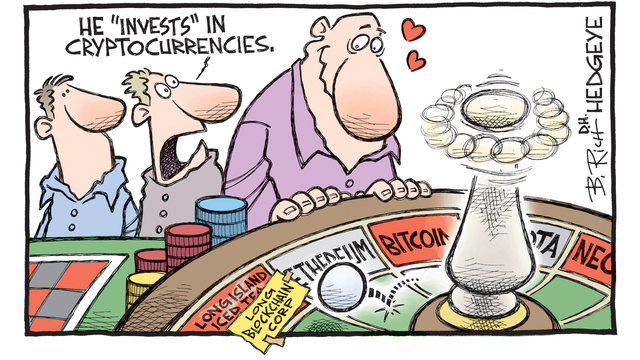

Blockchain is an extremely powerful idea but it's very far from being a mature technology. Certainly, if people are expecting to become millionaires from ICOs they're disincentivized from creating the next generation of technology. Hopefully, it's clear from my last two points that we sort of bled out those kinds of investors and are phasing out that kind of crypto.

In essence, crypto is getting serious. I've noticed this trend in the past year as I've attended cryptocurrency conferences. The average attendee is getting more professional, there's more of a business focus, and the levels of discussions have more substance and very holistic of the entire space and how it's moving forward. Many of the big players in the blockchain space are getting noticed by major financial players who are definitely coming to terms with the possibilities that distributed ledger technology (blockchain) is opening up.

On the market side of things, the most important statistical parameters of the Bitcoin market indicate very clearly for many months now that it has met important criteria of financial maturity. Sure, that's called into question when November was the worst month since April of 2011 for Bitcoin, but I think we're trending for transcending this volatile market and the Forex market can look forward to some very real competition.

The DApp Comeback

Another way that the crypto market is maturing is in user adoption. The most pressing issue for 2019 is getting user adoption, getting people to use what we've been building. We need people to care about what crypto can do and push the envelope of what it can do. As scaling solutions continue to improve and as we continue to develop the technology and as crypto continue to emerge as a resolute new industry, I think user adoption will be on our minds more and more. It's frustrating too because I think people can see it. We're close. The promise of decentralized apps(DApps), decentralized autonomous organizations (DAO), millions of smart contracts firing off without any human intervention, the dream of a product going from a manufacturer to a consumer's hands all without a single human's hand involved in the logistical process, it's tantalizing.

But we got a long way to go and I don't think that's a bad thing. It's going to be fun watching us make progress and getting results. We're building this together and I think one of the results that are really going to help us make that happen is scaling solutions really coming online.

Scaling Prevailing

One of the most interesting developments in cryptocurrencies today is the prototyping and release of layer 2 solutions such as Bitcoin's Lightning network Ethereum's Plasma.

As we've known from the beginning, the biggest issue or hurdle facing blockchain is while it's really good for security and the minuscule transaction fees that are inherent in the process, unfortunately, the biggest detracting element is how slow it is. It's become clear that cryptocurrencies that have been lucky enough to attract sufficient investors and users inevitably succumb to the twin afflictions of increasing fees and limited transaction times, something Steem is really good at dealing with.

Solving most existing blockchain scalability issues can and must take front and center in the year ahead if they're to stay in this race, and yes, I think we're getting closer. The developments made on both Lighting and Plasma this year have been great and in 2019 I think we'll continue to see them make incredible progress. One of my favorite talks I saw this year was Lightning Labs CEO Elizabeth Stark talking about the Lightning network. It's clear that there's a lot of smart, talented people working to make this happen and I'm really excited to see what gets developed and released over the next year. I think it's going to really help us push this space forward and achieve some of the milestones we're collectively looking for.

The Hunt

One of those milestones we all really need is that killer app. I mean, that's how I feel the internet became more than just this global communication layer. Look at the adoption curve of the internet in 1999 in the U.S., you had about 55% of the population connected to the internet in some way. Over the next 10 or so years that figure went from about 55% to around 80-90%. Sure, the 30 or so percent increase is not a huge gain over the course of a decade, but think about what happened during those 10-years.

Think about what was introduced on top of or working with the internet. It became incorporated into our lives. smartphones, streaming, social media; these advancements and use cases helped propel the internet into the realm of public conscientious.

There's definitely this desire for blockchains' killer app to help user adoption in the same way, a point argued many times over in the crypto community. To quote co-founder of Ethereum Vitalik Buterin, "There will be no killer app for blockchain technology".

The reason for this is simple, the doctrine of low hanging fruit. If there existed some particular application for which blockchain technology is massively superior to anything else then people would be loudly talking about it already. So far, there's been no single application that anyone has come up with that has seriously stood out to dominate everything else on the horizon.

Vitalik believes blockchain is valuable for the many applications that it enables and not for the possibility of some currently, unforeseen killer app, but I strongly disagree. I think a killer app framework is possible. While there are many cutting edge applications that I find interesting, the major drivers of blockchains' value are relatively narrow. Yes, the narrative of 2017 was trying to find the niche that will dominate all, but I think it's instructive to take the thousand-foot view and remind ourselves of the big picture.

There are four killer apps for blockchains.

You have the dark web and blockmarket payments with market size in the billions and this is where privacy coins and scaling can definitely help.

Then you have digital gold whose market size is in the trillions. There's tremendous potential here but unfortunately, volatility and consumer awareness stand in the way of that, but I think those are two things that are definitely solvable. Think forward 100-years how people will say why was so much intrinsic value placed on shiny rocks when it makes so much more sense to digitize value.

The third killer apps are payments; both macro and micro. This is a market size in the hundreds of billions and this is also the use case most people look at related to crypto and blockchain, but of course, adoption, ease of use, and scaling are definitely standing in the way of that. Those will definitely subside in the next decade or so but there's a lot of hurdles in our way.

And finally, the one I'm most excited about is tokenization, where honestly, I have no idea what the potential market size is, but I know it's massive. Again, I think people in 100-years will look back and say, why was equity or assets tracked with paper? It doesn't make any sense.

For a global economy to exist you need the ability to transcend sovereign borders so investment can take place in a digital sense. Of course, regulation, digital frameworks, and consumer education are definitely standing in the way of this but this is the area that really gets me jazzed up.

With that said, I don't want to disregard other exciting areas in this space. For example, I've been a fan of supply chain blockchain use cases. This space is full of innovation and is moving extremely fast, but if history is any indication it's likely that the largest killer apps for blockchains are going to be something no one yet expects or anticipates.

Exchange Interchange

I think we'll see meaningful advances in things like decentralized exchanges, shared liquidity across exchanges. A cleaning up of the crypto market will certainly make meaningful advances in the infrastructure of how we store and trade cryptos. I think security is another big issue that needs a lot of attention and hopefully, over the next few years, we'll see meaningful advances made there too.

We'll also see crypto continue to be married with the internet of things, something that also will help with adoption. For example, imagine devices that use a lot of electricity such as air conditioners and water heaters that also mine their own crypto to offset the cost of running them.

But coming back to reality for a moment and addressing the point that maybe is going to get me the most flack and that is...

Death To The ETF

I don't believe a Bitcoin ETF is going to come in 2019, at least for the first half. Hate me for saying it but I've disliked the Bitcoin ETF from the start. It's the wrong vehicle at the wrong time and if you actually read the proposal from VanEck and SolidX on their Bitcoin ETF application it's hot garbage.

Here's my take. SEC chairman Jay Clayton is staunchly anti-bitcoin ETF and I think for good reason. He doesn't have it out for this space. He's looking out for all the people that got burned this year as ICO's died and he's considering the future of what might happen this year if suddenly there's an ETF on a highly volatile asset suddenly tradeable on the open market.

Here's what we should consider. Volatility doesn't equal market manipulation. In fact, Clayton mentioned that the prices retail investors are seeing are the prices they should rely upon and free from manipulation. Not free from volatility but free from manipulation. Additionally, the SIX Swiss Exchange recently approved the first crypto ETP, or exchange-traded product, which consisted of a basket of cryptocurrencies. It's actually one of the most popular products on the exchange right now and has even reached the top trading volume spot. That gives us an idea of what the ETF might look like, but the U.S, is obviously a much bigger market, so, we need to get it right.

And finally, I think there's this really insidious notion that the ETF would be the catalyst of getting Bitcoin back to $20,000 and beyond, and honestly, what's that hypothesis based on? The Bitcoin futures? I've seen their closing dates correspond with market dumps throughout this bear market including the most recent market drop.

Have you considered how the market would react if the ETF was approved and we didn't go parabolic? Suddenly, we'd be right back into acting like the ship is sinking and that's why it's so dangerous to place your implicit faith in charlatans that say X + Y = Z. Seriously, nothing is guaranteed. Even the very wise cannot see all ends.

Clayton has also talked about how there's still massive custody issues. That's probably going to change in the next year but at present that's certainly on the SEC's mind. So, to segue, that's my next point.

Institutional Platforms But Not Institutional Money...Yet

Look, the other big narrative about how we get back to 2017 levels is big daddy Wall Street comes in and saves us from ourselves, and yes, you probably know what I'm going to say. That's naive and I don't want you guys to be blindsided believing something like that.

I understand that Bakkt, Fidelity, and all these other big banks getting on and building platforms are exciting. How could it not be? Wall Street is legitimizing this space, but don't mistake that with investing. Wall Street are not retail investors. They play a very different game than you and I. Where we speculate and invest, trade and flip, they play the game of control.

They look at a space and say; How can we control it? How can we adopt the models we're used to using to this new industry?

No, Bakkt and all these other platforms launching will not turn crypto market around. I'm sorry if that's flying in the face of what many others have probably told you, but you need to hear it. However, in time I do think they will bring more liquidity and investment to the space, but please, do not hold on to this notion that the day Bakkt launches or Fidelity goes online that we'll see Bitcoin shoot up thousands of dollars. Wall Street are not the guys lining up days in advance to buy the new iPhone, they're the ones holding the doors open and laughing as we fight among ourselves.

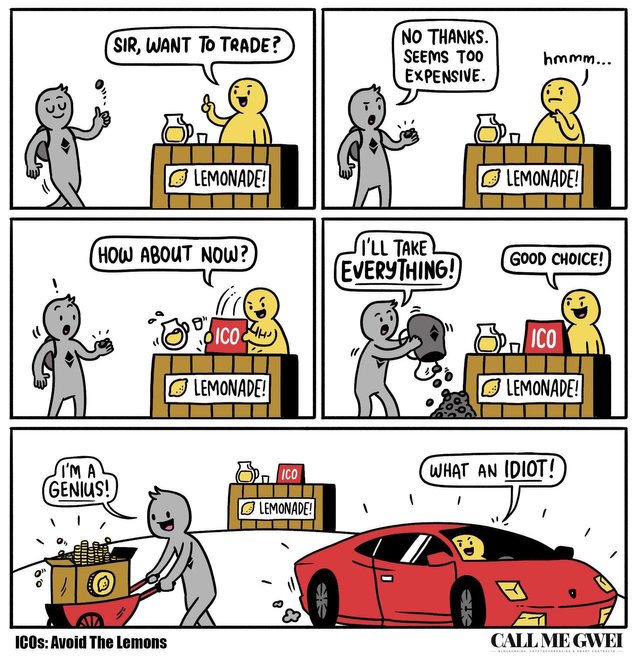

All this said it cannot be denied that institutional money is coming and that's a game changer. I think 2019s number one trend is going to be intrinsically tied to that. In 2018 the frustration with ICOs began as investors fell for scammers who collected money and then vanished to vacations and islands. The projects that conducted the initial placement of coins offered their investors to participate in the campaign to raise funds for their development of a startup in return for a cryptocurrency, however, these utility tokens are not investments in a project.

Contrary to popular opinion, these utility tokens are not an investment in a project. You do not receive shares in a company or related shareholder rights because utility tokens do not have assets that would give them value. That's why we're having considerable difficulties with regulation. In particular, the SEC does not really recognize these utility tokens because as far as the SEC is concerned they are securities.

The Year Of The Security

So, if 2017 was all about raising tons of money without fear of regulatory interference, the day of reckoning has come. Regulatory bodies are cracking down and even if they're not people just are not taking the chance anymore.

Therefore, security tokes and STOs look set to replace ICOs in 2019. All U.S. offerings will be held in compliance with SEC rules and regulations. This is the way that things should be done. The advent of the security token in 2019 will be a big game changer and it will do to the traditional VC (venture capital) industry what email did to the post office.

This year will be the year of the security token. People are no longer willing to purchase assets that are not tied to something with equity or hard asset such as real estate. Security tokens show a lot of promise and should help assist the blockchain with self-regulation and mass adoption.

Bridging the gap between finance and blockchain offers huge potential. The reduction of risk and associated scams will bring forward new confidence that has relegated tons of people to the sidelines, most importantly, institutions, and to that point, people who are afraid of institutions corrupting crypto, myself included, can see security tokens as being a whole new industry. Crypto can continue to do what it does whereas security tokens are going to go in a completely different direction.

That's why I hold them in such high regard. They are effectively the solution to the pain we've been feeling for the last 12-months. No, maybe not directly in capital appreciation but certainly in recognition and maturity. It's going to legitimize this space more so than just about anything else.

I hope this post was helpful and informative, if not a bit rambley. I'm extremely excited about where we're going into 2019 as a space. If you stuck it out through 2018, great job and hopefully you can take some of the lessons that you've learned over the last year and put them towards becoming a more informed investor for the year to come.

Related Posts

Keep in mind about markets is they all follow cycles and Bitcoin is no exception. The general trend for Bitcoin is perfectly natural and the underlying outlook for blockchain technology as a whole is looking good. The first video lays it all out and the second video is another person breaking down and summarizing the first video.

Luzcypher's Announcement For Steem Witness

👍

Posted using Partiko iOS

I haven't read depth and well-detailed analysis of the blockchain and cryptocurrency space like in decades ago but you sure did a great and fantastic job here. I hope there is a way I can bookmark on steemit.com?

Resteemed.

Really appreciate you reading and resteeming my post. You can bookmark the post on your browser and resteeming has the same effect. Thanks again.

Awesome insights, man. Well done and I'm re-steeming. Looking forward to a fun 2019.

Thanks for the resteem.

Very well written and insightful article. I will be checking your page for more! My team strongly believes Bitcoin and a few others like Steem and Dogecoin are poised to see massive adoption as well 2019. We are watching the space very closely indeed!

I'm really excited about Steem and think it is a groundbreaking blockchain. Plus, it's a lot of fun. That's why I've become a witness and am working to build communities here. Open Mic is my main thing and we're working on an app for it with the help of @prc who created DSound. The community aspect of the Steem blockchain is very interesting indeed. Have you been to a Steemfest yet? last years showed very promising developments.

Thanks for taking the time to read my post.

Great analysis m8. An interesting read for someone like myself who is definitely at a high school level of crypto knowledge.

Really well written and informative.

Posted using Partiko Android

I see a surge in Q2 2019.

Posted using Partiko Android

What makes you think there will be a surge?

The charts, history and my crystal ball.

Posted using Partiko Android

Hi @luzcypher!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 6.703 which ranks you at #128 across all Steem accounts.

Your rank has dropped 2 places in the last three days (old rank 126).

In our last Algorithmic Curation Round, consisting of 471 contributions, your post is ranked at #16.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server