Digital currency Market Loses $16 Billion as Dow Jones, Nasdaq Plummet

All main ten digital currencies and stocks from Dow Jones, S&P 500 and Nasdaq, are in the red on Thursday.

A Deadly Crypto Dive

The cost of huge digital currencies plunged with about $16 billion of significant worth being cleared out in merely three hours.

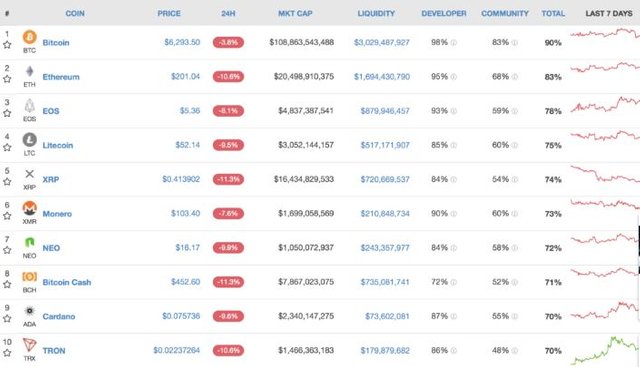

At the season of this composition, Bitcoin had dropped 4 percent to $6,294, while Ethereum and EOS jumped more than 10 and 8 percent, individually, as per the information on CoinGecko. XRP and Tron, which had a generally speaking bullish September, excessively fell radically – by more than 10 percent each, showing the past upsides were just promotion focused. Different coins, including Monero, Dash, Litecoin, NEO, Cardano, and Bitcoin Cash additionally failed 7-10 percent in esteem.

The crypto showcase was already hinting at consistent bullish energy in the wake of new institutional speculations. The drop came two days after the International Monetary Fund issued an extreme cautioning over Bitcoin and crypto's dynamic development. In its ongoing report, the UN association expected that crypto development would make "new vulnerabilities in the worldwide money related framework."

By and by, the market could manage the alleged base forecasts. Bitcoin, for example, is relied upon to hold its incentive above $6,000 to stay alluring to excavators and institutional speculators.

Facebook, Netflix, Visa Join Crypto Plunge

The crypto drop likewise showed up hours after US stocks endured a severe decrease on Wednesday. The Dow Jones Index was down 832, while the Nasdaq declined 4.1 percent, its most exceedingly awful session in two years.

Among the Dow washouts were Nike, Microsoft, Visa, Apple, Boeing, and 25 different segments – every one of whom dove more than Bitcoin. Nasdaq washouts likewise incorporate huge names like Netflix, Nvidia, Adobe and Amazon – which additionally dropped to some degree like their cousins in the crypto showcase.

The share trading system all in all, be that as it may, had strong explanations for the fall: rising financing costs.

The buyer advertise that started in 2009 not long after the Federal Reserve, European Central Bank and the Bank of Japan included greater liquidity with their verifiably low-loan costs and security buys started to lose sparkle after the Fed expanded store rates three times in a year. Only it could influence speculators to expect an expansion in loan fees. In this way, the fleeting butterflies for stocks.

A relationship among's Bitcoin and the other three stock lists can be set up in the diagram above. It is the second time this year since February when the crypto advertise is falling in accordance with money markets. The most recent week's drawback in the share trading system was the time when reserves were moving into Bitcoin. Prior to that, Bitcoin was indicating dependability in incentive according to the general crypto unpredictability guidelines around a similar time securities exchange files were drifting sideways.

The most recent drop in crypto and the share trading system has made open doors for here and now speculators. Commonly, a store supervisor who has circulated his dangers over a portfolio containing both standard and crypto resources ought to either sit perfect for a potential inversion, strategically pitch from feeble advantages for solid resources, or simply leave its situation on a substantial misfortune. One may see some upside moves in the less-controlled crypto advertise which could produce higher close term benefits because of the instability. Additionally, in light of the fact that the market is open every minute of every day, dissimilar to the Dow Jones, S&P 500 and Nasdaq.

Congratulations @lallimohan005! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!