Why "I like blockchains, but not cryptocurrency" is ignorant.

Many real businesses, investors, and individuals are getting excited about "distributed ledger technology." They realize how it solves the game theory coordination problem by bringing transparency, shared rules, and permission-less connectivity concerning verifiably trusted data. What they often don't understand is the value of the cryptocurrency itself as it relates to the security of blockchain technology.

Here's the way I see it:

A blockchain without a valuable cryptocurrency is not useful as a blockchain.

People get confused on this, I think, because they get confused with ideas like "private blockchains" or "permissioned blockchains" to the point where they are just talking about a centralized database. There's no "distributed" involved. It's just a ledger. A blockchain should be used when there is a need for Byzantine Fault Tolerance:

A Byzantine fault...is a condition of a computer system, particularly distributed computing systems, where components may fail and there is imperfect information on whether a component has failed. The term takes its name from an allegory, the "Byzantine Generals' Problem", developed to describe this condition, where actors must agree on a concerted strategy to avoid catastrophic system failure, but some of the actors are unreliable.

(via Wikipedia)

If the system itself isn't vulnerable to attacks of this kind, then there is no need for a blockchain because there is no need to protect against it. So much of this comes back to trust. The consensus algorithms involved, whether it's PoW, PoS, or DPoS, all have to create this system of security through trusted, verifiable outcomes.

The rewards pool on Steem, for example, is trusted because the blockchain algorithm itself which is open source and auditable determines how much each new block creates via inflation and where that new currency goes (some to the rewards pool for authors and curators, some to reward those holding Steem Power via increasing the ratio from Steem Power to VESTS, and some to the block producer witnesses as a reward for running the secure system that produced the block).

So getting back to the original point of this article, it's not possible to have a secure blockchain if the rewards given out to those who secure it are not valuable.

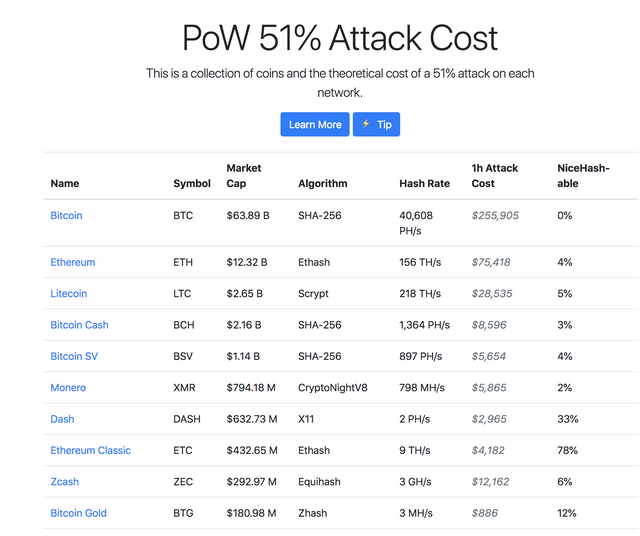

To highlight this idea, check out https://www.crypto51.app/ which keeps track of how much it would cost (in theory) to rent enough hash power for PoW mining to 51% attack a chain and double spend.

As you can see, the blockchains with the highest market cap also have the highest costs to attack. Going back to our reason for needing a blockchain to begin with, this also means these blockchains are the most secure because they are the most expensive ones to mess up (assuming all else being equal and they don't have a fundamental security flaw in their unique implementation). The value of the blockchain technology is directly connected to the cost to attack it which is directly related to the value of the token given out to those who are securing the network.

The same thing applies to DPoS chains like BitShares, Steem, and EOS. If the token price is so low that it's trivial to buy up enough tokens to vote in your own cabal of block producers to fork the code and make changes however you like (such as allowing a double spend, changing the inflation, etc, etc), then the security of the chain can not be trusted and it will not (or at least, should not) be used to protect anything of value against a Byzantine fault. The token price matters as does the rewards given to the block producers. Those rewards should be high enough to attract top talent who are willing to compete with others for a prize worthy of their attention.

If a token loses all value, then it will not be a valuable blockchain for preventing Byzantine faults because it will not have a trusted security model with real value behind it. It might be an interesting curiosity, a technical hobby toy to learn from, or an exploration of engineering methodology, but it is not valuable or useful as blockchain technology. This is why test networks, for example, are not used to secure anything of value. Test net tokens are easy to obtain and have no value so the systems which use them are not useful as blockchains, but as testing and training grounds. Whoever controls the issuing of new test net tokens controls the chain (much like a centralized database).

Those who try to separate out the value of the blockchain from the value of the cryptocurrency which secures it are, fundamentally, ignorant of either the economic motivational system in place to reward the block producers for creating security or the technical system itself which makes it secure in the first place.

It's okay to be ignorant.

Unfortunately many people see being told they are "ignorant" about a given topic as an insult of some kind (myself included). In reality, it's just a statement of fact. We all have opinions and views on things based on incomplete knowledge. I'm quite certain, for example, that some of what I've written in this post is also ignorant about the many nuances involved. That's okay. Learning that you are ignorant of something is actually a gift as it helps you grow your understanding (and possibly your wisdom). If someone sent you this post because you may have been ignorant, don't take offense. Celebrate that you now know more than you did.

I think we're witnessing the evolution of the future of human interaction via trusted, programmable money. This stuff is important, and it's important to talk about it accurately so we don't find ourselves using centralized systems yet again.

Luke Stokes is a father, husband, programmer, STEEM witness, DAC launcher, and voluntaryist who wants to help create a world we all want to live in. Learn about cryptocurrency at UnderstandingBlockchainFreedom.com

Great analysis. I hadn't realised that private blockchains were really pointless.

Private blockchains are interesting, but only based on where they fit on that spectrum. Some people consider DPoS systems "permissioned blockchains" because only the elected block producers can produce. With PoW, anyone can spend money on a mining rig, turn it on, and produce blocks (in theory). Some private blockchains may make sense within, for example, a corporate structure or within a group of companies working together where data interoperability is a major cost and having a shared protocol use very useful for solving the coordination problem. It's similar, I guess, to a private database with decentralized nodes that has very clear specifications for how things work. Getting everyone to agree on that protocol can be tricky and having a governance mechanism to remove those who are not performing is also valuable, which a private blockchain could give, but it's still not unique to "blockchain technology" in a meaningful way, IMO.

I like what Ari Paul said about permissioned blockchains last year:

https://twitter.com/AriDavidPaul/status/983104467762536448

When you look at markets and supply chains, some are obviously better organized than others. When blockchain proposals are popular, that suggests a market failure - which could be solved by a centralized solution if there's an organization trusted by all participants.

Man, if I had a Satoshi for every time someone at work mentioned using a private blockchain for something that amounts to just using git …

The real innovation of Bitcoin, IMO, was aligning economic forces such that one is more incentivized to secure the block chain rather than to cheat it. Your ledger cannot be secure AND decentralized without that.

Well said, Wolski! Nice to see you on the Steem blockchain. :)

I wonder why many of the coins that generated name accounts as opposed to hash didnt grow as popular. Bitshares, Steem, EOS, etc. Or even the protocols like OpenAlias wasnt as popular. If many people complain about usability, the usability protocols should have been front and center to the new generation of wallets and such.

That's an interesting question. I don't think it's about "named accounts" as much as fundamental differences of opinion related to which consensus mechanism is better (PoW vs. DPoS). DPoS systems all created by the same person (and, in some cases, by a specific company like Steemit, Inc or Block One) might be considered more centralized than systems where pull requests are accepted by anyone and more work is done on the core protocol by the community instead of a central group.

That said, I agree, usability should be front and center. It's the key to mass adoption. It's why I'm joining the Dapix team to build out the FIO protocol.

The simple biggest issue right now for usability by regular people is the hash naming and the volatility of the coins. I know the usual rationalization answers of both things, but that doesn't really make it go away.

My own source of issues has to do with the lack of business applications, I think the wallet has been a waste of time since most people buy stuff from companies, not other person. Think about it... Groceries, Gas, School fees, Transportation (bus, train, planes). So until those businesses adopt crypto, the need would be very marginal.

Yes, I spent many years building FoxyCart trying to get our stores to integrate with BitPay/Coinbase and accept cryptocurrency. There was simply no demand. Things won't change until users start demanding of the merchants they frequent: let me pay in cryptocurrency!

Exactly! What Andreas said in the first three minutes. :)

You might have the case if you replace cryptocurrency with erc-20 coins though.... 😁

Posted using Partiko Android

ERC20 tokens (along with tokens on EOS, tokens on Neo, and now even tokens on Steem via Steem Engine, etc, etc) aren't directly involved in the security of the system because they don't run the blockchain. That has been offloaded to the parent chain. The token, if it's a voting or governance token, may reintroduce a need for value to secure what is being governed, but I see it as a unique, case-by-case basis when it comes to tokens without their own chain.

Nice presentation. I agree completely.

Thanks!

Ive come to realize that, especially in crypto, there is always someone that knows more about something than you do.

Its easy for me to admit Im wrong about something in crypto because there is so much to learn and so much that changes daily. Im actually happy when someone points out something Im ignorant in as its just an opportunity to learn something new.

Posted using Partiko Android

In today's society, being called ignorant has become of a very negative connotation. Personally, I prefer the term uninformed or unknowledgeable. While we can explain and most folks will get what we mean, the problem I believe is when there are those who are unknowledgeable but believe that they are. I know that I am ignorant to a lot of things crypto and blockchain and the info doesn't seem to compute in my brain. And that's ok. I'm one of those who needs the "Blockchain for Dummies" manual. The little I do know, I try to understand better. And if while explaining someone loses me, then that's ok too. But when people are closed to learning or understanding the little they know or how little they know, they'll get defensive and think they know better. This is where misinformation comes in and confuses people like me 😁

Posted using Partiko Android

Maybe understandingblockchainfreedom.com can help a little.

Ooh! I'll check it out. Thanks 😀

Posted using Partiko Android

This story was recommended by Steeve to its users and upvoted by one or more of them.

Check @steeveapp to learn more about Steeve, an AI-powered Steem interface.

"A blockchain without a valuable cryptocurrency is not useful as a blockchain." Spot on! You cannot have a viable blockchain without some kind of vehicle for transferring the value (coin/ token).