Digital Con of the Century: The DCG Group – How we are being sucked into a digital slave matrix (Part 2)

For Part 1 - click here

Digital Con of the Century: The DCG Group – How we are being sucked into a digital slave matrix (Part 2)

DCG Portfolio

Now, let’s have a look at the DCG’s own website and its extensive portfolio of companies. As of the time of this writing (late July of 2019) the group’s Porfolio page counts no less than 129 entities (some of which can even be split further). But I either read or heard in an interview (apologies, as I can’t recall the original source) that DCG now owns no less than 145 companies/entities.

Here are some notable and fairly well-known players belonging to the group (key facts emphasized in red underlining):

While many of you will be familiar with several of these listed above, it may come as a surprise that these are owned by the Digital Currency Group (DCG).

I have chosen these in particular because I have some issues regarding how DCG may be exploiting these entities for not-so-honorable means. Accordingly, I will present my concerns for each in a fairly brief fashion hereunder:

BLOCKCHAIN:

Blockchain was one of the earlier players whereby people could easily get into the world of cryptos by opening an account and buying/trading some Bitcoin and Ethereum as entry points into this market. Now that DCG is in control of this platform – which accounts for over 100 million transactions in 140 countries across the globe, who knows to what extent they are recording/archiving the transactions for future scrutinization. Yeah, for the most part these transactions appear to be totally anonymous in that the accounts are opened by users without the need to provide their names or other personal information, but this could change in the future. And who really knows what they are doing behind the scenes.

It is also worthwhile to note the [recent news (on July 30) stating that Blockchain, Bitcoin’s largest wallet blockchain, is nearly set to launch its own cryptocurrency exchange. While this may appear as exciting news at first for the masses (retail investors), I can immediately spot some major red flags. First, here are a few snippets from the article along with some of my observations and concerns [with some Emphasis added]:

Blockchain’s head of retail products, TD Ameritrade alum Nicole Sherrod, told CoinDesk the custodial exchange, called The PIT, can connect to non-custodial Blockchain wallets for nearly instant transfers.

Sherrod said that with nearly 40 million wallets already created – and an exchange matching-engine set up in London’s Equinix LD4 data center – PIT could be posed to attract more liquidity than competitors. “That’s what market makers are looking for,” Sherrod said. “They want to co-locate [data center servers] with you, they want to directly connect to your matching engine. It’s the way it’s done on Wall Street.”

We need to decode this a bit. By “attract more liquidity she is likely referring to institutional investors who would be the ones placing large orders. After all, that is what ‘market makers’ like the big investment banks do on Wall Street.

Market making is a cleverly disguised investment term that really means these banks either create shoddy products to sell to their clients (see how Goldman Sachs did this during the Financial Crisis of 2007-8 as an example) or use sophisticated and illegal (I must add) trading methods such as employing HFT (High-Frequency Trading) algos and also what we call ‘Front-Running’ (explanation: “Front-running is when a broker or other entity enters into a trade because they have foreknowledge of a big non-publicized transaction that will influence the price of the asset, resulting in a likely financial gain for the broker.”).

It is quite easy to see how a firm such as Grayscale (a key DCG company mentioned below) could easily create such a market whereby they could front-run Bitcoin (or other crypto) transactions that have just entered through a market order:

Indeed, Tom Haller, previously the chief software architect for trading systems at the New York Stock Exchange, contributed to the development of PIT’s matching engine. Sherrod added the exchange will measure speed in “microseconds,”

This was also referenced to in a recent Reuters/New York Times article:

the launch of a cryptocurrency exchange called The PIT that aims to execute trades in microseconds for retail and institutional investors.

The Reuters/NYT article added:

A stealth team inside the company composed of veterans from the New York Stock Exchange, TD Ameritrade, Google, Goldman Sachs, UBS, Interactive Brokers and Revolut built The PIT with the goal of executing trades at high speeds, Blockchain said in a statement.

(note that I highlighted Goldman Sachs here because they have been employing practices such as the Front-Running fraud since at least 2011)

In other words, Blockchain’s PIT would be an ultra-fast exchange capable of much faster transactions than with traditional exchanges. Hence, they would enjoy an incredible market advantage over other cryptocurrency exchanges.

For instance, they could easily “spot” a large Bitcoin transaction and before it can be executed front-run it with another trade (depending on whether it is a buy or sell order) essentially placing a much larger trade knowing in advance the effect (direction) the previous trade would have on the market; while this may seem completely innocuous for regular, smaller, trades, it could have a huge impact for trades that deal in the hundreds of thousands of dollars’ worth or more.

Although such a tactic is illegal according to US Securities laws, these powers-that-be have the regulators (such as the SEC) in their pockets, as has been astutely noted by Bitcoin connoisseur Andreas Antonopolous in his ‘Escaping the Global Banking Cartel’ speech.

BLOCKSTREAM:

Here is one of MAJOR CONCERN. Blockstream is currently the core software development company for Bitcoin! In other words, they are in full control of the technology behind Bitcoin. As the leading cryptocurrency with the largest market cap which pretty much dictates the direction of the entire market, the amount of power held by DCG with the levers of granddaddy Bitcoin is immeasurable.

BRAVE:

The new Brave Web Browser has been touted as highly private which blocks countless ads and trackers. And, although many in the truth/alternative media community have praised it as a substitute for the highly intrusive Google Chrome, they are sadly unaware that DCG is in control of this important software which has the potential to be used by hundreds of millions of unsuspecting freedom & privacy loving individuals. As complaints mounted about Google being too big, powerful, and intrusive, who is to say the behemoth of DCG will not act in likewise manner after the masses have been sucked-in?

CIRCLE:

At first glance, Circle doesn’t appear to be of much concern. But they have acquired one of the biggest cryptocurrency exchanges in the United States – Poloniex. Hence, as with Coinbase (listed just below) this gives DCG a tremendous amount of power in the cryptosphere – particularly in the highly regulated US market. What I mean by this is that what gets to appear in the list of acceptable/approved/tradable cryptocurrencies and tokens on such exchanges will assuredly dictate who gets to play in this digital market game and who doesn’t; in other words, if they are not approved by those who are really behind DCG then they will have very little chance of mass adoption and success.

CIVIC:

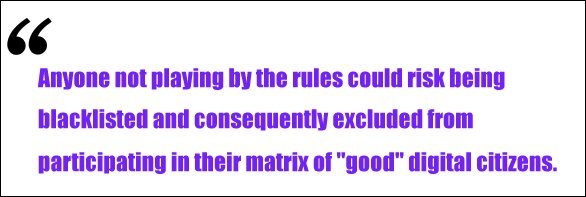

Just its name, Civic, sounds like “civic duty”, or a compliance mechanism for the sheep lead to slaughter. Although it presents itself as a noble means by which identities can be authenticated online (to avoid fraud, etc.) what it really is, in my view, is a means to entrap the masses into one giant biometric database whereby none of your personal identity will remain private, sacred, and inherently, yours. They present their service in terms of convenience for the user by creating a [non anonymous] ‘digital identity’ that can be trusted by other parties. What is at greater play here, I think, is that DCG wants to ensure that any user of its affiliates’ services will be totally identifiable and traceable at all times so as to always to keep an eye and permanent record of its users. Anyone not playing by the rules could risk being blacklisted and consequently excluded from participating in their matrix of “good” digital citizens. Lastly, I wouldn’t be surprised to see Civic implement a ‘social credit score’ type system as is the case in China sometime in the not so distant future.

COINBASE:

Let’s face it, Coinbase, one of the largest and most popular digital currency wallet and platforms in the world with over 30 million users, is really the antithesis of what crypto is meant to be. Coinbase is no small exchange; as a website it currently ranks #986 overall in the world in terms of user engagement according to alexa.com. As an early crypto exchange providing its users with a fairly easy means by which they could exchange fiat currency to purchase crypto and enter the market, the tradeoff for them, however, is that they had to submit a lot of personal information basically rendering themselves completely on the radar of the authorities (governmental, intelligence agencies, the taxman, etc.) and thus susceptible to future pilfering and loss of privacy. Case in point: just before tax season last year, Coinbase had to oblige to the IRS (Internal Revenue Service) by sending many of its users’ data to ensure they would pay taxes on cryptocurrency gains. As with its previous onboarding of eager crypto enthusiasts along with the inevitable booming of the crypto market, millions more will, undoubtedly and unfortunately, be sucked into this exchange and thus become easy pickins for profiteering.

COINDESK:

Launched in May of 2013, Coindesk, a news provider for the crypto and blockchain community, was acquired by DCG in January of 2016. Even though, on the whole, the news outlet appears quite innocuous, there is no doubt that it will be used as the preferred propaganda outlet for anything DCG wishes to promote or put on the radar of enthusiasts from the community. Therefore, one must be vigilant and keep this in mind. The crypto and blockchain industry is largely driven by and highly sensitive to news that comes out regarding different projects, events, and happenings. Consulting the site on a regular basis could serve as a useful means by which we can all keep an eye on what DCG wants to designate as “hot” / trendy (be it their own cryptocurrencies, blockchain platforms, or partners), or whatever else it wishes to push/promote to the unsuspecting masses.

ETHERSCAN:

Etherscan is the Ethereum blockchain explorer. Ethereum is the most popular blockchain platform for decentralized applications and smart contracts in the world. So, all transactions that take place on the Ethereum network can be viewed via Etherscan. Although the data on the Ethereum blockchain is publicly viewable by any party, the fact that it is owned and controlled by DCG can be cause for concern. This will all depend on the stewardship of the team managing it. In other words, how will the ‘big data’ obtained be used? As thousands of tokens and projects are created on the Ethereum blockchain, many parties can be affected by these actions. It remains to be seen to what extent DCG influences this subsidiary and for which purposes.

GRAYSCALE:

Here is another one that doesn’t appear too worrisome at first. But, Grayscale is the entity behind the Bitcoin Investment Trust – the first large institutional investment vehicle for the big boys to play the crypto market. As we all know is the case in the financial markets, it is the institutional investors who really dictate and move the direction of markets in one way or another. And, without a doubt, the exact same game is already being played in the, already highly volatile, crypto market. The smaller, inexperienced, traders/investors/speculators will handily be outwitted by these savvy and experienced/professional traders who know all the tricks and have all the best algos, AI, quants & resources at their disposal. Accordingly, if they want to move Bitcoin northwards or southwards, they can easily do so. Another reason to distrust Grayscale is the manner in which they are trying to plug Bitcoin as vastly superior to gold with their dropgold.com outfit and related Twitter hashtag.

KRAKEN:

According to CCN Markets USA, Kraken is a $4 billion ‘Top Three’ cryptocurrency exchange (along with Coinbase and Binance) serving more than 4 million active users. To sign-up for an account at Kraken, users must provide their full name, date of birth, address, and phone number, similar to Coinbase. In other words, although this is required for ‘security’ purposes, users would basically have little expectation of privacy and also would have to expect that their cryptocurrency trading records and earnings be shared with authorities such as the IRS (or their counterparts if in Europe). As per CCN’s article Crypto Exchange Kraken Secures Blockbuster $4 Billion Valuation After $100m Mega Deal, Kraken stated:

“Kraken launches futures trading via nine-figure deal, will soon close a fundraising round at $4B valuation…“ [Emphasis added]

And also:

The timing of the $100 million megadeal it closed with the approval of the U.K. Financial Services Agency (FSA) allowed the exchange to expand its range of products in Europe prior to closing a new funding round. [Emphasis added]

It is worthwhile noting, that the FSA (Financial Services Agency) is an integral part of the International Banking Cabal, similar to the FSB (Financial Stability Board) set up by the BIS (Bank for International Settlements – the central bank of central banks). Without the FSA’s approval, no financial entity will get permission to operate in the financial markets (which, going forward, will include cryptocurrency exchanges and settlements), at least in the UK.

These supervisory institutions (such as the FSA, FSB, and other country-specific entities that fall under the supervisory umbrella of the BIS) dictate the “rules of the game” and will require any fintech company, such as cryptocurrency exchanges wishing to offer financial related products to share user information so that every single financial transaction can be traced, tracked, databased, and scrutinized.

Thus, Coinbase and Kraken exchanges have no way of “opting out” of this already established corrupt financial system.

LIGHTNING NETWORK:

The Lightning Network touts itself as the ‘next generation decentralized global payment platform’. I’m not yet sure to what extent their fast network will indeed be decentralized. I lack the technical knowledge to properly make a sound assessment in this respect. From what I’ve read thus far, however, I have doubts regarding the level of honesty regarding the way the network is being set up. If anyone has any pertinent information about this, please post it in the comments section below.

RIPPLE:

Ripple (XRP) is often referred to as the ‘banker’ coin. It is currently the most traded coin following Bitcoin and Ethereum according to coinmarketcap.com. Personally, what I find most unappealing about this coin and project has to do with its monumental supply (which currently sits at around [42+ billion coins in ‘Circulating Supply’ and nearly 1 trillion in ‘Total Supply’). Think about that amount for a minute. One trillion coins. That is probably why it currently trades at around $0.32 (versus nearly $10,000 for a single Bitcoin). Regardless of my observation in this respect, XRP is still one of the most popular and highly-traded coins in the crypto market. Similar to Bitcoin, it is heavily promoted. Once more, I am not an expert on the technical feasibility of this project; nevertheless, I have reservations about it – particularly the fact that it can be more easily traceable, especially on DCG’s exchanges given their access to transaction data.

SHAPESHIFT:

This one was quite surprising for me. The extremely popular, highly versatile, and easy to use trading portal Shapeshift is very well liked and used among crypto enthusiasts. There’s arguably no better portal to swap one coin for another and transactions can be done quickly and efficiently without any [apparent] need to provide personal information other than one’s public keys. This, folks, is what worries me. That it is owned by DCG is worrisome, to say the least. Just the fact that DCG will have access to their entire database of crypto transactions can be cause for concern. Who is to say they won’t provide this data to their partners and the ‘authorities’ with whom they are bound to be subservient to? It really sucks that they got their hands on this gem. Really sucks.

ZCASH:

Along with Monero and Dash, Zcash is regarded as very private (and popular) coin. “The future of money is digital, decentralized and private.”, they state on their website. But is it really? Lacking technical expertise, I could give them the benefit of the doubt. Yet, for similar reasons stated above with regards to Bitcoin and Ripple, I remain highly skeptical regarding these claims. I can easily see DCG pushing this privacy coin as a solid alternative to them ‘nosy and intrusive bankers’ who want to know everything about their customers. Guess what, though, their parent DCG is in bed with those very same banksters.

I must add one point regarding the extent to which the entities owned by DCG Group have with regards to how much power they hold over the fate of Bitcoin, namely with regards to its price direction and manipulation. Along with with Blockstream’s hold on the development of the coin itself, Grayscale’s ‘Bitcoin Investment Trust’, big transaction data held by Blockchain as well as the major exchanges of Coinbase, Kraken, and Poloniex we must also factor in Blockstream’s ‘Liquid Network’ (described as: an inter-change settlement network linking together cryptocurrency exchanges and institutions around the world, enabling faster Bitcoin transactions and the issuance of digital assets.) which also holds tremendous power in that it is built as a Bitcoin sidechain which acts as an extension of the Bitcoin blockchain allowing users to speedily swap coins from the main blockchain to its sidechain. Once again, this can be used to their users’ advantage (and to the detriment of regular Bitcoin enthusiasts).

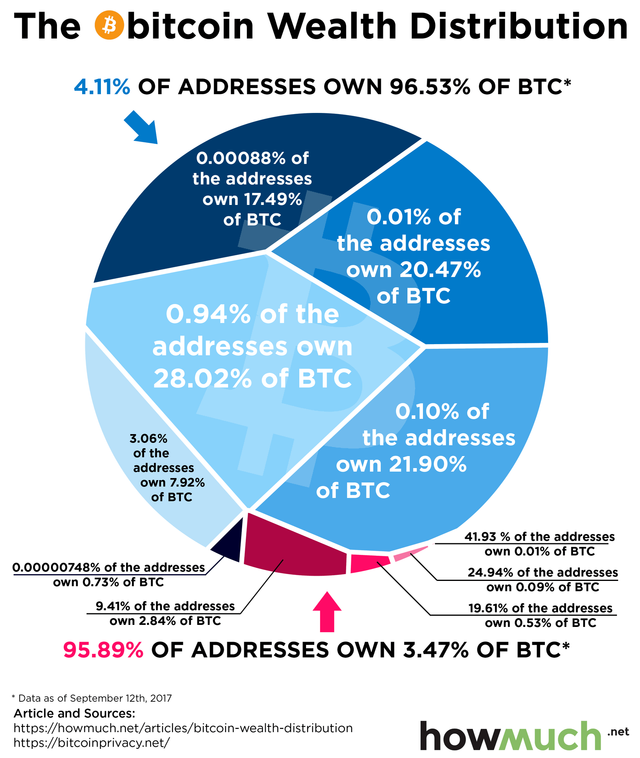

Another major worry of mine – for which I must point out that I do not currently see an apparent direct connection with DCG (i.e., consider this a side note to this post) – is regarding the widespread contention that roughly 4% of Bitcoin users own 95% of Bitcoins.

While this was outlined in a, somewhat outdated, 2017 ZeroHedge article(drawn on one from a howmuch article), I think it deserves our attention nonetheless, as it wouldn’t be far-fetched to surmise that a similar situation still currently exists today whereby a very small group of ‘whales’ control the lion’s share of the granddaddy coin.

Couple this with the fact that the criminal CME Group launched Bitcoin Futures in December of 2017. That changed everything.

With Wall Street institutional investors thence having the ability to short Bitcoin, it doesn’t take a rocket scientist to see that the big boys on Wall Street would no longer let cryptocurrencies (most of which follow the direction of Bitcoin) reflect their true (supply/demand based) price valuations in the market. In other words, it is the perfect means by which members of the banking elite can manipulate the price in their favor (gains for their preferred clients, and pain for the rest).

In my opinion, I think that those who are heavily invested in Bitcoin must at least entertain the notion that it could be possible for these power players to one day simply kill the entire Bitcoin market by “retiring” the coins (i.e., leaving them idle). Let me explain and prove to you how easy it would be for them to do so.

If they do indeed own close to 95% of the Bitcoin market then it wouldn’t be impossible to do so. Just look at the current market cap of Bitcoin which now sits at roughly $179 billion. When you think about it that is almost chump change for the collective financial clout of the current banking elite.

The dark funds (estimated to be in the trillions of dollars) that are currently held off-book by the Working Group on Financial Markets’s Plunge Protection Team(a team consisting of high-level members of the Fed, US Treasury, SEC, and CFTC who regularly intervene, i.e. rig, the bond, stock, and metals markets) could easily be used to soak up the near bulk of Bitcoins.

Now some of you may doubt and challenge my claim that there could actually be trillions of dollars held in this dark fund. But for those who do, I will invite you to have a look at how over $21 trillion dollars of money has gone missing from merely two government departments (the Department of Defense, and the Department of Housing and Urban Development). These funds could easily be used – and I suspect that they are – to manipulate current markets in the US and likely elsewhere in the world. Just consider the US Treasury Bond market; foreigners like China, Japan, Russia, et al, are no longer buying them and in order to pay the annual budget deficits and keep interest rates low, somebody (some entity) has to be getting into the market to soak them up. If they aren’t, then please tell me who the hell is.

Therefore, what could prevent them from spending a measly $179 billion to wipe out the entire Bitcoin (and crypto) market should the wish to do so?

Yeah, it’s probably something extremely unlikely, but nonetheless technically possible.

A final note to keep in mind with regards to these entities listed above is that: as per DCG’s own news outfit Coindesk, OFAC’s Bitcoin Blacklist Could Change Crypto. What is OFAC? Glad you asked.

OFAC stands for Office of Foreign Asset Control. Last year, it announced “that it was considering including digital currency addresses associated with its list of persons and entities with whom U.S. persons and businesses are forbidden to transact business.” Citing from the same article: “OFAC noted that it “may add digital currency addresses to the SDN List to alert the public of specific digital currency identifiers associated with a blocked person.” In case you are wondering what the ‘SDN List’ is, it is the blacklist of undesirables. These ‘digital rejects’ are labeled ‘Specially Designated Nationals (SDNs)’ by the US Treasury Department. (Yes, the same one Bitcoin hater Steven Mnuchin heads).

See how things start to get inter-connected now?

Of course, these authorities always go by the mantra we need to go after “terrorists, money launderers, drugs/weapons/human traffickers”, et al) and use ‘all means necessary’ to keep a record of them. But we all know that, in reality, they are targeting anyone who is (or becomes) a threat to their current ponzi scheme of a financial/monetary system. Period. The end.

Are you already blacklisted? Find out by consulting the list here (last updated on July 29, 2019, as of this posting).

Note that merely receiving Bitcoin funds from a ‘blacklisted’ account (something you may not even be aware of) could even render you a persona non grata as well and subject to a hell of a lot of scrutiny.

And rest assured it won’t only be Bitcoin transactions that they will be examining; more than likely, for pretty much all coins they can trace they will do so. I currently see very few coins with which they would have difficulty in tracking, with perhaps only the highly-private and secure Monero as a possible exception.

It is not too difficult for one to foresee how a powerful group like DCG – who is already highly connected and integrated with the current global financial system (Cabal) along with their buddies from the US Treasury Dept. & Federal Reserve – to “unplug” any undesirable from their new/upcoming digital slave matrix.

Think of it as China’s ‘Social Credit System’ on steroids. That is how much power the DCG Group already holds.

Sadly, enthusiasts in the cryptosphere are mostly oblivious (or in the dark, to put it more simply) regarding DCG’s sheer power and dominance given the opaque nature of their cohesive, web-like, structure.

TO SUM UP:

Sorry that I’ve made this particular section of my post quite long; so let me try to summarize it in a smaller, condensed, form:

So we have the DCG Group – a massive web of 145 entities – that own crypto & blockchain related companies across the entire spectrum of this nascent industry – with key positions in three of the biggest cryptocurrency exchanges (Coinbase, Poloniex, and Kraken), one of the most popular and convenient coin-swapping portals (Shapeshift), two highly popular cryptocurrencies (Ripple & Zcash), digital wallets (Circle), several blockchain explorers (Blockchain, Etherscan), the current developer of Bitcoin (Blockstream), ultra-fast networks and sidechains (Lightning Network), privileged & institutional investors (Grayscale), a means to biometrically database and track users (Civic), a media outlet to shape narratives (Coindesk), and a web browser (Brave) that is already fooling the masses to believe it is safe enough for browsing and privately accessing online cryptocurrency & blockchain related resources). Pure genius.

And I haven’t event delved into the other 135 or so companies that DCG owns!

So, imagine what other nefarious projects are lurking in their dark web of deception.

I hope, though, that this post can at least get people to start thinking about this. I’ve created a summative infographic hereunder (also shown at the top of this post), so feel free to share it far and wide (along with the URL of this post).

What becomes clear after reading through this is that the mainstream (status quo, banksters, etc) are building up their own economy in the digital realm, using large chunks of the "decentralized" crypto world to do so. At some point there's going to be a divide between the two, and what side you're on will have to be chosen. Until then, they seem content to build power (and collect data).

I think it's important to spread awareness of this. Thank you.

I think people should look more into the truly private cryptos, and into getting right off the mainstream big tech sites. Don't even humor FB or Goog anymore.

I will continue soon with part 3. Thank you!

Much agreed. And private cryptos will be key! For the moment, I like Monero and Dash with the latter showing their efficacy in South American countries where debt monetization and hyperinflation are destroying local fiat. Coming to a theater near you!

Shockingly Protocol Labs (the dev behind IPFS that is used in many dapps) is part of it 😱Wondering if they may acquire Steemit Inc one day

That's a nice catch @techcoderx; I hadn't noticed they had their claws on IPFS too. Wasn't/Isn't this platform used by many Steemers to post video?

Why do I get the feeling there is much more lurking under in this swamp...

And thank you so much @techcoderx for re-steeming! Much appreciated. Now following you!

I have been expecting this kind of market manipulation to eventuate. I am surprised about only one of the companies you mentioned: Brave. I almost switched to Brave after I incurred a loss of tokens because my browser (Opera) does not support Steem Keychain.

I'm now glad I didn't.

Thanks!

Yes, the Brave one surprised me when I saw it.

While I am not a techie, I had thought it was 'open source' software which is supposed to be verifiable by all who wish and care to inspect the code. It is both on Github and SourceForge but we'd need to have some real techie dig into the most cornered details of this beast to see if it is compromised or not.

Like you (from what I gather), I have my own doubts because it is now owned and controlled by DCG.

I think we need to at least put on its users' radar that this is the case.

Thanks for weighing in.

Just... WOW... It really is depressing in a way isn't it !

Heading to Part 3 now.

Thanks!