Bitcoin Price Intraday Analysis: BTC/USD on Sideways Trend

Bitcoin cost on Friday made no noteworthy rectifications from its intraday low close $6,302.

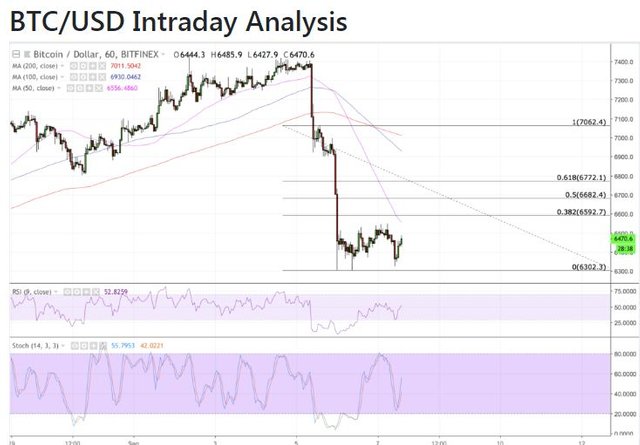

The BTC/USD through the span of recent hours has completed a raise-and-delete act, flagging a sideways estimation. Toward the start of the Asian session, the match had noticed a frail bull rectification endeavor, with the goal that it set up an intraday high around 6540-fiat. The bulls experienced some kind of hysteria around 6500-region and merchants began leaving their long positions – maybe on little intraday gains – to drive Bitcoin back towards the past low. That was the European session.

Also, the BTC/USD is now inside a monster slipping triangle rather than reports that Goldman Sachs' wants to defer their crypto exchanging work area pushed the cost down the bluff – a story which the CEO later affirmed was phony. Not that it concerns our investigation, but rather it without a doubt enables us to post an antiquated and renowned toon from the Wall Street.

The inquiry is: will's identity the one to shout a major BUY and push BTC/USD back towards the general bullish way. We don't have an answer. Along these lines, allows simply center around what is important the most, the specialized pointers and intraday positions.

he BTC/USD match currently incline sideways inside a genuinely isolated exchanging range. The combine is underneath its key here and now and long haul moving midpoints. The 50H MA in pink is especially implying a hybrid underneath the 100H MA in blue, foreseeing a bearish peak in the close term. Should that happen, a break underneath 6300-6302 zone could demonstrate unavoidable. Besides, a broadened drawback could likewise push the 50H MA beneath the 200H MA – a passing cross – that could mean a rerun towards the Bitcoin base around 5860-fiat.

There is a chronicled design from early August, featured with a pink oval, that seems to be like the economic situation at exhibit. Along these lines, best case scenario, we are taking a gander at a keep running towards the closest base and after that endeavor a ricochet back towards the upper trendline of our dropping triangle (find in this investigation from yesterday).

The range we are watching like yesterday is characterized by 6500-fiat going about as our mental obstruction and 6302 as our break bolster. We could crush off some little benefits from our long position towards 6500-fiat on a bob once again from 6375-fiat. We have officially set another long towards the opposition level from the ongoing bob back point close to 6325-fiat. So clearly, our first need is meet the objective, take out misfortunes and sit tight for a further activity to flag our future positions.

So, on a pullback from help, we will enter a short towards 6375-fiat while keeping our stop misfortune a two-pips over the passage position. Correspondingly, a breakout over 6500-6510 region would have us put a long position towards 6592-fiat. It is a little dangerous position in light of the fact that the most recent upside endeavors have been dismissed around 6540-fiat, so anyone reflecting our exchange would be asked for to put a short misfortune just two-three-pips underneath the passage point.

who knows this article can help you https://steemit.com/cryptocurrency/@lovar/difference-from-cafecoin-with-others